Understanding Metropolitan Exchange: Opportunities for Retail Investors in the Indian Market

The Metropolitan Exchange of India (MSE), earlier known as MCX-SX, may not be as big as the NSE or BSE, but it plays a unique role in India’s financial markets. For retail investors, traders, and SMEs, MSE provides an alternative trading platform with affordable costs, innovative products, and strong SEBI regulation.

In this blog, we’ll break down everything you need to know about MSE — its history, key features, products, opportunities for investors, and the challenges it faces — all in simple language

What is the Metropolitan Exchange of India (MSE)?

The Metropolitan Exchange of India (MSE) is a SEBI-recognized stock exchange that provides a platform to trade in equities, derivatives, debt instruments, and currency futures. Established in 2008, MSE aims to bring transparency, competition, and financial inclusion to India’s markets.

Key Highlight: MSE was one of the first exchanges to specialize in currency derivatives, giving it a distinct edge

History and Evolution of MSE

- 2008 – Launch as MCX-SX: Focused only on currency derivatives.

- 2012 – SEBI Approval: Expanded into equities and equity derivatives.

- 2014 – Rebranding: Became the Metropolitan Exchange of India (MSE) to reflect its broader offerings.

- Today: Focused on inclusivity, SMEs, and advanced tech infrastructure for seamless trading.

Key Features of Metropolitan Exchange

Diverse Product Offerings MSE facilitates trading across a range of financial instruments, including:

- Diverse Product Offerings – Equities, equity derivatives, currency derivatives, bonds, and interest rate futures.

- Regulated by SEBI – Ensuring transparency, investor protection, and trust.

- Inclusive Access – Targeting under-served cities and retail investors.

- Advanced Technology – Low-latency, high-speed trading infrastructure.

Why Metropolitan Exchange Matters

The MSE holds a unique position in India’s financial ecosystem:

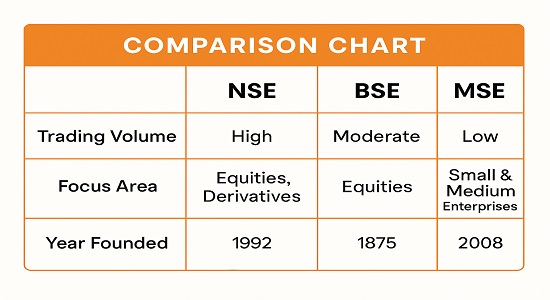

- Competition in Indian Markets: MSE ensures that NSE and BSE do not dominate fully, encouraging better services and reduced costs.

- Boost for Currency Derivatives: Helped popularize USD/INR and other forex contracts in India.

- Support for SMEs: Provides small businesses with a platform to raise funds and grow visibility.

- Financial Inclusion: Expands access to retail investors in tier-2 and tier-3 cities.

Products Offered by MSE

| Product | What it Means | Who Benefits |

| Equity Trading | Buy/Sell shares of listed companies | Retail and Institutional Investors |

| Equity Derivatives | Futures & Option Contracts | Traders & Hedgers |

| Currency Derivatives | Hedge Forex risks (USD/INR) (JPY/INR) | Businesses & traders |

| Debt Instruments | Bonds & Govt Securities | Risk-averse investors |

| Interest Rate Futures | Hedge against interest rate | Banks & Financial Institutions |

How to Start Trading on MSE

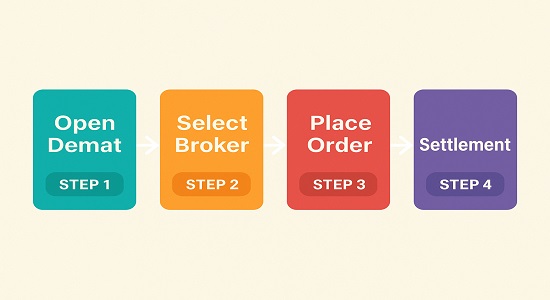

- Open a trading & Demat account with a SEBI-registered broker connected to MSE.

- Complete KYC (PAN, Aadhaar, proof of address).

- Choose your segment (equities, derivatives, debt, etc.).

- Place your trades and track them on MSE’s platform.

Benefits of Trading on MSE

- Lower Transaction Costs – Affordable for retail traders.

- Diverse Products – Beyond just equities (currency & debt instruments).

- Regulated Platform – SEBI ensures safety and fairness.

- Accessibility – Reaches smaller towns and SMEs

Challenges Faced by MSE

Despite its advantages, MSE faces challenges that impact its growth:

- Low Liquidity – Trading volumes are lower than NSE/BSE.

- Fewer Listed Companies – Limited equity options.

- Visibility Issues – Retail awareness is still low.

Future Prospects of MSE

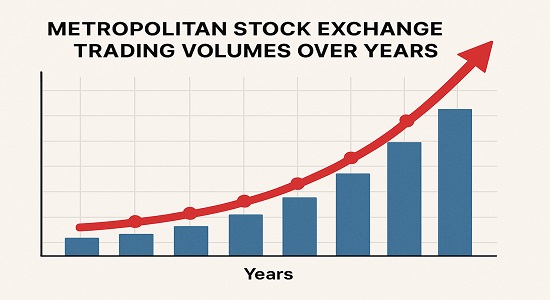

The Metropolitan Exchange is working to address its challenges by:

- Expanding its product range to include innovative instruments.

- Strengthening its SME platform to attract more businesses.

- Enhancing market awareness through investor education programs.

- Partnering with global exchanges to improve visibility and liquidity.With these efforts, MSE aims to establish itself as a key player in India’s financial markets.

Expert View: For long-term, MSE’s role in currency derivatives and SME financing makes it a platform worth watching, especially for retail investors looking for cost-efficient trading options

Conclusion

The Metropolitan Stock Exchange of India (MSE) might not rival NSE or BSE in size, but it offers unique opportunities in currency derivatives, SME financing, and inclusive trading. For retail investors, it’s a cost-effective, regulated, and growing platform to explore.

If you are a trader or investor seeking to diversify your strategy beyond NSE and BSE, keeping an eye on MSE could unlock fresh opportunities.

Suggested FAQ Section

Q1: Is MSE safe for trading?

Yes, MSE is regulated by SEBI and follows strict compliance guidelines.

Q2: What is the main advantage of MSE over NSE/BSE?

Lower costs, focus on currency derivatives, and inclusivity for retail & SMEs.

Q3: Can retail investors trade on MSE?

Absolutely. Retail traders can trade equities, derivatives, and bonds via SEBI-registered brokers.