How High-Frequency Trades (HFT) Changed the World

What is High-Frequency Trading?

High-Frequency Trades (HFT) is a form of algorithmic trading that involves executing vast orders with the help of highly sophisticated computers at very high speeds — sometimes in halves of a second or less. It has transformed the behavior of financial markets worldwide. Whether you’re a trader, an investor, or simply a curious mind, knowing how HFT works can make you better understand the fast-paced dynamics of the financial world.

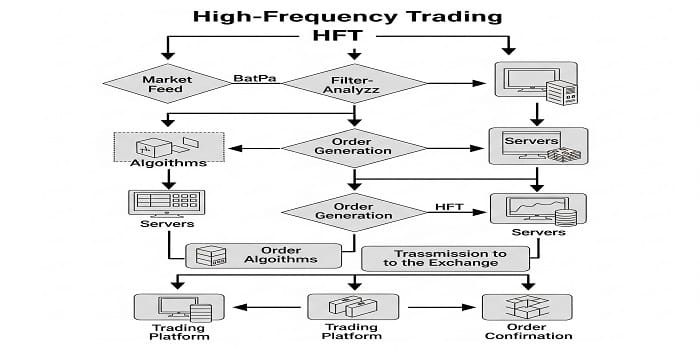

How Does High-Frequency Trades (HFT) Work?

High-Frequency Trading HFT uses intricate algorithms, low-latency networks, and high-speed data feeds to scan market data and make lightning-fast trading decisions. The trades are completed so rapidly that even human traders cannot compete.

Key Features of High-Frequency Trades (HFT)

| Features | Description |

| Speed | Executes trades in microseconds or nanoseconds |

| Volume | Handles thousands of trades per seconds |

| Automation | Fully automated with minimal human intervention |

| Arbitrage | Exploits tiny price discrepancies across exchanges |

| Co-location | Servers are physically close to exchange data centers for speed |

Global Impact of High-Frequency Trades Concerns and Controversies Associated with HFT

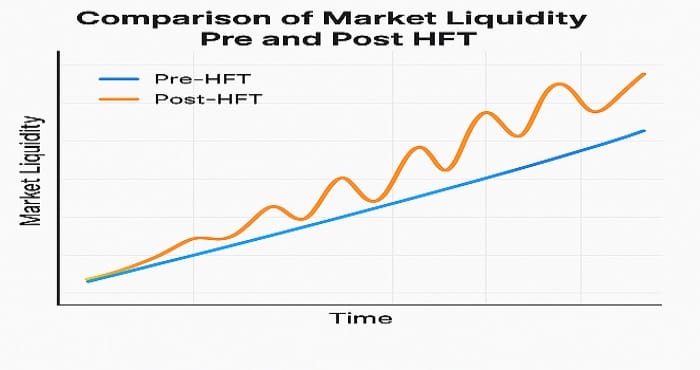

Increase Market Liquidity

- High-Frequency Trades companies offer constant bids and offers to facilitate smoother and more liquid markets. This assists in compressing spreads and making transactions cheaper for everybody.

Narrower Bid-Ask Spreads

- The fierce competition between High-Frequency Trades companies makes the gap between selling and buying prices minimal — good news for retail investors.

Market Efficiency

- By rapidly adjusting price misalignments, HFT assists in moving prices nearer to their equilibrium value.

Global Reach

- HFT High-Frequency Trades is not exclusive to the U.S. or Europe. India’s NSE, Japan’s TSE, and China’s markets all have seen increased high-frequency activity.

Concerns and Controversies Associated with HFT

| Risk | Impact |

| Market Manipulation | Some HFT Strategies may lead to spoofing or layering |

| Flash Crashes | Sudden price due to algorithmic errors |

| Lack of Transparency | Complex algorithms make it hard to trace accountability |

| Favoritism | Only Firms with resource can afford HFT Infrastructure |

Real-World Example: The 2010 Flash Crash

On May 6, 2010, the American stock market suddenly and precipitously crashed, with the Dow Jones Industrial Average falling more than 1,000 points in a matter of minutes — only to rebound immediately. Examinations found that high-frequency trading was responsible for causing the crash by greatly magnifying a small mistake into a system-wide panic.

India’s Take on High-Frequency Trades (HFT)

In India, guidelines have been brought in by the Securities and Exchange Board of India (SEBI) to govern HFT. Access to co-location, monitoring of latency, and fairness in the market are key concerns.

SEBI’s Measures:

- Randomized order delays

- Equal access to data

- Audit trails of algo trades

Should You Worry as a Retail Investor?

Not particularly. Although Pros & Cons of HFT (HFT) can appear to be a mysterious aspect of the financial industry, for the average retail investor, it actually enhances trade execution and reduces expenses. But knowing it makes you more aware and watchful during times of volatility.

Pros & Cons of Pros & Cons of (HFT)

| Pros | Cons |

| Enhances Liquidity | Can cause sudden volatility |

| Narrows Bid- ask spreads | Difficult for regulator to check |

| Faster Execution | Favors large Players |

Final Thoughts

As technology advances, so will financial markets. High-Frequency Trading is merely the start of algorithmic finance. Keeping current with these trends is no longer a choice — it’s imperative.

Sign up now and claim your bonus instantly! The game is waiting for you. – https://krakenpartners.net/ru/track/1174

— Monica – Your Ultimate AI Assistant for Every Task!

Looking for a way to boost productivity and streamline your daily tasks? Monica.im is your all-in-one AI assistant, integrating top-tier AI models like OpenAI o1-preview, GPT-4o, Claude 3.5, and Gemini 1.5. It helps you with communication, research, writing, and even coding—all accessible through a browser extension for Chrome and Edge, as well as mobile apps for Android and iOS. (monica.im)

— Key Features of Monica (https://monica.im/invitation-affiliate?ref=ztk2ymi&ref_aff=ztk2ymi

AI Chat: Interact with leading AI models in one place.

AI Summarizer: Save up to 90% of your time by instantly summarizing web pages and videos.

AI Writer: Generate or enhance any content 10x faster, from short paragraphs to full-length articles.

AI Search: A powerful search engine with real-time access to the latest information.

AI Translator: Translate entire web pages for seamless bilingual reading.

AI Art Generator: Turn your ideas into stunning images effortlessly.

— Why Choose Monica?

Available Across All Platforms: Use Monica on browsers, desktops, or mobile devices.

Intelligent Toolbar: Quickly explain, translate, or summarize any highlighted text.

Writing Assistant: Create, rewrite, or improve text content on any webpage.

Enhanced Web Experience: Get AI-powered answers alongside search results, summarize YouTube videos, and extract key insights with timestamps.

— Start Boosting Your Productivity Today with Monica https://monica.im/invitation-affiliate?ref=ztk2ymi&ref_aff=ztk2ymi)

— Install for Free: https://monica.im/invitation-affiliate?ref=ztk2ymi&ref_aff=ztk2ymi

At this page you can find a lot of useful information.

It is created to guide you with multiple topics.

You will see simple explanations and everyday examples.

The content is frequently improved to stay relevant.

https://indianastars.us

It’s a reliable resource for learning.

Anyone can take advantage of the materials here.

Feel free to reading the site right away.