The Nifty Next 50: A Strategic Investment in India’s Growth Story

What is the Nifty Next 50 Index?

The Nifty Next 50 Index is a stock market index on the National Stock Exchange (NSE) that represents companies ranked 51st to 100th by free-float market capitalization. Often called the “junior Nifty,” it acts as a feeder index to the Nifty 50, spotlighting the future blue-chip companies of India.

Well-known giants like HDFC Bank, Infosys, and Reliance Industries were once a part of this index before graduating to the Nifty 50 — showcasing the index’s ability to identify tomorrow’s leaders

Why is the Nifty Next 50 Index Important?

The index is more than just a number — it is a gateway to India’s emerging leaders:

- Bridge to Nifty 50 → Companies here are the next potential entrants into the Nifty 50.

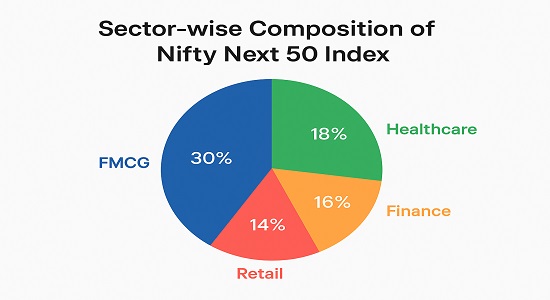

- Sectoral Diversification → Covers FMCG, healthcare, finance, and industrial.

- High Growth Potential → Mid-to-large cap firms in an aggressive expansion phase.

- Benchmark Role → Widely tracked by mutual funds and ETFs.

- Balanced Risk-Reward → Growth opportunities higher than Nifty 50 but less risky than small caps

Composition of the Nifty Next 50

The index spans India’s fast-growing sectors:

- Consumer Goods – Dabur India, Godrej Consumer Products, Marico

- Healthcare – Apollo Hospitals, Biocon

- Finance – ICICI Lombard, emerging NBFCs

- Retail & Services – Avenue Supermarts (D-Mart)

- Industrial Goods – Infrastructure & construction leaders

Benefits of Investing in the Nifty Next 50

- Exposure to Future Leaders – Access to companies that may soon join the Nifty 50.

- Diversification – Reduces risk of sector concentration.

- Long-Term Wealth Creation – Strong historical returns as companies mature.

- Passive Investing Options – ETFs and index funds make investing simple.

- Mid-Cap to Large-Cap Transition – Offers growth like mid-caps and stability like large-caps.

Risks of the Nifty Next 50

Investors must also be aware of the risks:

- Market Volatility – Higher than Nifty 50 during downturns.

- Sectoral Risks – Certain sectors dominate the index at times.

- Transition Uncertainty – Not all companies graduate to Nifty 50.

- Liquidity Risks – Slightly lower liquidity compared to large caps.

Nifty Next 50 vs Other Indices

| Aspect | Nifty Next 50 | Nifty 50 | Nifty Mid-cap 50 |

| Market Cap | Mid to Large Cap | Large Cap | Mid Cap |

| Growth Potential | High | Moderate | Very High |

| Risk Profile | Moderate | Low | High |

| Diversification | High | High | Moderate |

Future Outlook of the Nifty Next 50

- Domestic Growth – India’s expanding economy boosts these companies.

- Rising Middle-Class Spending – Strong growth for FMCG, retail, and healthcare.

- Government Support – Policies like Make in India & infra push add tailwinds.

- Global Expansion – Many companies are increasing international presence.

How to Invest in the Nifty Next 50

- ETFs → Low-cost, easy way to track the index.

- Mutual Funds → Professionally managed index funds.

- SIPs → For disciplined long-term investing.

- Direct Equity → For active investors with strong research skills.

Strategies for Investors

- Long-Term Holding → Benefit from compounding and growth.

- Diversify Across Indices → Balance Nifty Next 50 with Nifty 50, midcap, small cap.

- Monitor Sectoral Trends → Some sectors may weigh heavier at times.

- Review Regularly → Re-balance based on goals and market conditions.

FAQs on Nifty Next 50

Q1 Is Nifty Next 50 better than Nifty 50?

- Not necessarily. Nifty 50 is more stable, while Nifty Next 50 has higher growth potential with slightly more risk

Q2 Can I invest with small amounts?

- Yes, via ETFs or mutual funds through SIPs.

Q3 Is it suitable for long-term investors?

- Absolutely. Historical trends show wealth creation when held over 7–10 years.

Conclusion

If you’re an investor looking for growth beyond the Nifty 50, the Nifty Next 50 Index offers a diversified, future-oriented portfolio of India’s emerging giants. While it carries moderate volatility, the long-term reward potential is high, making it a strong candidate for inclusion in a balanced investment portfolio

Disclaimer: Investments in securities market are subject to market risks. Read all scheme-related documents carefully before investing