Microfinance Explained: How to Achieve Financial Freedom Through Small Loans

In a country where millions still lack access to traditional banking, Microfinance has emerged as a lifeline. Imagine a woman in rural Bihar starting her tailoring business with just ₹10,000 — that’s the magic of microfinance. It bridges the gap between poverty and opportunity by offering small loans, savings, and insurance to those excluded from formal financial systems.

In this blog, you’ll discover how it works, why it’s crucial for India’s financial inclusion, and the opportunities it offers investors and communities alike. Whether you’re a finance enthusiast, policymaker, or investor, this guide will help you understand the engine that fuels grassroots entrepreneurship.

What Is Microfinance?

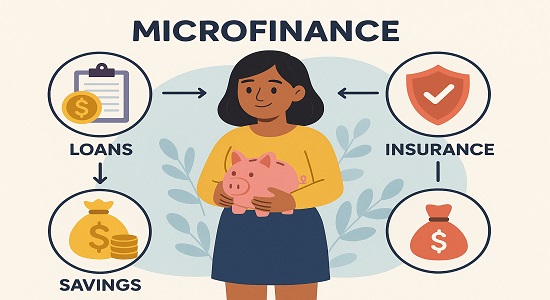

It refers to a system of providing small-scale financial services — like loans, savings, and micro-insurance — to individuals or groups who lack access to traditional banking. It primarily targets low-income households, small entrepreneurs, and self-help groups (SHGs).

Example: In Andhra Pradesh, a women’s SHG borrowed ₹25,000 through a micro-finance institution (MFI) to start a pickle-making business. Within a year, the group doubled its income — showcasing micro-finance’s transformative impact.

How Does Microfinance Work?

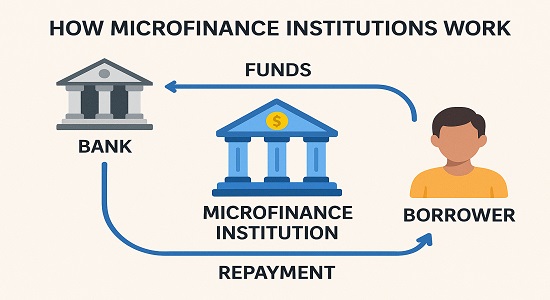

Micro-finance institutions (MFIs) act as intermediaries between banks and borrowers. They collect funds from investors or banks and distribute small loans to customers, often through joint liability groups (JLGs) or self-help groups (SHGs)

Key Components of Micro-finance

- Microcredit: Small loans for income-generating activities.

- Microsavings: Allowing people to save small amounts safely.

- Microinsurance: Protection against health or crop risks.

- Financial Literacy: Educating borrowers about responsible finance.

Why is Micro-financing is Important?

Micro-finance is not just about lending — it’s about empowerment, inclusion, and growth.

Key Benefits to Investors and Society

- Financial Inclusion: Enables access to credit for un-banked populations

- Women Empowerment: 80% of microfinance borrowers in India are women

- Poverty Reduction: Creates self-employment and sustainable income streams

- Rural Development: Boosts local economies by supporting small enterprises

- Low Default Rates: Average repayment rate in Indian MFIs is above 95% (Source: Sa-Dhan Report 2024)

Risk and Limitations

While micro-finance has transformed millions of lives, it’s not without challenges.

| Pros | Cons |

| Promotes Entrepreneurship | High interest rates (18–24%) |

| Encourages savings | Over-indebtedness risk |

| Strengthens women’s role in economy | Limited regulatory oversight |

| Builds credit history | Vulnerable to rural defaults during crises |

Micro-finance must balance profitability with social impact to sustain long-term success.

How to Invest in Microfinance

- Invest in Micro-finance Institutions : Listed companies like Credit Access Grameen Ltd, Spandana Sphoorty, and Bandhan Bank are major players.

- Mutual Funds & ETFs: Some funds allocate exposure to micro-finance or inclusive finance portfolios.

- Impact Investment Platforms: Online platforms like Rang De allow individuals to lend directly to micro-entrepreneurs.

Historical Performance

| Year | MFI Loan Portfolio (Cr) | YoY Growth |

| 2020 | 2,10,000 | – |

| 2021 | 2,32,000 | +10% |

| 2022 | 2,88,000 | +24% |

| 2023 | 3,64,000 | +26% |

| 2024 | 4,40,000 | +21% |

(Source: Micro-finance Institutions Network – MFIN Report 2024)

Microfinance assets under management (AUM) in India have grown over 15% annually in the last five years — outperforming several traditional lending segments.

Future Outlook / Expert View

According to NABARD, India’s microfinance sector could exceed ₹6 lakh crore by 2027, driven by digital lending, fintech partnerships, and AI-based risk assessment. Experts from Crisil project strong growth as rising rural incomes and government programs like PMEGP and Digital India expand access to finance.

FAQ on Microfinance

Q1. What is the difference between microfinance and microcredit?

- Microcredit means only small loans, while microfinance includes loans, savings, and insurance.

Q2. Is microfinance profitable for investors?

- Yes. Many MFIs are profitable due to high repayment rates and scalable models.

Q3. Who regulates MFIs in India?

- The Reserve Bank of India (RBI) regulates NBFC-MFIs and sets lending norms.

Q4. Can individuals directly lend through microfinance?

- Yes, through platforms like Rang De or MicroGraam, individuals can lend small amounts to borrowers.

Conclusion

- Microfinance empowers millions by offering access to credit, especially for women and small entrepreneurs.

- It plays a crucial role in India’s financial inclusion and rural economic growth.

- Investors can gain both social impact and financial returns through MFIs and related funds.

- As technology deepens, digital microfinance will redefine grassroots banking.

Explore our latest financial insights to discover how you can be part of India’s microfinance revolution and support inclusive growth.

Hiya, I’m really glad I’ve found this information. Nowadays bloggers publish only about gossips and net and this is really frustrating. A good blog with exciting content, that’s what I need. Thank you for keeping this website, I’ll be visiting it. Do you do newsletters? Cant find it.