Urban Company IPO & Financials: What Every Small Investor in India Must Know

If you’re a beginner or intermediate investor in India wondering whether Urban Company is a promising stock (especially with its IPO and FY25 financials making headlines), this blog is for you. We’ll explore what the company does, how it makes money, what its recent performance looks like, what risks to watch, and whether it might be worth investing in

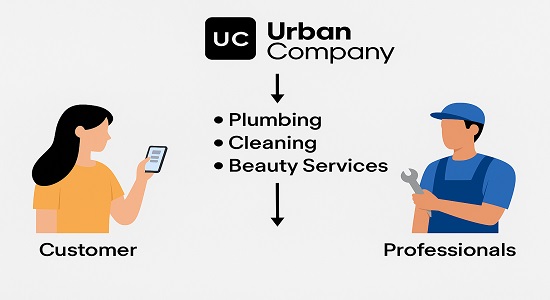

What is Urban Company & How It Works

Urban Company (formerly “Urban Clap”) is a home-services and beauty-services marketplace. It connects customers with trained service professionals across categories like plumbing, cleaning, carpentry, pest control, grooming, massages, etc.

Some key aspects:

- Operates in India and some international markets (Singapore, UAE, etc.).

- Also sells its own products (e.g. Native water purifiers and smart locks) besides the service marketplace.

- Generates revenue not just from commissions, but from memberships, product sales, training/skilling, lead generation etc.

Recent Financial Performance (FY24-25)

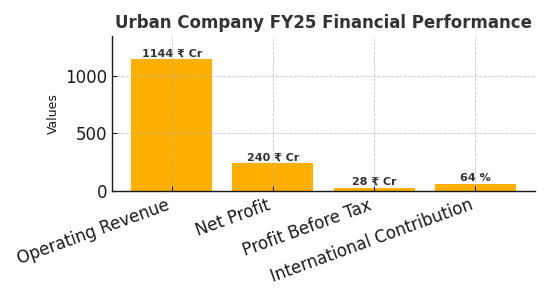

Here’s a snapshot of how Urban Company performed in FY25 vs prior years. Retail investors will want to focus especially on revenue growth, profits/losses, and what drove any turnaround.

| Metric | FY24 | FY25 |

| Operating Revenue | ₹827 crore | ₹1,144 crore (~38% YoY growth) |

| Net Profit/ loss | Net loss (~ ₹93 crore) in FY24 | Net profit ~ ₹240 crore in FY25 |

| Profit Before Tax | Negative in FY24 | Positive (~ ₹28 crore pre-tax) in FY25 even without major credits. |

| Contribution from International | Lower in earlier years | Grew ~ 64% in FY25, though India remains the main market. |

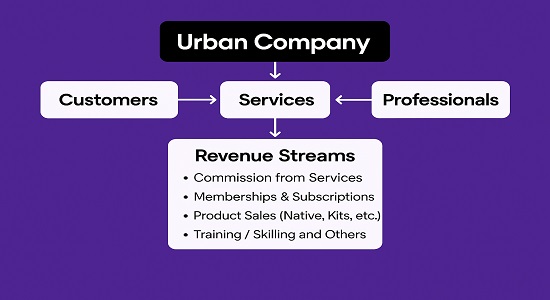

Business Model & Revenue Streams

Understanding how Urban Company makes money helps you assess whether its profits are sustainable.

Key Revenue Streams

- Commission from Services: Each service booked (repair, cleaning, beauty etc.) yields a commission for the platform. This is still the largest chunk of its revenue.

- Memberships & Subscriptions: For service-providers (“pros”) there are paid options for better leads / visibility etc. Also for consumers there may be loyalty / membership benefits.

- Product Sales (Native, Kits, etc.): The new product vertical (water purifiers, smart locks etc.) is growing fast.

- Training / Skilling and Others: Fees from training service professionals, lead generation etc.

What Helped the Turnaround

- Better unit economics; cutting losses by controlling costs.

- Scale & Growth in core service categories in India.

- International expansion also contributing.

What Retail Investors Should Watch Out For (Risks & Considerations)

While the numbers look good, there are always risks. Here are key ones:

- Sustainability of Profit: A part of FY25 profit came from deferred tax credits. Without those, profit margins may be slimmer.

- Competition & Pricing Pressure: Many local / un-organised service-providers; the market is price sensitive. Consumer behavior could shift.

- Quality & Partner Relationships: The business depends heavily on service quality and ratings. If partners (pros) aren’t satisfied, quality may slip.

- Regulatory or Gig-Worker Issues: As with many gig-economy firms, there’s attention on worker welfare, commissions, blocks or ratings policies etc. Could impact reputation.

- Capital Intensity of Scaling: Expanding into new product verticals / new geographies requires investment; margins may be under pressure.

Is Urban Company IPO / Stock Worth Considering?

For beginners / intermediate investors, here are factors to help you decide:

- Valuation & Growth vs Risk: If priced reasonably, growth of ~38% YoY plus profitable FY25 makes a good case, but you’ll need to compare with peers.

- Diversification of Revenue: Having multiple streams (services + products + memberships) is a plus. It helps cushion downturns in any one area.

- Macro Tailwinds: Growing urban population, rising incomes, greater demand for convenience & home services → environment favors platforms like Urban Company.

- Long Term vs Short Term: If you are a long-term investor, Urban Company’s shift to profitability is promising. For short-term gains, IPO pricing & market sentiment matters a lot.

FAQs on Urban Company?

Q1. What was the FY25 revenue and profit of Urban Company?

- Urban Company did ~₹1,144 crore in operating revenue in FY25 (up ~38% YoY) and reported a net profit of ~₹240 crore, marking a turnaround from a loss in FY24.

Q2. How much of its revenue comes from India vs international markets?

- India remains its core market. Although international business grew ~64% year-on-year, India still contributes the majority of revenue.

Q3. What is the business model? How does Urban Company make money?

- Key revenue comes from commissions on services booked. Other streams include product and kit sales, membership/subscription (for both consumers and service professionals), training & skilling, and lead generation.

Q4. Are there red flags?

- Profit sustainability (especially excluding tax credits), maintaining quality of service, regulatory or legal risks around gig economy operations, and competition are important to watch.

Conclusion

Urban Company has demonstrated that profitability + growth can coexist. FY25 was a watershed: revenue growth of ~38%, a profitable bottom line, and diversification of its business model. For Indian retail investors, that’s heartening.

But the fine print is important. Monitor how the company fares stripping out the one-time boosts (such as deferred tax credits), how costs trend from here on, how it manages partner satisfaction & quality, and how stringent competition becomes. If you think Urban Company can sustain momentum, it may be a great addition to your portfolio

Very good written information. It will be useful to anybody who employess it, including myself. Keep up the good work – for sure i will check out more posts.

Very interesting topic, thankyou for putting up.

Very interesting information!Perfect just what I was searching for!

I like what you guys are up also. Such smart work and reporting! Carry on the superb works guys I¦ve incorporated you guys to my blogroll. I think it’ll improve the value of my web site 🙂