Tata Capital IPO Explained: Everything You Need to Know in 5 Minutes (2025)

The Tata Capital IPO is one of the most awaited public issues in recent times. With Tata being a household name in India, retail investors are closely tracking this IPO for potential wealth-creation opportunities. In this blog, we will cover everything you need to know about the Tata Capital IPO — from company background, IPO details, and financial performance, to pros, cons, and FAQs. The aim is to provide you with an easy-to-understand yet detailed analysis that will help you make an informed decision

What is Tata Capital?

Founded in 2007, Tata Capital Limited is a diversified NBFC offering a wide range of financial products, including:

- Personal loans

- Home loans

- Business loans

- Vehicle finance

- Wealth management

- Infrastructure financing

The company has built trust and credibility over decades, making it one of the leading financial institutions in India.

Why is Tata Capital IPO Important?

The Tata Capital IPO is special for three reasons:

- Trusted Brand Value: Tata is a household name synonymous with trust and stability.

- Sector Growth: India’s NBFC sector is growing rapidly, driven by rising credit demand.

- Retail Investor Opportunity: IPOs from Tata Group companies have historically created wealth for long-term investors.

Tata Capital IPO Details

Below is a table summarizing the expected IPO details (based on market reports):

| Particulars | Details |

| IPO Opening Date | October,6 2025 |

| IPO Closing Date | October,8 2025 |

| Price Band | 310-326 |

| Face Value | 10 |

| Lot Size | 46 |

| Issue Size | INR 15,512 |

| Listing At | NSE , BSE |

| Min Investment | INR 14,260 |

Why is Tata Capital Coming with an IPO?

The primary reasons are:

- Raising Growth Capital: To expand lending operations and strengthen the balance sheet.

- Debt Reduction: To reduce dependence on external borrowings.

- Brand Building: Listing will enhance Tata Capital’s visibility in financial markets.

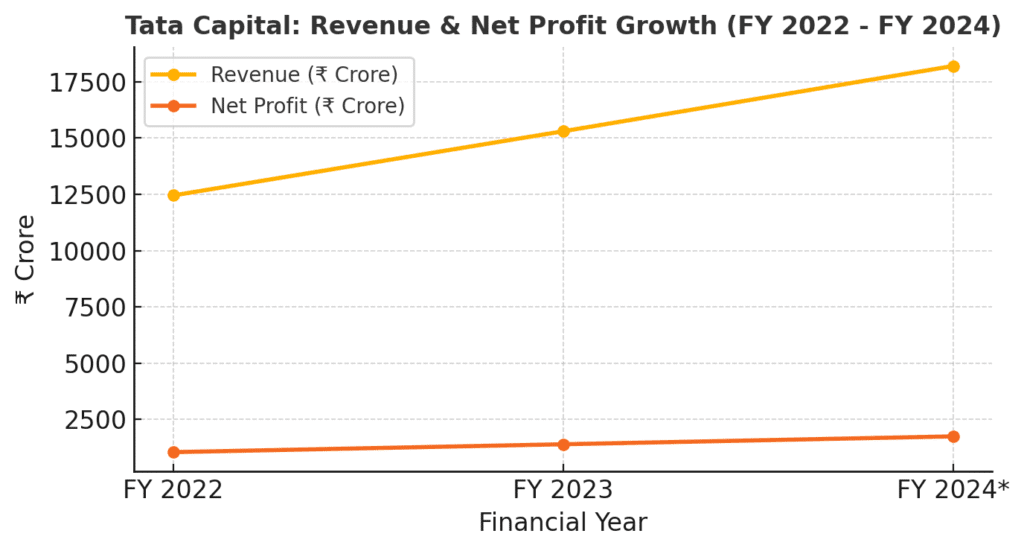

Tata Capital Financial Performance

A quick look at the company’s financials:

| Financial Year | Revenue (₹ Crore) | Net Profit (₹ Crore) |

| FY 2022 | 12,450 | 1,050 |

| FY 2023 | 15,300 | 1,400 |

| FY 2024* | 18,200 | 1,750 |

FY 2024 numbers are provisional estimates.

Strengths of Tata Capital

- Strong Parentage: Backed by the Tata Group, a trusted brand in India.

- Diversified Portfolio: Offers loans and financial products across categories.

- Pan-India Presence: Wide customer base across retail and corporate sectors.

- Strong Growth Potential: Increasing demand for credit in India.

Risks and Concerns

- NBFC Competition: Faces competition from Bajaj Finance, HDFC, and others.

- Regulatory Risks: NBFCs are tightly regulated by RBI.

- Market Conditions: Stock market volatility may affect listing gains.

Should Retail Investors Apply?

For retail investors, the Tata Capital IPO may look attractive due to:

- Brand Value: Strong trust factor with Tata Group.

- Stable Growth: Consistent financial performance.

- Long-Term Potential: Opportunity to participate in India’s growing credit market.

However, investors must consider risks like high competition and regulatory pressures. As always, it is advisable to assess your own risk appetite and investment horizon before applying

FAQs on Tata Capital IPO

Q1. When will Tata Capital IPO open?

- October,6 2025. Stay tune for more Updates

Q2. What is the minimum investment for retail investors?

- INR 14,260

Q3. Is Tata Capital IPO good for long-term investment?

- Yes, given the company’s strong parentage and financial growth, it may be a good long-term bet.

Q4. Will Tata Capital IPO give listing gains?

- Listing gains depend on market demand, subscription levels, and overall market conditions.

Conclusion

The Tata Capital IPO is set to be one of the biggest financial events of the year. With the trust of the Tata brand, strong financials, and a growing credit demand in India, it is likely to attract huge interest from retail investors. However, investors should also keep in mind the risks associated with the NBFC sector.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions

you have a great blog here! would you like to make some invite posts on my blog?