Unlock Potential: A Comprehensive Guide to Nifty PSE Investments in India

Nifty PSE have played a pivotal role in shaping the country’s economic landscape. To provide a benchmark for the performance of these government-owned enterprises, the National Stock Exchange (NSE) introduced the Nifty PSE Index. This index tracks the top-performing public sector companies listed on the NSE, giving investors a snapshot of their growth and financial health.

What is the Nifty PSE Index?

The Nifty PSE Index represents the performance of publicly traded companies in which the Indian government holds a majority stake. These enterprises span various industries, including energy, finance, minerals, and more.

Why is the Nifty PSE Index Important?

The Nifty PSE Index is significant for several reasons:

- Backbone of the Economy: PSEs are integral to India’s economic development. They operate in sectors critical to infrastructure, energy, and national security, making them essential for the country’s growth.

- Dividend Potential: Many companies in the index have a history of paying high dividends, making it attractive for income-focused investors.

- Government Support: Being government-owned, these companies often receive policy support and financial backing, enhancing their stability and growth prospects.

- Representation of Core Industries: The index captures key industries such as oil and gas, coal, power, and engineering, providing insights into the performance of India’s core sectors.

- Long-Term Growth Opportunities: As India continues to focus on infrastructure development, energy production, and industrial growth, companies in the Nifty PSE Index are poised for long-term expansion.

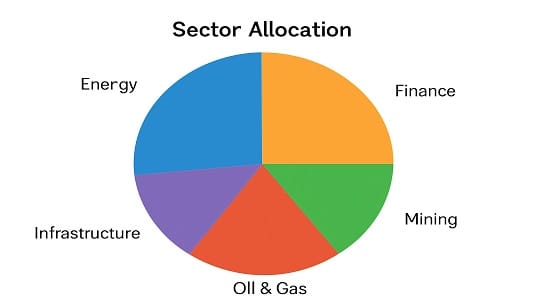

Composition of the Nifty PSE Index

The Nifty PSE Index includes companies from a variety of industries. Here’s a breakdown of its key sectors:

- Energy and Utilities: Companies like Coal India and NTPC are dominant players in this sector. They focus on meeting India’s growing energy demands.

- Finance and Banking: Includes financial giants such as State Bank of India (SBI) and REC Limited. These institutions play a vital role in funding India’s infrastructure and development projects.

- Mining and Minerals: Companies like NMDC contribute to the extraction and supply of essential minerals.

- Oil and Gas: Public sector oil companies like ONGC and Indian Oil Corporation ensure energy security for the nation.

- Infrastructure and Manufacturing: Enterprises like BHEL (Bharat Heavy Electricals Limited) contribute to the development of industrial and power infrastructure.

Factors Influencing the Nifty PSE Index

The performance of the Nifty PSE Index is affected by various factors, including:

- Commodity Prices: As many PSEs operate in energy, metals, and mining, global commodity price trends significantly impact their profitability.

- Government Policies: Policy changes, such as subsidies, tax reforms, or disinvestment initiatives, influence the operations and valuations of public sector enterprises.

- Economic Growth: A growing economy boosts demand for energy, infrastructure, and industrial goods, benefiting companies in the index.

- Dividend Announcements: High dividend payouts by PSEs often attract investors, driving up demand for these stocks.

- Regulatory Changes: Environmental regulations, tariff adjustments, and trade policies can impact the operational efficiency of companies in the index.

- Global Market Trends: International economic conditions, such as oil price fluctuations or trade wars, affect the export-oriented PSEs and companies dependent on global demand.

Benefits of Investing in the Nifty PSE Index

- Stable and Reliable Investments: PSEs are backed by the government, offering stability and reduced risk compared to private sector companies.

- High Dividend Yields: Many companies in the Nifty PSE Index are known for paying generous dividends, making them ideal for investors seeking regular income.

- Exposure to Core Sectors: The index provides diversified exposure to critical industries, including energy, power, and metals, which are less vulnerable to economic downturns.

- Long-Term Growth Potential: With increasing government focus on infrastructure development and energy security, PSEs are positioned for sustainable growth.

- Value Investing: PSEs often trade at attractive valuations, offering good entry points for long-term investors

Risks Associated with the Nifty PSE Index

While the Nifty PSE Index has numerous advantages, it also comes with certain risks:

- Government Influence: Decisions driven by government priorities, rather than market conditions, can affect profitability and operational efficiency.

- Regulatory Challenges: Changes in regulations or delays in policy implementation can impact the performance of public sector enterprises.

- Commodity Price Volatility: Fluctuations in prices of crude oil, coal, and metals can lead to earnings volatility for companies in the index.

- Competition: Despite their scale, PSEs face increasing competition from private players, particularly in energy and telecommunications.

Strategies for Investing in the Nifty PSE Index

- Dividend Reinvestment: Reinvest dividends received from PSE stocks to compound your returns over time.

- Diversified Portfolio: Complement your investment in the Nifty PSE Index with other indices, such as Nifty 50 or Nifty Infra, for balanced exposure.

- Long-Term Focus: Hold investments for the long term to benefit from the stable growth of public sector enterprises.

- Monitor Government Policies: Stay updated on government initiatives, budget announcements, and policy changes that could impact the index.

Historical Performance of the Nifty PSE Index

The Nifty PSE Index has shown periods of strong performance, particularly when government reforms or initiatives have supported public sector growth. Key drivers include:

- Disinvestment Programs: When the government reduces its stake in PSEs, it often leads to improved operational efficiency and investor confidence.

- Infrastructure Development: Increased investment in infrastructure boosts the demand for PSE services.

Performance Snapshot:

- The index has delivered steady returns over the long term, driven by dividend payouts and sectoral growth.

- During periods of economic recovery, PSEs often outperform due to their strategic importance.

Future Outlook for the Nifty PSE Index

The outlook for the Nifty PSE Index remains positive, supported by:

- Infrastructure Push: The government’s focus on infrastructure development will drive demand for services provided by PSEs.

- Renewable Energy Initiatives: PSEs in the energy sector are diversifying into renewable energy, opening new growth opportunities.

- Digital Transformation: Many PSEs are adopting digital technologies to improve efficiency and competitiveness.

- Global Market Expansion: Public sector companies are increasingly exploring international markets, boosting their revenue streams.

Trust in PSEs for consistent growth in the heart of India’s economy