Demerger & Your Portfolio: What Happens When A Company Splits In India?

Demerger is a corporate strategy where a firm divides its business into two or more companies. It is usually used to release trapped value, improve operating intensity, and facilitate better investor sentiment. Whereas mergers merge strengths, restructuring separate core and non-core operations to build slender, nimble businesses.

What is a Demerger?

It is a form of corporate restructuring in which a business is broken down into separate legal entities. It allows parts of a company to operate independently.

Example:

In July 2004 Larsen & Toubro (L&T) demerged its IT and engineering services arm (L&T Infotech), which later became a strong company on its own.

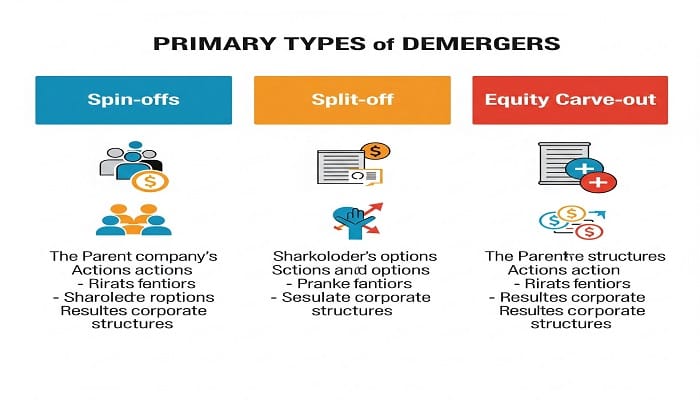

Types Of Demerger

| Types of Demerger | Description | Example |

| Spin – Off | Shares of the new entity are given to existing shareholders | Infosys |

| Split – Off | Shareholders exchange parent company shares for shares in the new entity | Reliance’s telecom |

| Equity Carve – Out | The parent sells a portion of its subsidiary to public investors via IPO | HDFC IPO of HDFC Life |

Why Do Companies Go for a Demerger?

- Unlocking Shareholders Value: Investors can value each business division separately, which tends to value them higher

- Focused Strategy: Individual entities can now focus on their specific market or industry without facing internal competition.

- Transparency: Streamlined financial reporting provides investors with greater transparency about revenue and profitability.

- Attracting Investment: Small, focused companies post-restructuring tend to attract concentrated institutional investors.

- Better Management Efficiency: Independent leadership for distinct entities ensures more responsible governance.

Benefits Of Demerger for Investors

| Benefits | Explanation |

| Enhanced Valuation | Market tends to re-rate the new entities generating capital gains |

| Better Investment Choices | Investors can choose to stay in the core business or explore the demerged unit |

| More Focused Management | Better decision making and business alignment |

| Portfolio Diversification | Maintaining two different businesses after restructure reduces risk diversification |

Demerger Vs Merger: Quick Comparison

| Feature | Demerger | Merger |

| Structure | One entity becomes two or more | Two or more entities become one |

| Objective | Focus, transparency, unlocking value | Synergies, scale, consolidation |

| Impact or Shareholders | Receive shares in new entities | Receive shares of the merged entity |

| Investor Perspective | Often positive due to better valuation | Depends on synergy realization |

How Demerger Impact Stock Performance

Case Study: Reliance Industries’ Jio Demerger

Following Reliance’s re-structure of Jio Platforms, there was a distinct value separation between telecom and oil companies that investors could discern. Jio IPO and digital investments contributed immensely to the overall market perception and valuation of RIL.

Stock Impact Summary:

| Parameter | Before Demerger | After Demerger |

| RIL Share Price | ₹1000 | ₹1400 |

| Investor Sentiments | Mixed | Strong |

| Analyst View | Undervalued Conglomerate | Valuable Standalone Units |

What to Watch as an Investor?

- Record Date: This is the deadline for shareholders to be eligible for new shares.

- Business Strategy: Get acquainted with growth opportunities for both firms.

- Management Commentary: Listen to the earnings calls and the reports for clarity.

- Post Demerger Valuation: Compare with sector peers to assess pricing.

- Liquidity: Newly created entities might have lesser liquidity in the short term.

Demerger News: Why It’s Trending

India is seeing a tide of corporate re-structure as conglomerates look to nimble, digital-led strategies. Be it Tata Group’s super app ambitions or Adani’s re-structurings, are turning out to be a potent fiscal engineering instrument.

Conclusion: Is a Demerger Good or Bad?

It is neither positive nor negative — it all depends on implementation. Strategically implemented and managed with transparency, re-structure is advantageous to all stakeholders, particularly shareholders. As an investor, knowing why and when it takes place can provide lucrative opportunities. Be well-informed, examine the fundamentals, and always monitor the parent as well as the re-structure entities.

IT is often a strategic surgical procedure, allowing disparate business units to shed the constraints of a large entity and pursue their own distinct growth trajectories thereby unlocking hidden value for shareholders