Tax Collection at Source (TCS) in India: Complete Guide for 2025

Tax Collection at Source (TCS) is an important tool in India’s taxation system that ensures transparency and compliance. Under Section 206C of the Income Tax Act, sellers are required to collect tax from buyers on specified goods and transactions.

For retail investors, business owners, and even casual taxpayers, It has a direct impact—from buying a motor vehicle above ₹10 lakh to making overseas remittances. In this article, we’ll simplify Tax Collection at Source, highlight the latest rules for 2025, and answer common queries.

What is Tax Collection at Source (TCS) ?

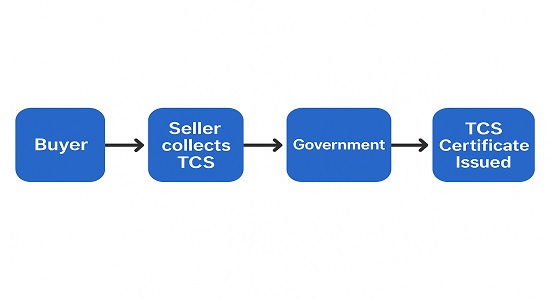

It is a tax mechanism where the seller collects tax from the buyer at a prescribed rate and deposits it with the government.

Example: If a buyer purchases scrap worth ₹5 lakh, the seller collects 1% (₹5,000) as TCS and deposits it with the government. The buyer can claim this while filing income tax returns.

Transactions Covered Under TCS (Section 206C)

Here are some key transactions:

- Sale of Goods: Alcoholic liquor, tendu leaves, timber

- Minerals and Metals: Scrap, coal, lignite, iron ore

- High-Value Transactions:

- Sale of motor vehicle > ₹10 lakh

- Overseas remittance under LRS (above ₹7 lakh)

- E-commerce transactions

Current Tax Collection at Source Rates (2025)

| Goods / Transaction | TCS Rate |

| Alcoholic liquor | 1% |

| Scrap | 1% |

| Timber | 2.5% |

| Coal, lignite, iron ore | 1% |

| Motor vehicle (>₹10 lakh) | 1% |

| Foreign remittance (LRS > ₹7 lakh) | 5% |

| E-commerce transactions | 1% |

Note: Rates are subject to change in the Union Budget and CBDT circulars. Always verify latest updates before transactions.

Who Collects Tax Collection at Source?

- Entities responsible:

- Central/State Government bodies

- Local authorities

- Statutory corporations

- Companies, firms, co-operatives

- Individuals/HUFs with turnover > ₹1 crore (business) or ₹50 lakh (profession) in the previous year

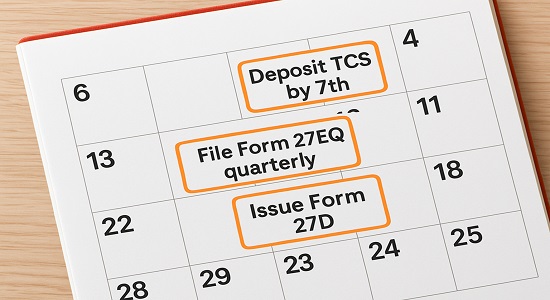

Compliance Process

- Collection: Seller collects tax at source.

- Deposit: Must be deposited by the 7th of the following month.

- Return Filing: Form 27EQ (quarterly).

- TCS Certificate: Issued in Form 27D to buyers.

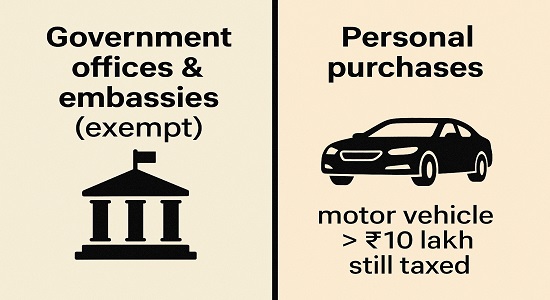

Exemptions & Special Cases

- Personal Use: Not applicable, except for motor vehicles above ₹10 lakh.

- Government Entities/Embassies: Exempt.

- Lower/Nil TCS Certificate: Buyers may apply via Form 13 to the Assessing Officer.

Benefits of TCS

- Tax Compliance: Tracks high-value transactions.

- Revenue Assurance: Ensures steady flow to government.

- Transparency: Both buyer and seller maintain records.

Challenges for Taxpayers

- Higher compliance burden on businesses.

- Confusion over multiple rates.

- Cash flow impact on buyers (especially in remittances).

Challenges Faced by Taxpayers

While It has numerous benefits, taxpayers face certain challenges:

- Administrative Burden: Businesses need to maintain accurate records, file returns, and issue certificates, increasing compliance costs.

- Complexity of Transactions: Understanding applicable TCS rates for different goods and transactions can be challenging.

- Cash Flow Impact: For buyers, upfront payment of it may impact liquidity.

Recent Updates and Amendments

Tax Collection at Source provisions are periodically updated to reflect economic changes and government policies. Recent changes include:

- Higher TCS rates for foreign remittances to encourage domestic investments.

- Its applicability to e-commerce transactions to bring digital businesses under the tax net.

How to Ensure TCS Compliance

Businesses can ensure Tax Collection at Source compliance by:

- Maintaining Accurate Records: Track all transactions and ensure proper documentation.

- Regular Filing of Returns: File its returns quarterly and pay the collected tax on time.

- Training Staff: Educate employees on Its provisions and procedures.

- Using Technology: Leverage software to automate its calculations and filings.

FAQs on Tax Collection at Source

Q1. Is TCS refundable?

Yes, it is adjustable against your total tax liability when you file your ITR.

Q2. What’s the difference between TDS and TCS?

- TDS: Deducted by payer while making payment.

- TCS: Collected by seller at the time of sale.

Q3. Does TCS apply on international travel packages?

Yes, higher TCS rates apply for overseas tour packages under LRS.

Conclusion

Tax Collection at Source is more than just a compliance requirement—it plays a crucial role in tracking transactions, curbing tax evasion, and ensuring government revenue flow.

If you’re a retail investor, trader, or individual planning a high-value purchase or overseas transaction, always check Its latest rules. Consulting a CA or financial advisor can help you optimize compliance and avoid penalties

I truly prize your piece of work, Great post.