Shreeji Global FMCG IPO: A Promising Bet in the FMCG Space

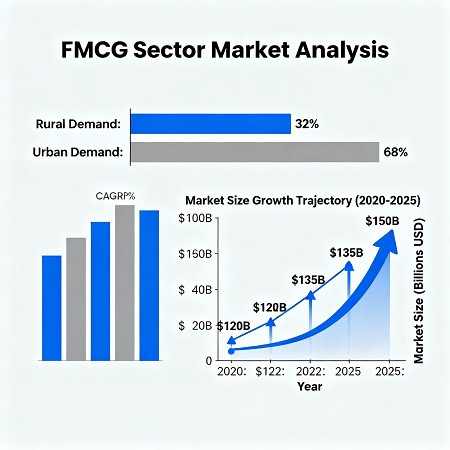

The Shreeji Global FMCG IPO has caught the attention of retail investors and analysts alike. With India’s (FMCG) sector growing rapidly due to rising rural demand and brand-conscious consumers, this IPO is making waves. The company’s focus on consumer essentials positions it perfectly in one of the most resilient sectors of the economy.

If you’re looking for an IPO that offers both growth potential and stability, this deep dive into Shreeji Global FMCG IPO will guide you through its business model, financials, risks, and future prospects — helping you decide whether it deserves a spot in your investment portfolio.

What Is Shreeji Global FMCG IPO?

Shreeji Global FMCG Limited is issuing an IPO to grow, strengthen working capital, and grow the brand through equity funds. The IPO is a fixed price SME issue at an estimated valuation of around ₹284 crore it will also be an opportunity for investors to participate in the fast-growing Indian consumer goods market.

IPO Details:

- IPO Open Date: November 4, 2025

- IPO Close Date: November 7, 2025

- Listing Date: November 12, 2025

- Price Band: ₹120 – ₹125 per share

- Lot Size: 1,000 shares

- Listing Exchange: NSE SME & BSE SME

- Issue Type: Fresh Issue

- Issue Size: ₹85 crores

- Shreeji Global FMCG Limited IPO GMP: Check Here

Why Is It Important? / Benefits To Investors

Investing in Shreeji Global FMCG IPO offers several benefits:

- Strong Demand Outlook: FMCG is one of India’s most recession-proof sectors.

- Rural Consumption Growth: Increased penetration in Tier-2 and Tier-3 cities drives sales stability.

- Diversified Product Portfolio: Reduces dependency on single product categories.

- Steady Cash Flows: FMCG businesses typically maintain consistent revenue even during downturns.

- Government Focus: Initiatives like Make in India and PLI schemes support domestic manufacturing.

Risks / Limitations / Challenges

| Pros | Cons |

| High growth potential in consumer goods | Intense competition from established players |

| Strong retail distribution opportunities | Thin margins in early years |

| Brand-building potential | Exposure to commodity price volatility |

| Scope for exports and private labeling | Limited geographical diversification |

Historical Performance + Data Table

| Metric | FY (2023) | FY (2024) | FY (2025) |

| Total Income | 468 Cr | 588 Cr | 650 Cr |

| Profit after Tax | 2 Cr | 5 Cr | 12 Cr |

| EBITDA | 4 Cr | 10 Cr | 20 Cr |

| EPS in ₹ | 1.47 | 3.74 | 7.61 |

Future Outlook / Expert View

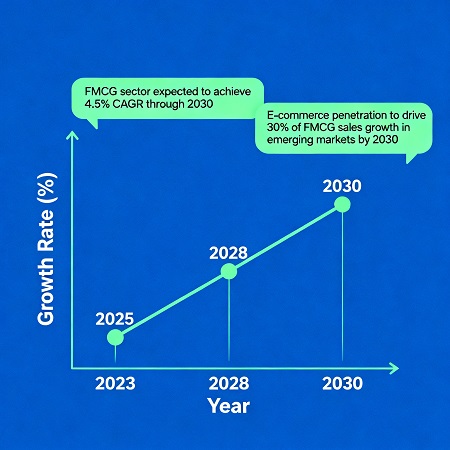

- Experts view Shreeji Global FMCG IPO as a potential long-term bet in the consumer goods space.

- FMCG remains one of India’s most stable sectors, supported by population growth, urbanization, and rising disposable incomes,” says an analyst from ETMarkets

- As per the latest NSE data, the FMCG sector is expected to grow at a 10–12% CAGR over the next five years, suggesting a robust runway for emerging players like Shreeji Global.

FAQ On Shreeji Global FMCG IPO

Q1. What is the issue size of Shreeji Global FMCG IPO?

- Issue Size: ₹85 crores

Q2. What is the IPO opening and closing date?

- Open Date: November 4, 2025 Close Date: November 7, 2025

Q3. On which exchange will it list?

- The IPO will list on NSE SME & BSE SME

Q4. Is it a good investment for long-term investors?

- FMCG is considered a stable sector; investors seeking consistent returns may find it attractive.

Q5. Check Allotment Status for Shreeji Global FMCG

- To check your allotment status – click here

Conclusion

- Shreeji Global FMCG IPO offers exposure to India’s growing consumer goods sector.

- Backed by strong demand and resilient business fundamentals.

- Ideal for investors seeking stability + steady growth.

- Watch out for valuation, competition, and margin pressures.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.

My brother suggested I might like this blog. He was entirely right. This post actually made my day. You cann’t imagine simply how much time I had spent for this info! Thanks!