Demystifying Share Pledging: A Practical Guide for Indian Stockholders

Learn everything about share pledging – what it means, why promoters do it, and how it affects stock prices. A complete guide for investors with examples, tables & tips.

Share Pledging Explained: What Every Stock Market Investor Should Know

Have you ever come across the term “Promoter Share Pledging” while analyzing stocks? It’s one of those critical terms that often gets ignored but can make or break your investment. In this blog, we’ll simplify what share pledging means, why promoters do it, and how it can impact you as an investor.

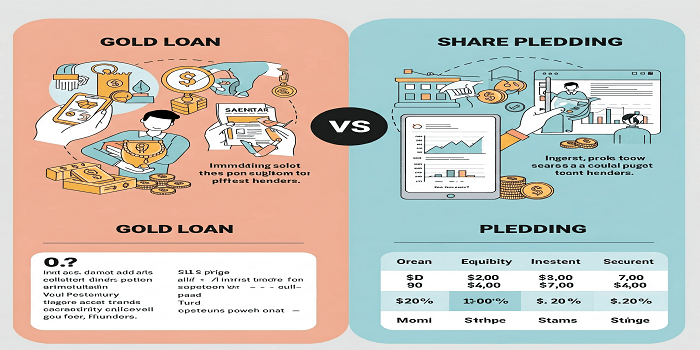

What is Share Pledging?

Share pledging is when promoters use their shares as collateral to borrow money. Just like individuals mortgage property or gold for loans, promoters can pledge company shares to raise funds.

Example

A promoter has 60% shares of the company. He vows 20% of them to take a loan. This means that 20% of its shares are now in the hands of the lender until the loan is repaid.

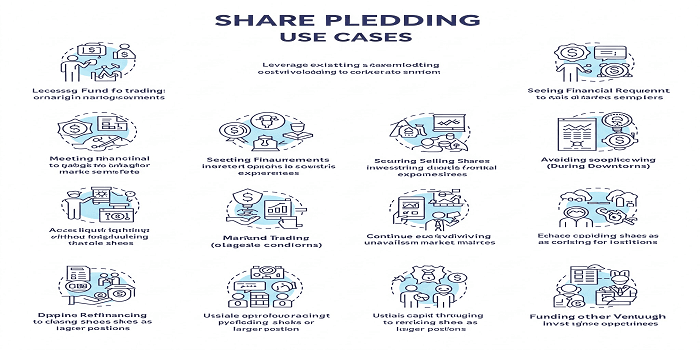

Why Do Promoters Pledge Shares?

| Reason | Explanation |

| Business Expansion | Raise money for new undertakings without reducing ownership. |

| Working Capital | Manage day-to-day trade cash flow requirements. |

| Personal Expenses | For personal loan or investment. |

| Debt Repayment | To refinance or pay back older debts. |

How Share Pledging Affects Retail Investors

- Risk of Forced Selling: If the stock price falls, the value of the pledge shares falls. Lenders can sell them, which leads to a even greater price.

- Governance Concerns: High pledge suggests that promoters are dependent on debt – a potential red flag.

- Price Volatility: If the shares are discontinued, heavy pledge can cause wild movements in stock prices.

How to Check Share Pledging Status of a Stock?

You can check pledge details from:

- Company filings on NSE/BSE

- Websites like Moneycontrol, Groww

Sample Table:

| Company | Promoter Holding | Pledged Shares | Risk Level |

| ABC Ltd | 65% | 0% | Low |

| XYZ Ltd | 50% | 35% | High |

Good vs Bad Share Pledging

| Indicator | Good | Bad |

| Pledge % | Less than 10% | More than 30% |

| Purpose | Business Needs | Unknown or Personal reason |

| Consistency | One Time or reducing trend | Frequent increase in Pledging |

| Fundamentals | Profitable & low debt | Loss-making & High debt |

Real-World Examples of Share Pledging Impact

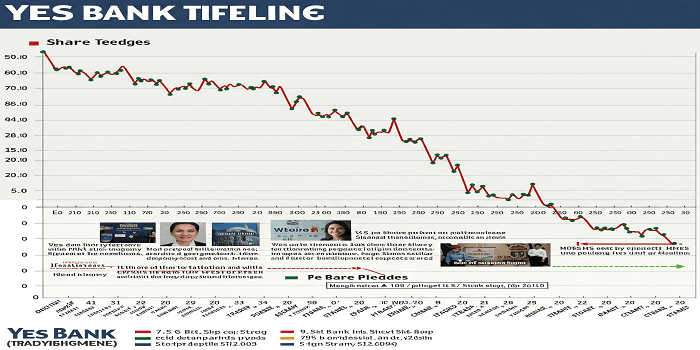

Yes Bank (Pre-2020)

- Promoters had high pledged shares.When the share price tanked, it triggered massive selling

Zee Entertainment

- Promoter pledging cause stock volatility when lender began offloading share

Should You Avoid Stocks With Pledged Shares?

Not always. But investors should be vigilant:

- Pledge percentage is increasing

- Promoter transparency is low

- Company fundamental are weak

Checklist before Investing

- Is pledge percentage is below 10%

- Is pledge trend reducing?

- Are funds used for Business?

- Is promoter trustworthy

Tips to Stay Safe

- Avoid companies with more than 30% shares pledged

- Monitor pledge data quarterly

- Prefer firms with low debt and clean governance

- Use alerts on platforms like Groww or Tickertape

FAQs – Share Pledging

- Q1. Is share pledging always risky?

- Not always. It depends on how much is pledged and why.

- Q2. Where can I check share pledge data?

- On NSE/BSE sites or financial platforms like Moneycontrol.

- Q3. Can pledged shares be sold?

- Yes, if the promoter defaults, lenders can sell the pledged shares.

Final Thoughts

Share pledge is not a deal breaker, but it may indicate possible troubles. As an investor, always keep an eye on promoter activities. A high pledge ratio, especially when combined with weak financial, should be raised red flags.

Only a smiling visitor here to share the love (:, btw great design and style.