Gold ETF: The Smart & Simple Alternative to Physical Gold Investment

In a world where market volatility keeps investors awake at night, Gold ETFs have emerged as the ultimate safe-haven instrument. As global uncertainties rise and inflation remains sticky, investors are increasingly looking at gold — not as jewelry, but as a strategic investment.

Gold Exchange Traded Funds (ETFs) allow investors to gain exposure to gold’s price movements without worrying about storage, purity, or liquidity. This article breaks down everything you need to know about Gold Exchange Traded Funds — how they work, why they matter in 2025’s dynamic financial landscape, and how to start investing wisely.

What is a Gold ETF?

Gold ETFs are listed and traded just like company shares.

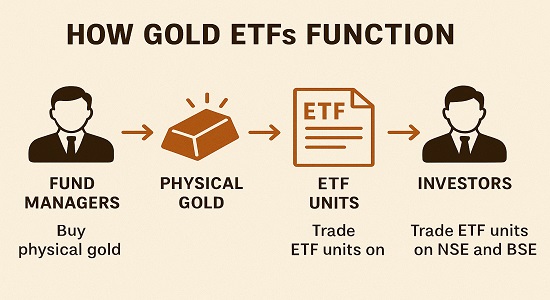

Here’s how they function:

- Asset Composition: 100% backed by physical gold (of 99.5% purity).

- Price Tracking: Mirrors domestic gold prices as published by the India Bullion and Jewellers Association (IBJA).

- Trading & Liquidity: You can buy/sell through a Demat account during market hours.

- Returns: Based on gold price movements and tracking efficiency.

Example:

- If gold prices rise by 10%, your Gold ETF’s NAV (Net Asset Value) increases proportionately.

Why is it Important / Benefits to Investor

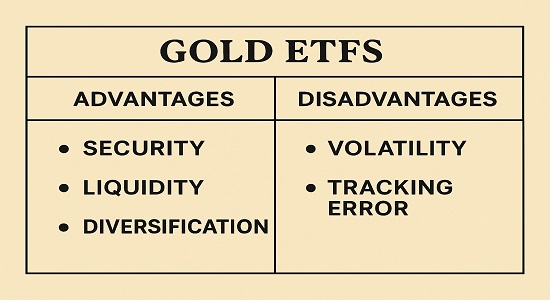

It offer diversification and inflation protection — two key pillars of any strong portfolio.

Key Benefits:

- Inflation Hedge: Gold prices often rise when inflation does.

- No Storage Hassles: Unlike physical gold, no lockers or insurance needed.

- Easy Liquidity: Buy/sell instantly on NSE or BSE.

- Portfolio Diversification: Reduces overall portfolio risk.

- Transparency: Daily NAV updates and SEBI-regulated holdings.

According to NSE data (2025), assets under management (AUM) in it have grown 35% year-on-year, reflecting strong retail participation and institutional confidence.

Risk / Limitations / Challenges

While Gold-ETFs are low-risk, they aren’t risk-free.

| Pros | Cons / Risk Factor |

| Secure, SEBI-regulated | Market-linked volatility |

| High liquidity | Spot price |

| Transparent holdings | No dividend or interest income |

| Low cost | Subject to capital gains tax |

Volatility and opportunity cost (when equity markets outperform) are the key challenges investors must evaluate.

How to Invest / Access it

Investing in Gold-ETFs is straightforward:

- Open a Demat & trading account with any broker (Zerodha, Groww, etc.).

- Search for Gold ETFs like Nippon India Gold ETF, HDFC Gold ETF, or ICICI Prudential Gold ETF.

- Buy units like shares during trading hours.

- Track performance via NSE/BSE apps or AMC websites.

Tip: Consider using SIPs (Systematic Investment Plans) in Gold ETFs for rupee-cost averaging

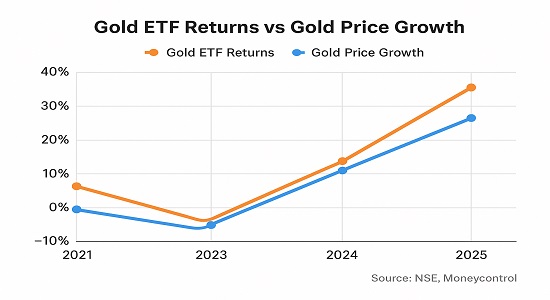

Historical Performance + Data Table

| Year | Gold Price (per 10 gram) | Gold ETF Avg Return |

| 2021 | ₹47,500 | 5.08% (Economic Times) |

| 2022 | ₹52,800 | 14.11% (Economic Times) |

| 2023 | ₹60,200 | 10% (Economic Times) |

| 2024 | ₹67,100 | 20% (Economic Times) |

| 2025 (YTD)* | ₹71,800 | 47.8% (Moneycontrol) |

Future Outlook / Expert View

According to ETMarkets analysts, Gold-ETFs are expected to maintain steady inflows through FY2025–26 as central banks continue buying gold aggressively and global uncertainties persist. SEBI reports highlight that millennial investors are increasingly viewing gold as a “digital inflation shield.”

Experts predict a 5–8% annual return over the next three years, with potential spikes if geopolitical tensions or rate cuts drive gold prices higher.

FAQ On Gold ETF

Q1. Can I convert my Gold ETF into physical gold?

- No, Gold-ETFs are tradable only in electronic form — but can be redeemed in cash.

Q2. What is the minimum investment?

- You can start with 1 unit (≈1 gram of gold), making it beginner-friendly.

Q3. Are there taxes on Gold ETF profits?

- Yes. Gains held for more than 3 years are taxed as long-term capital gains (with indexation).

Q4. How are Gold ETFs different from Sovereign Gold Bonds (SGBs)?

- SGBs offer interest + redemption at market prices, while ETFs provide pure market exposure and liquidity.

Conclusion

- Gold ETFs = Smart + Safe + Simple way to invest in gold.

- Ideal for hedging against inflation and currency risk.

- Backed by physical gold, managed transparently under SEBI norms.

- Suited for both short-term traders and long-term investors.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.

Loving the info on this website , you have done great job on the articles.