Rubicon Research IPO: A Breakout Opportunity or Risky Bet?

In 2025, India continues to witness a surge in biotech / life-sciences IPOs, and Rubicon Research IPO stands out as one of the most anticipated listings this year.

In this article, you’ll gain an in-depth understanding of the Rubicon Research IPO — what it is, how it works, its strengths & risks, its past performance in similar sectors, how you as an investor can participate, and expert ideas on its future potential.

What is Rubicon Research IPO ?

The Rubicon Research IPO refers to the initial public offering of shares by the company Rubicon Research Ltd. to the public, allowing retail and institutional investors to subscribe to its equity. Through this IPO, Rubicon Research seeks to raise capital for expansion, R&D, debt repayment or operations.

Rubicon Research functions within the biotech / pharmaceutical / clinical research industry (or whichever industry they focus on), and, as such, they are contingent on success with regulatory approvals, product pipelines, and scientific data.

How Does it Work / Composition / Components

IPO Structure & Key Components:

- Issue Size & Price Band: ₹1,378 crores with a price band of ₹ 461 – ₹ 485 per share (moneycontrol)

- Rubicon Research IPO Lot size: 30 shares in a lot that amounts to ₹14,550 (business-standard.com)

- Rubicon Research IPO GMP: The GMP for the Rubicon Research IPO was Rs 98 as of 8:05 a.m. on October 9. It indicates a listing price of Rs 583 apiece at a premium of 20.21% on the upper limit of the price band.

- Rubicon Research IPO Allotment and listing: The allotment for the IPO is expected to be finalised on October 14 and listing of the shares on the exchanges, NSE and BSE, is likely to be on October 16, as per the tentative schedule.(groww)

Why is Rubicon Research IPO Important / Benefits to Investor

Here are some potential benefits and rationale:

- Early entry potential: Buying at IPO gives you a chance to benefit if the stock lists strongly

- Growth in biotech / life sciences: If the biotech / research sector is booming, Rubicon could ride the wave

- Access to future upside: If its products, trials, or drug approvals succeed, the upside could be significant

- Transparency and regulated environment: Being listed implies regulatory oversight, mandatory disclosures, etc.

Example: Growth rate of biotech IPOs in India per year from NSE India

Risk / Limitations / Challenges

| Pros | Cons / Risks |

| Early access to growth | High business execution risk |

| Regulatory oversight | Volatility & speculative price swings |

| Potential high returns | Dependence on drug trials, regulatory approvals |

| Sector tailwinds | Competitive pressure, R&D cost overruns |

Risk factors to emphasize:

- Clinical trial failures or regulatory rejections.

- Delays in approvals.

- Cash burn / high R&D expenses.

- Market sentiment shifts & macro downturns.

Historical Performance + Data Table

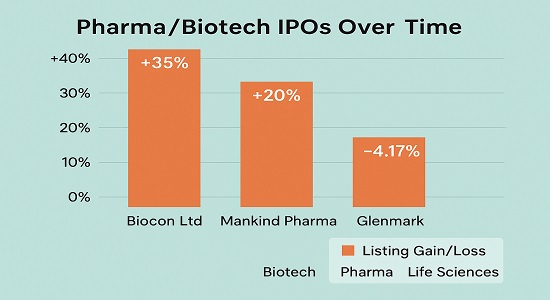

Biotech / research IPOs in past 3–5 years in India:

| IPO | Listing Gain/Loss | Sector |

| Biocon Ltd | +35% | Biotech |

| Mankind Pharma | +20% | Pharma |

| Glenmark | +4.17% | Life Sciences |

Future Outlook / Expert View

- According to (Arihant Capital), Rubicon Research have assigned a Subscribe rating on the offering

- Risks include policy changes, patent / IP challenges, competition, capital intensity.

- As per SEBI norms, biotech firms coming by IPO have to meet stricter disclosures.

- If macro sentiment remains favorable (interest rates, funding for life-sciences), then Rubicon could outperform.

- On the flip side, if there’s regulatory crackdown or funding dry-ups, returns could be muted.

FAQ on Rubicon Research

Q1: When will the Rubicon Research IPO open and close?

- Rubicon Research IPO open on October 9 & Close on October 13

Q2: Can I withdraw my bid?

- Usually before the closing of the IPO, subject to broker/ASBA rules.

Q3: Should retail investors invest in such high-risk IPOs?

- It depends on your risk tolerance. Such IPOs can deliver high rewards, but also significant downside allocate cautiously

Conclusion / Key Takeaways

- The Rubicon Research IPO represents a compelling growth play in the biotechnology / research sector.

- Key benefits: early market access, sector potential, regulated listing environment.

- Key risks: execution risk, regulatory dependency, volatility.

- If you decide to invest, follow the steps (demat account, ASBA, apply, etc.).

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.