Decoding MCLR: A Comprehensive Guide For Borrowers And Investors

In the dynamic world of finance, MCLR plays an important role in shaping borrowing and lending activities. One such important benchmark in India’s banking sector is a Marginal Cost Of Funds Based Lending Rate (MCLR). In 2016, introduced by the Reserve Bank of India (RBI), It serves as a minimum interest rate, below which banks cannot lend, credits ensure transparency and efficiency in the market.

In this blog, we will be engrossed in It’s complexities, its calculations, effects on debt and how it differs from the previous benchmark.

What is MCLR?

The Marginal Cost Of Funds Based Lending Rate(MCLR) is an internal benchmark or reference rate that banks in India use to determine interest rates on various loans. This reflects money, operating costs and marginal costs of tenner premiums, ensuring that lends rates are more responsible for changes in policy rates set by RBI.

MCLR: A Response to Need: Understanding the Reasons Behind Its Introduction

Prior to Marginal Cost Of Funds Based Lending Rate, banks used the base rate system to determine borrowing rates. However, there were limitations of the base rate system, especially in broadcasting the borrowers to transmit policy rate changes. To increase transparency and ensure that the benefits of policy rate cuts are passed more effectively to customers, RBI introduced Marginal Cost Of Funds Based Lending Rate framework.

Breaking Down MCLR: How Banks Calculate Their Minimum Lending Rates

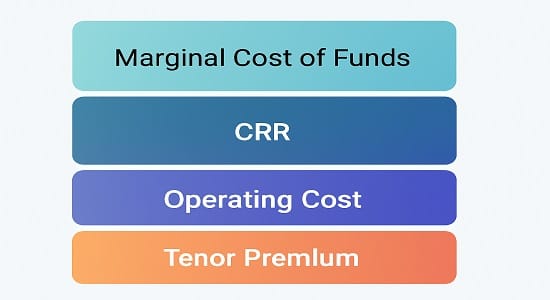

MCLR is determined based on several components:

- Marginal Cost of Funds: This includes interest rates on various deposits and lending. It is responsible for the incremental cost of getting money.

- Negative Carry on Cash Reserve Ratio (CRR): Banks need to maintain a certain percentage of their deposits as CRR with RBI, on which they do not earn any interest. The cost associated with this is the factor in Marginal Cost Of Funds Based Lending Rate.

- Operating Costs: These are the expenses incurred by banks in their day-to-day operations, excluding the costs recovered through service charges.

- Tenor Premium: This takes into consideration the risks involved in lending over various time periods. Loans with longer duration may come with a higher premium due to the increased risk.

By considering these components, banks arrive at the Marginal Cost Of Funds Based Lending Rate for various loan tenors, such as overnight, one month, three months, six months, and one year.

MCLR vs. Base Rate: Key Differences

While both MCLR and Base Rate serve as benchmarks for lending rates, they differ in several aspects:

- Calculation Method: The Base Rate mainly takes into account the average cost of funds, while Marginal Cost Of Funds Based Lending Rate emphasizes the marginal (incremental) cost, which makes it more responsive to shifts in policy rates.

- Transmission of Policy Rates: MCLR allows for a faster adjustment of policy rate changes for borrowers, as it is updated more often according to current funding costs.

- Transparency: MCLR provides enhanced transparency in the determination of lending rates, which helps borrowers access more competitive rates.

The Impact of MCLR on Your Loans: What You Need to Know

For borrowers, Marginal Cost Of Funds Based Lending Rate has significant implications:

- Interest Rate Variability: Loans tied to MCLR are subject to interest rate adjustments, which can cause variations in EMIs depending on shifts in the MCLR.

- Loan Comparisons: With standardized MCLR rates, borrowers can easily compare loan options from various banks to find the best terms.

- Benefit from Rate Cuts: Borrowers can take advantage of reductions in policy rates more quickly, as MCLR responds to these changes without delay

How MCLR Affects Your Loan Costs: A Financial Perspective

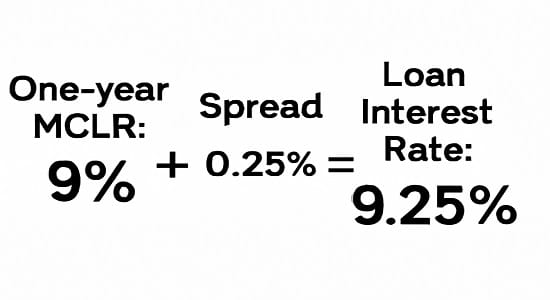

When you take out a loan that is linked to the Marginal Cost Of Funds Based Lending Rate, the interest rate is usually determined by adding a spread to the MCLR. For instance, if the one-year MCLR is 9.00% and the bank adds a spread of 0.25%, your loan’s interest rate would be 9.25%.

It’s also important to understand that Its-linked loans have reset periods, which can be either annual or semi-annual. During these reset times, the interest rate on your loan may change according to the current MCLR, which can impact your Equated Monthly Installments (EMIs).

Tips for Borrowers

- Stay Informed: Stay updated on the MCLR rates set by your bank, as they can affect your loan EMIs during reset periods.

- Understand the Spread: Pay attention to the spread your bank applies over the MCLR, as it plays a crucial role in determining the final interest rate on your loan.

- Negotiate Terms: If possible, talk to your bank about negotiating the spread to get a better interest rate.

- Consider Reset Frequency: Choose a loan with a reset frequency that fits your financial strategy. More frequent resets can result in faster changes to your EMIs when interest rates fluctuate.

Conclusion

The Marginal Cost of Funds-Based Lending Rate plays a key role in India’s banking system, helping to align lending rates with the prevailing economic conditions and policy rates. For borrowers, grasping the concept of Marginal Cost Of Funds Based Lending Rate is essential for making well-informed choices regarding loans and effectively managing interest rate risks.

By being informed and taking initiative, borrowers can leverage the intricacies of Marginal Cost Of Funds Based Lending Rate-linked loans to their benefit, obtaining better terms and managing their financial obligations more effectively.