Forex Trading in India Made Easy: A Beginner’s Step-by-Step Guide

Forex trading in India or foreign exchange trading, is a global marketplace for buying and selling currencies. With a daily turnover exceeding $7 trillion, it is the largest financial market in the world. While forex trading is immensely popular globally, it’s gaining momentum in India as well. This guide simplifies forex trading in India, highlighting its legal aspects, benefits, risks, and tips for success.

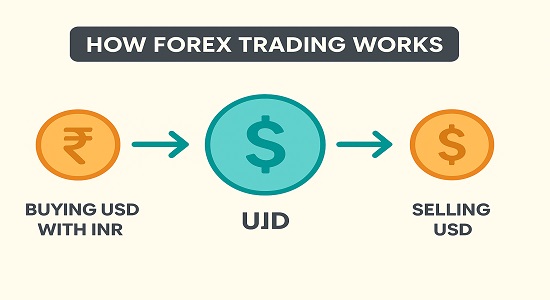

What is Forex Trading?

Forex trading involves the exchange of one currency for another. For instance, buying USD (U.S. Dollar) using INR (Indian Rupee). Traders profit from fluctuations in currency prices driven by market forces like supply and demand, geopolitical events, and economic indicators. Unlike stock markets, the forex market operates 24 hours a day, five days a week, providing unparalleled opportunities for traders. The market is driven by economic events, geopolitical developments, and changes in monetary policies across the globe.

Example: If you buy USD/INR at 83.00 and sell it at 83.50, you make a profit of 0.50 INR per dollar.

Is Forex Trading Legal in India?

Forex trading in India is legal in India but comes with specific regulations to ensure investor protection and maintain economic stability. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) govern forex trading in the country.

Key Rules for Forex Trading in India:

- Permitted Currency Pairs: Forex Trading in India is allowed only in select currency pairs, such as:

- INR-based pairs: USD/INR, EUR/INR, GBP/INR, JPY/INR.

- Cross-currency pairs: EUR/USD, GBP/USD, USD/JPY.

- Authorized Platforms: Forex trading must be conducted through authorized platforms such as NSE, BSE, and Multi Commodity Exchange (MCX).

- No Offshore Trading: Trading on foreign forex platforms is prohibited for Indian residents. Engaging in unauthorized trading can lead to penalties.

By adhering to these guidelines, traders can participate in the forex market legally and securely.

How to Start Forex Trading in India?

Starting forex trading in India is simple. Follow these steps:

- Choose a Licensed Broker: Ensure the broker is registered with SEBI. Popular Indian brokers include Zerodha, Angel One, and ICICI Direct.

- Open a Trading Account: Sign up for a forex trading account with your chosen broker. Complete the KYC process by submitting documents like PAN and Aadhaar.

- Fund Your Account: Deposit funds into your trading account through a bank transfer or UPI.

- Choose a Currency Pair: Select a permitted currency pair like USD/INR or EUR/INR.

- Start Trading: Use the broker’s platform to place buy or sell orders. Monitor market trends to make informed decisions.

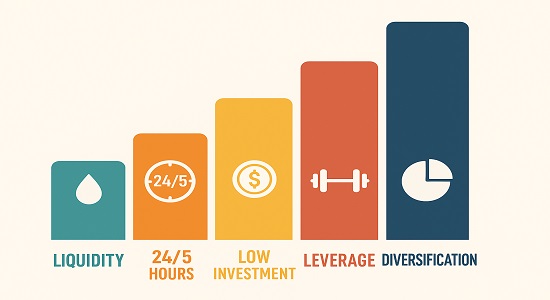

Why Forex Trading is Gaining Popularity in India

Forex trading is attracting Indian investors for several reasons:

- High Liquidity: The forex market is the most liquid financial market globally, allowing traders to enter and exit positions with ease, even in large volumes.

- 24/5 Trading Hours: Unlike stock markets, forex trading operates around the clock from Monday to Friday, accommodating traders across different time zones.

- Low Initial Investment: Forex trading requires minimal capital to start, making it accessible for beginners.

- Leverage Opportunities: Forex brokers offer leverage, enabling traders to control larger positions with a smaller capital investment. However, this comes with higher risk.

- Diversification: Forex trading provides exposure to global currencies, helping traders diversify their investment portfolios beyond traditional asset classes.

Factors Influencing Forex Market Movements

Several factors affect currency exchange rates in the forex market:

- Economic Data: GDP growth, inflation, and unemployment rates impact currency strength. Positive economic data often leads to currency appreciation.

- Central Bank Policies: Interest rate changes by central banks like the RBI, Federal Reserve, or ECB can significantly impact currency prices.

- Political and Geopolitical Events: Elections, trade agreements, and geopolitical tensions influence currency volatility.

- Global Market Sentiment: Risk appetite among investors, driven by global economic conditions, affects currency demand and supply.

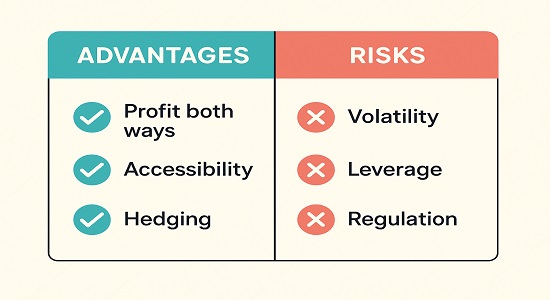

Advantages of Forex Trading

Forex trading in India offers several benefits for traders in India:

- Accessibility: Easy to start with minimal capital requirements.

- Profit in Both Rising and Falling Markets: Traders can take long or short positions, profiting from upward or downward price movements.

- Hedging Opportunities: Businesses and investors can hedge against currency risks, reducing potential losses.

Risks of Forex Trading

While forex trading is lucrative, it comes with risks:

- High Volatility: Currency prices can change rapidly, leading to significant gains or losses.

- Leverage Risks: While leverage amplifies profits, it also increases potential losses.

- Regulatory Risks: Engaging in unauthorized forex trading can lead to penalties.

- Emotional Trading: Fear and greed often lead to impulsive decisions, resulting in losses.

Strategies for Successful Forex Trading

To succeed in forex trading, consider the following strategies:

- Technical Analysis: Use tools like moving averages, RSI, and Fibonacci retracement to identify trading opportunities.

- Fundamental Analysis: Analyze economic data, central bank announcements, and geopolitical events to anticipate currency movements.

- Risk Management: Set stop-loss and take-profit levels to limit losses and secure profits. Avoid risking more than 2% of your capital on a single trade.

- Diversify Trades: Avoid over-concentration in one currency pair. Spread your trades across multiple pairs to reduce risk.

- Stay Informed: Follow market news, economic calendars, and expert analysis to stay ahead of market trends.

Taxation on Forex Trading in India

Income from forex trading in India is taxable in India under “Income from Other Sources” or “Capital Gains,” depending on the nature of your trades.

Points to Remember:

- Short-term gains are taxed at the applicable income tax slab rate.

- Long-term gains (if applicable) may attract a lower tax rate.

- Keep a record of all transactions for filing returns.

Common Mistakes to Avoid in Forex Trading

- Over trading: Avoid excessive trading as it leads to higher transaction costs and emotional exhaustion.

- Ignoring Risk Management: Always calculate the risk-reward ratio before entering a trade.

- Chasing Losses: Don’t make impulsive trades to recover losses; it often worsens the situation.

- Using Unregistered Brokers: Stick to SE BI-regulated brokers to ensure safe and legal trading.

Analyzing economic indicators and news events to predict currency movements.

How to double bets? Aviator game review insight

Try Spribe Aviator demo game without losing money

Get your casino fix using a fresh mirror

Casino mirror login supports two-factor auth

Mirror links keep your casino available always

Predict smartly using data from Aviator game download interface.