Pine Labs IPO: The Most Anticipated Fintech Debut in 2025

India’s fintech landscape is buzzing — and the Pine Labs IPO is at the center of it all. As one of the country’s largest merchant payment solution providers, Pine Labs’ upcoming IPO in 2025 is generating massive interest among retail and institutional investors alike.

Founded in 1998, Pine Labs has evolved from a simple card payment solutions provider to a leading digital payment and merchant commerce platform used by over 500,000 merchants across India and Southeast Asia. Investors are keen to know what this IPO means for the fintech ecosystem, its valuation, and whether it could be India’s next Paytm or Razorpay moment.

What is Pine Labs?

Pine Labs is a leading Indian merchant commerce platform that offers payment solutions, buy-now-pay-later (BNPL) services, and value-added merchant analytics. The company’s technology helps businesses accept payments via debit/credit cards, UPI, and digital wallets, while also offering working capital loans and gift card services.

IPO Details:

- IPO Open Date: November 7, 2025

- IPO Close Date: November 11, 2025

- Listing Date: November 14, 2025

- Price Band: ₹210 – ₹221 per share

- Lot Size: 67 shares

- Listing Exchange: NSE & BSE

- Issue Type: Fresh Issue: ₹1819

- Issue Type: Offer For Sale: ₹2080

- Issue Size: ₹3899 crores

- Pine Labs IPO GMP: Check Here

Why is the Pine Labs IPO Important?

The Pine Labs IPO is more than just a fundraising event — it’s a benchmark for India’s fintech evolution

Benefits for Investors

- Leading player in digital payments and issuing platforms with a strong tech stack.

- Integrated suite of in-store, online payments, and prepaid solutions.

- Strong market presence across India and Southeast Asia.

- Robust merchant partnerships and scalable cloud-based infrastructure.

- Recognized with multiple awards in fintech innovation and service.

Risks and Limitations

- Recent financial losses due to high operating expenses.

- Exposure to fraud, charge backs, and billing disputes.

- Dependency on cloud and tech partners like AWS for scalability.

- Regulatory challenges in expanding to new international markets.

- Vulnerable to competition from fintechs and government digital platforms like UPI.

How to Invest in Pine Labs IPO

- Open a Demat Account with any SEBI-registered broker.

- Visit your broker’s IPO section during the issue period.

- Choose Pine Labs IPO and select the lot size.

- Use UPI or ASBA for payment authorization.

- Wait for allotment confirmation and subsequent listing on NSE/BSE.

Historical Performance

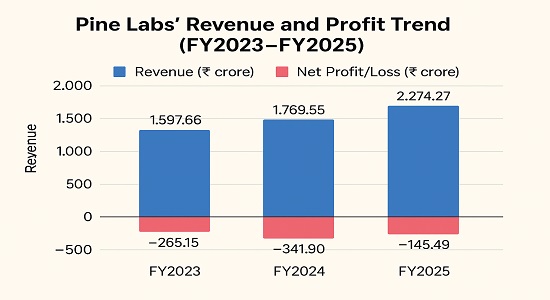

Although unlisted, Pine Labs’ unlisted share price has seen consistent growth.

| Year | Revenue (₹ crore) | Net Profit/Loss (₹ crore) |

| 2023 | 1,597.66 | -265.15 |

| 2024 | 1,769.55 | -341.9 |

| 2025 | 2,274.27 | -145.49 |

Future Outlook / Expert View

- According to analysts, Pine Labs’ listing could redefine fintech valuations in India. With strong merchant reach and scalable technology, it’s expected to compete directly with Paytm and Razorpay.

- If Pine Labs maintains its growth trajectory and controls costs, it could become India’s most profitable fintech in the next 3 years,” — Economic Times Report, 2025

- The IPO could also pave the way for more fintech listings, signaling investor appetite for digital-first financial platforms.

- Pine Labs raises Rs 1,754 Cr from anchor investors ahead of IPO. Entrackr.com

FAQ On Pine Labs

Q1. What is the expected Pine Labs IPO date?

- The IPO is expected to open in early 2025, pending SEBI approval.

Q2. Who are the major investors in Pine Labs?

- Sequoia Capital, Temasek, PayPal, and Mastercard.

Q3. What makes Pine Labs different from Paytm?

- Pine Labs focuses on B2B merchant payments, while Paytm primarily targets retail consumers.

Q4. Can retail investors apply for the IPO?

- Yes, once SEBI approves the issue, retail investors can apply via UPI or ASBA.

Conclusion

- Pine Labs’ IPO could be India’s most awaited fintech listing of 2025.

- Strong business fundamentals and high investor confidence make it a potential multibagger for long-term investors.

- Keep an eye on SEBI filings and DRHP updates for official details.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.