What Is The BSE Bankex? A Comprehensive Investor’s Guide

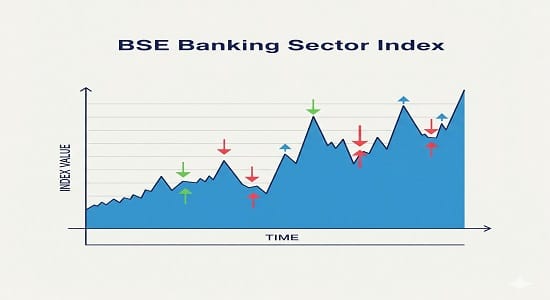

The Bse Bankex is a prominent stock market index in India, representing the performance of the banking sector on the Bombay Stock Exchange (BSE). Launched in 2003, it serves as a barometer for the health and trends of the Indian banking industry, offering investors insights into this crucial segment of the economy.

Composition of the BSE Bankex

The Bankex comprises the top banking stocks listed on the BSE, selected based on market capitalization and liquidity. As of December 2024, the index includes major players such as HDFC Bank, ICICI Bank, State Bank of India, Kotak Mahindra Bank, and Axis Bank, among others. These institutions collectively account for over 90% of the banking sector’s total market value, making the Bankex a comprehensive reflection of the industry’s performance.

Selection Criteria

To ensure that the Bankex accurately represents the banking sector, the following criteria are applied for stock selection:

- Market Capitalization: Only the top companies by market capitalization are eligible for inclusion. This ensures that the index reflects the most significant players in the industry.

- Liquidity: Stocks must exhibit high liquidity, ensuring smooth trading and minimal price manipulation. A stock must have been traded on each trading day in the past three months to qualify.

- Listing History: Typically, a minimum of three months of listing history is required. However, newly listed companies with substantial market capitalization may be considered as exceptions.

These criteria ensure that the BSE Bankex remains a reliable indicator of the banking sector’s performance.

Performance Tracking and Rebalancing

The BSE Bankex is calculated and disseminated throughout the trading day, reflecting real-time performance of the banking sector. The index is reviewed and rebalanced semi-annually, in January and July, to accommodate changes in the market and ensure it remains representative of the sector.

Significance of the BSE Bankex

The BSE Bankex holds significant importance for various stakeholders:

- Investors: It provides a benchmark to evaluate the performance of individual banking stocks and aids in making informed investment decisions.

- Analysts: The index offers insights into the health of the banking sector, facilitating sectoral analysis and economic forecasting.

- Policy Makers: Fluctuations in the Bankex can indicate underlying economic trends, assisting in policy formulation.

Investing in the BSE Bankex

Investors can gain exposure to the BSE Bankex through various avenues:

- Exchange-Traded Funds (ETFs): ETFs that track the BSE Bankex allow investors to invest in the entire banking sector without purchasing individual stocks.

- Mutual Funds: Certain mutual funds focus on banking sector indices, providing diversified exposure to the industry.

- Direct Stock Purchase: Investors may choose to invest directly in the constituent companies of the Bankex.

Recent Performance Trends

As of December 27, 2024, the BSE Bankex closed at 58,217.01, marking a modest increase of 0.08% from the previous close. The index has shown resilience amid market volatility, reflecting the robustness of India’s banking sector.

Factors Influencing the BSE Bankex

Several factors can impact the performance of the BSE Bankex:

- Economic Indicators: GDP growth, inflation rates, and fiscal policies directly affect banking operations and profitability.

- Regulatory Changes: Modifications in banking regulations or monetary policies can influence bank performance and, consequently, the index.

- Global Economic Conditions: Global financial trends and foreign exchange rates can have a bearing on the banking sector, especially for banks with international operations.

Technical Analysis of the BSE Bankex

Technical analysis involves evaluating statistical trends from trading activities, such as price movement and volume. For the BSE Bankex, indicators like Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are commonly used to predict future movements. These tools assist traders in identifying potential buy or sell signals based on historical data.

BSE Bankex reflects the pulse of India’s banking sector offering a clear lens into the financial backbone driving the nation’s economic growth.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.