Unlocking Opportunities in India’s Commodity Market: The Role of NCDEX

Why NCDEX Matters

India is one of the world’s largest producers and consumers of agricultural commodities. Yet farmers often face price fluctuations that impact their income. This is where the National Commodity and Derivatives Exchange established in 2003, plays a critical role.

It provides a transparent, regulated, and technology-driven platform for trading agricultural commodity derivatives. For retail investors, it opens up new diversification opportunities beyond stocks and bonds. For farmers, it ensures fair pricing, hedging tools, and reduced middlemen exploitation

What is NCDEX?

The National Commodity and Derivatives Exchange is an online commodity exchange regulated by SEBI, specializing in agricultural products.

- Headquartered in Mumbai, it operates across multiple commodity delivery centers in India.

- It offers futures contracts on commodities like soybean, chana, mustard seed, guar gum, turmeric, jeera, and cottonseed oil cake.

- Trades are executed through a state-of-the-art electronic trading platform, ensuring speed and transparency.

Key Features of NCDEX

Diverse Commodity Offerings

- Cereals, pulses, oilseeds, spices, fibers.

- Example: Soybean and chana contracts are among the most traded on NCDEX

Transparent Price Discovery

- Real-time data ensures fair pricing.

- Farmers, traders, and investors get access to accurate market trends.

Efficient Trading Platform

- Orders executed in milliseconds.

- Ensures liquidity and seamless market participation.

Strong Regulatory Oversight

- Governed by SEBI.

- Ensures transparency, governance, and investor protection.

NCDEX: Empowering Farmers

One of NCDEX’s missions is farmer empowerment.

- Fair Pricing: Farmers can directly access prevailing market prices.

- Hedging: By locking prices through futures contracts, farmers protect themselves against volatility.

- Better Farming Practices: Quality standards encourage adoption of best practices.

- Government Linkages: It supports initiatives like eNAM (National Agriculture Market), integrating spot and futures markets.

Example: A soybean farmer in Madhya Pradesh can use NCDEX futures to secure prices before harvest, protecting against post-harvest price crashes.

Innovations and Technology in NCDEX

- Data Dissemination: Provides real-time and historical commodity data.

- Educational Resources: Offers webinars, training sessions, and farmer literacy programs.

- Mobile Access: Traders and farmers can access live commodity updates via mobile trading apps.

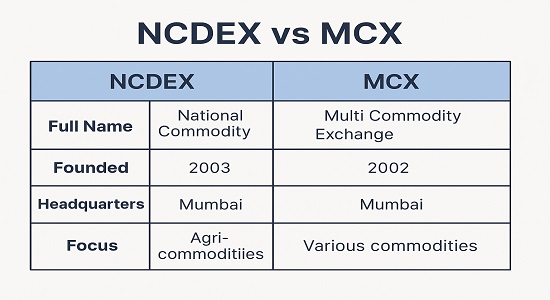

NCDEX vs MCX: What’s the Difference?

- NCDEX: Specializes in agriculture commodities (soybean, chana, jeera, mustard).

- MCX (Multi Commodity Exchange): Focuses on non-agri commodities like gold, silver, crude oil, and natural gas.

How to Start Trading on NCDEX (Step-by-Step Guide)

- Choose a SEBI-Registered Broker – Select an NCDEX member (like Zerodha, Angel One, or ICICI Direct).

- Open a Trading + Demat Account – Submit Aadhaar, PAN, and address proofs.

- Understand Commodity Contracts – Study margin requirements, expiry dates, and contract sizes.

- Learn with Small Trades – Begin with liquid commodities like soybean or chana futures.

- Stay Informed – Track crop reports, rainfall patterns, and government policies, as they affect agri prices.

Risks in NCDEX Trading

- Price Volatility: Commodity prices depend on monsoons, global supply-demand, and government MSP policies.

- Leverage Risk: Futures contracts involve margins, which can amplify profits and losses.

- Liquidity Risk: Some commodities may have low trading volumes.

Conclusion

The National Commodity and Derivatives Exchange has transformed India’s agricultural commodity market by ensuring transparency, empowering farmers, and giving retail investors a new diversification tool. For farmers, it’s a way to secure fair value. For investors and traders, it’s an opportunity to participate in India’s agri-economy — a sector that forms the backbone of the nation. Whether you are a farmer seeking stability or an investor looking for diversification, It offers a platform worth exploring.