Investing In The Nifty India Manufacturing Index: A Comprehensive Guide

In the ever-evolving landscape of India’s economy, the Nifty India manufacturing Index plays a crucial role, fueling growth, innovation, and job creation. For investors looking to engage with this essential segment, the Nifty India Manufacturing Index provides a well-defined route. This blog explores the core aspects of the Nifty India Manufacturing Index, including its composition, importance, and the opportunities it presents for investors.

Nifty India Manufacturing Index: A Guide for Investors

The Nifty India Manufacturing Index aims to showcase how companies in India’s manufacturing sector are performing. It includes a wide variety of industries, offering a thorough insight into the sector’s overall health and direction.

Key Highlights:

- Objective: The index is designed to monitor the performance of stocks that represent the manufacturing sectors in India.

- Selection Universe: Companies are chosen from a diverse pool that includes the Nifty 100, Nifty Midcap 150, and Nifty Small cap 50 indices, providing a wide representation across different market capitalizations.

- Weighting Methodology: Constituent weights are determined by free-float market capitalization, with a maximum limit of 5% on individual stock weights to promote diversification. Additionally, a minimum allocation of 20% is designated for certain manufacturing sectors to ensure balanced representation.

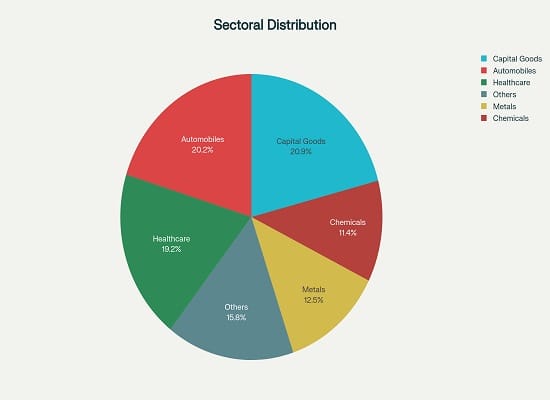

Composition of the Index

As of January 2025, the Nifty India Manufacturing Index comprises 77 companies spanning multiple industries. The sectoral distribution is as follows:

- Capital Goods: 20.09%

- Automobile and Auto Components: 20.02%

- Healthcare: 19.19%

- Metals & Mining: 12.48%

- Chemicals: 11.44%

- Oil, Gas & Consumable Fuels: 8.53%

- Consumer Durable: 6.49%

- Textiles: 1.76%

Investment Opportunities

For investors interested in the manufacturing sector, the Nifty India Manufacturing Index is an important benchmark. One option to explore is the Navi Nifty India Manufacturing Index Fund – Direct Growth. This equity mutual fund, which was launched on August 29, 2022, seeks to mirror the performance of the Nifty India Manufacturing Index. Since it started, it has provided average annual returns of 13.30%.

Recent Trends in India’s Manufacturing Sector

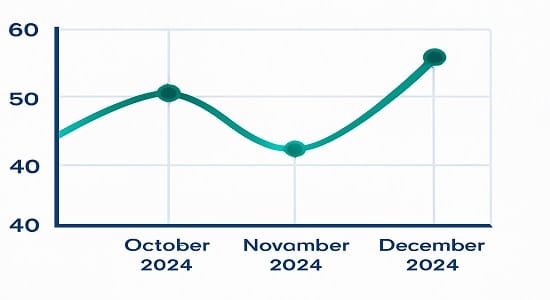

Understanding the broader economic context is crucial for informed investment decisions. Recent data indicates:

- In December 2024, the manufacturing sector saw its slowest growth of the year, as the Purchasing Managers’ Index (PMI) fell to 56.4 from 56.5 in November. This deceleration was linked to weaker demand, even though cost pressures eased and job growth remained strong.

- In November 2024, growth slowed down as inflationary pressures increased. The PMI fell to 56.5, down from 57.5 in October, with input cost inflation hitting its highest level since July.

- October 2024: The sector experienced a modest increase, fueled by robust demand. The PMI climbed to 58.6, up from September’s 58.3, indicating the 39th straight month of growth.

These trends underscore the sector’s resilience amidst varying economic conditions.

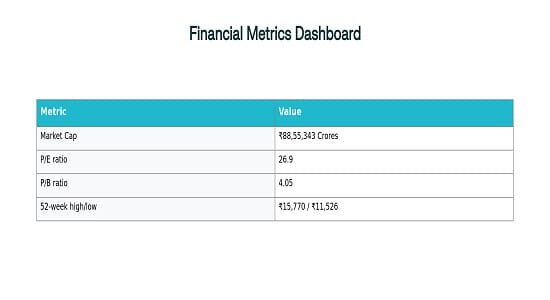

Performance Metrics

Investors frequently evaluate indices using important financial metrics. According to the most recent data, the Nifty India Manufacturing Index shows the following:

- Market Capitalization: ₹88,55,343 Crores

- Price-to-Earnings (P/E) Ratio: 26.9

- Price-to-Book (P/B) Ratio: 4.05

- 52-Week High/Low: ₹15,770 / ₹11,526

These metrics offer insights into the valuation and market perception of the manufacturing sector in India.

Conclusion

The Nifty India Manufacturing Index provides investors with a well-structured way to engage with the diverse manufacturing sector in India. Its varied composition and clear methodology make it a vital resource for those looking to tap into the growth potential of this crucial part of the economy.

As with any investment, it’s essential to perform thorough research, keep abreast of market trends, and take into account personal financial goals and risk tolerance. The manufacturing sector, known for its dynamic nature, offers both opportunities and challenges. By utilizing indices like the Nifty India Manufacturing Index, investors can navigate this landscape with increased confidence and accuracy.

The data and statistics presented in this blog are based on information available as of January 2025. Investors are advised to consult the latest resources and seek professional advice before making investment decisions.