Navigating the Storm: A Guide to Surviving Bear Markets

A bear market is a period of sustained decline in stock prices, often defined as a drop of 20% or more from recent highs. During these periods, investor sentiment turns negative, leading to selling pressure and a downward spiral in asset prices. While the term is primarily associated with the stock market, bear markets can also impact other asset classes, such as real estate, commodities, and cryptocurrencies.

What Defines a Bear Market?

Bear market are typically accompanied by negative sentiment and pessimism about the economy. Investors become concerned about weakening economic conditions, leading to reduced consumer and business spending, which in turn puts pressure on corporate earnings and overall market performance.

Causes of a Bear Market

Several factors can contribute to the onset of a bear market. Here are some of the common causes

- Economic Recession: A significant slowdown in economic growth, high unemployment rates, and shrinking GDP often result in a bear run. Recessions and bear run tend to go hand-in-hand

- High Inflation: When inflation rises quickly, purchasing power decreases. This leads to reduced consumer spending, slowing business profits, and ultimately causing stock prices to decline.

- Interest Rate Hikes: Central banks, like the Federal Reserve, often increase interest rates to combat inflation. Higher rates make borrowing more expensive, reducing corporate profits and overall economic activity, which can trigger a bear run.

- Geopolitical Events: Political instability, wars, or significant global events like the COVID-19 pandemic can cause economic uncertainty, which often leads to a market downturn.

- Asset Bubbles: When asset prices rise excessively due to speculation, they eventually “burst,” leading to a sharp market decline. The dot-com bubble in the early 2000s is a good example of this phenomenon.

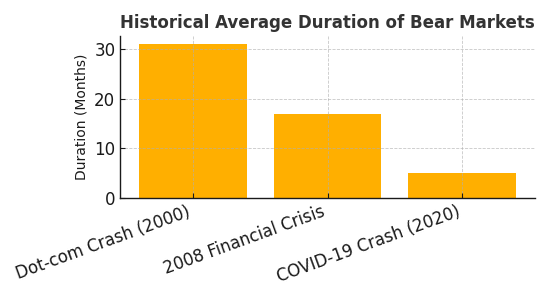

How Long Do Bear Markets Typically Last?

The length of bear markets can vary significantly. Historically, they last for an average of 9 to 18 months, but there have been longer ones lasting several years. For example, the bear market following the dot-com crash lasted over two years, while the bear market during the financial crisis in 2008 lasted about 17 months. However, some bear markets are shorter, particularly when they are triggered by temporary shocks, like the COVID-19 pandemic, which resulted in a bear run that lasted only a few months

Bear markets are part of the natural economic cycle, and while they can be painful in the short term, they are often followed by bull markets, where stock prices rise and investors regain confidence.

Bear Market Survival: Investing Tips for Profit

Navigating a bear market can be challenging, but with the right strategies, you can mitigate losses or even take advantage of the downturn. Here are some key strategies to consider:

- Diversification: Spread your investments across various asset classes (stocks, bonds, commodities) and sectors. This can reduce the impact of market volatility on your portfolio.

- Defensive Stocks: A Shield Against Bear Markets Defensive sectors such as utilities, healthcare, and consumer staples tend to perform better during bear run as they provide essential services that people need, regardless of the economic environment

- Consider Bonds: Bonds, particularly government bonds, tend to perform well in bear run as they are considered safe-haven assets. As stock prices decline, investors often shift their money into bonds, driving up bond prices.

- Stay the Course: It’s tempting to sell off assets during a bear run, but long-term investors should avoid panic selling. Historically, markets recover, and selling during a downturn can lead to locking in losses

How to Recognize the End of a Bear Market

Recognizing the end of a bear market is difficult, but there are some signs that indicate the worst may be over:

- Economic Indicators Improve: Signs of an economic recovery, such as increasing GDP, lower unemployment, and improved corporate earnings, suggest that the market may be ready to rebound.

- Central Bank Policies: A reduction in interest rates or other supportive measures from central banks can stimulate economic growth, leading to a market recovery.

- Stock Prices Stabilize: After a period of falling prices, the market may begin to show signs of stability

- Investor Sentiment Shifts: When investors start feeling positive about the future and think the market has already considered all the bad news, a bull market (when prices go up) might be coming soon.

Which Sectors Perform Well in a Bear Market?

While most sectors experience losses during a bear market, some perform better than others

- Healthcare: Healthcare services and products are always in demand, making the sector more resilient during economic downturns.

- Consumer Staples: Companies that produce essential goods like food, beverages, and household items tend to perform better in a bear run because people continue to buy these products regardless of the economy’s health.

- Utilities: Companies sell things we always need, like electricity, water, and gas. People still buy these things even when the economy is bad, so investing in utility companies is usually pretty safe.

Bear Market Fallout: How Investors Are Hit

When the stock market goes down, most people lose money. It can be hard to watch your savings shrink. But for people who plan to invest for a long time, this can be a good time to buy great stocks at a lower price. It’s important to remember that bad times in the market don’t last forever, and things usually get better.

Bad times in the market can teach us a lot about taking risks and why it’s important to have different kinds of investments. People who have invested in a mix of things, like stocks, bonds, and real estate, are better prepared to handle tough times.