Banking Sector in India

The banking sector in India is a cornerstone of the country’s financial system and economic growth. Over the past few decades, it has undergone significant transformation driven by technological advancements, regulatory reforms, and an increasing focus on financial inclusion. This blog explores the evolution, current status, and future prospects of banking in India, shedding light on key players, trends, and challenges.

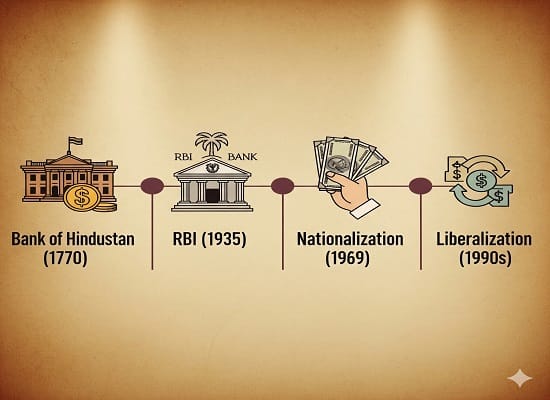

The Evolution of Indian Banking

banking sector in India has its roots in the early 18th century, with the establishment of the Bank of Hindustan in 1770. The Banking Sector in India has evolved through several phases, with major milestones including the establishment of the Reserve Bank of India (RBI) in 1935 and the nationalization of 14 major private banks in 1969 under the Indira Gandhi government. This move was aimed at ensuring that banking services reached the broader population, particularly in rural areas.

Key Milestones:

- Pre-independence Era: Banks were primarily focused on serving British interests and Indian elites.

- Post-independence: Nationalization and the creation of the RBI as a central regulatory body reshaped the industry.

- Liberalization in the 1990s: Reforms introduced by the Indian government opened the banking sector to private players, both domestic and international, leading to rapid modernization and competition.

Structure of the Indian Banking System

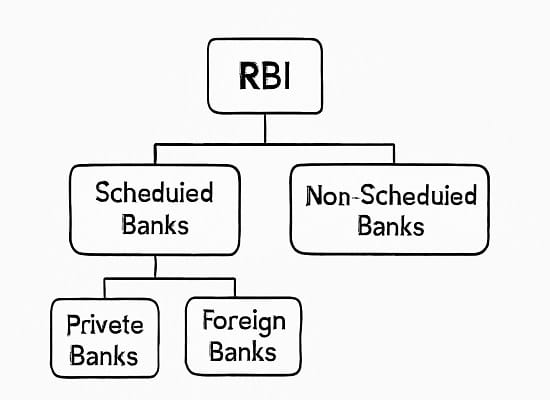

Banking sector in India in India is a well-structured one, with the Reserve Bank of India (RBI) at the helm, acting as the central authority. The system can be broadly classified into two main categories:

Scheduled Banks:

These are banks that are listed under the Second Schedule of the RBI Act, 1934, and include:

- Public Sector Banks (PSBs): These are banks where the majority stake is held by the government. Examples include the State Bank of India (SBI), Bank of Baroda, and Punjab National Bank.

- Private Sector Banks: Private entities or individuals hold the majority stake in these banks. Examples include HDFC Bank, ICICI Bank, and Kotak Mahindra Bank.

- Foreign Banks: These are banks with their head offices outside India but have branches within the country. Citibank, Standard Chartered, and HSBC are major players in this segment.

- Regional Rural Banks (RRBs): Established to serve rural areas and promote financial inclusion, these banks operate with a mix of ownership between the government and commercial banks.

Non-Scheduled Banks:

These are smaller banks that do not fall under the criteria required to be listed as scheduled banks by the RBI. They hold a limited role in India’s broader financial ecosystem.

Key Players in the Indian Banking Sector

Several banks stand out due to their size, service quality, and market reach:

- State Bank of India (SBI): As the largest public sector bank in India, SBI plays a critical role in the banking system, boasting an extensive branch network and a dominant market share.

- HDFC Bank: Known for its customer service and technological innovations, HDFC is a leader in the private sector.

- ICICI Bank: A major player in the private sector, ICICI has pioneered several digital initiatives and offers a wide range of financial products.

- Axis Bank: Another major private sector bank, Axis is known for its growing retail and corporate banking divisions.

- Foreign Banks: Citibank and Standard Chartered have made significant inroads in the Indian market, particularly in urban areas and corporate banking.

Technological Advancements in Banking

The banking sector in India has witnessed rapid technological evolution, especially over the past two decades. With the proliferation of mobile technology and internet penetration, banking has become more accessible and convenient for millions of Indians. Here are some of the significant technological trends shaping the sector:

Digital Payments:

The introduction of Unified Payments Interface (UPI), developed by the National Payments Corporation of India (NPCI), has revolutionized digital payments. UPI allows instant money transfers between bank accounts via mobile apps and is widely used across India for peer-to-peer payments, bill payments, and even retail transactions.

Mobile Banking:

Mobile banking apps developed by both public and private sector banks have become a vital tool for customers to perform banking transactions, pay bills, transfer money, and manage investments from the convenience of their smartphones.

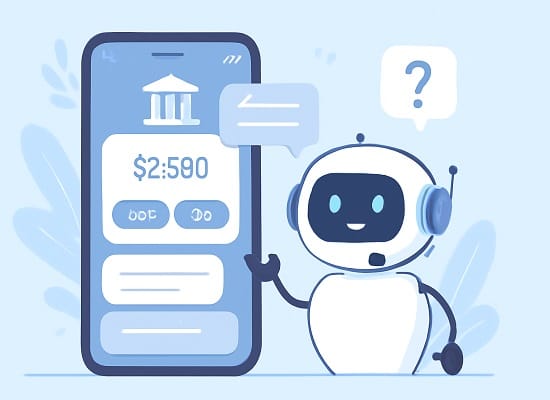

Artificial Intelligence and Chat bots:

Many banks, like ICICI and HDFC, have adopted AI-powered chatbots to provide 24/7 customer support. These chatbots assist in basic queries, transactions, and financial product recommendations, improving customer engagement.

Blockchain and Fintech Collaboration:

Banks are increasingly exploring blockchain technology for secure transactions and partnerships with fintech firms to enhance digital lending, payments, and financial services.

Financial Inclusion: The Key Focus

Financial inclusion remains a central theme in India’s banking reforms. With a significant portion of the population residing in rural areas with limited access to banking services, various initiatives have been taken to bridge this gap.

Pradhan Mantri Jan Dhan Yojana (PMJDY):

Launched in 2014, PMJDY aims to provide universal access to banking facilities. The scheme has been highly successful, with millions of accounts opened for previously unbanked individuals. It also facilitates access to insurance and pension products, contributing to a more inclusive financial system.

Microfinance and Small Finance Banks:

Specialized banks such as Small Finance Banks (SFBs) and Microfinance Institutions (MFIs) have been created to serve low-income populations and small businesses, ensuring credit access to those who are traditionally underserved by larger commercial banks.

Challenges Facing the Indian Banking Sector

Despite the progress, the Indian banking sector faces several challenges:

Non-Performing Assets (NPAs):

NPAs have been a persistent issue, particularly for public sector banks. This refers to loans or advances that are in default or arrears. High levels of NPAs can weaken banks’ balance sheets, leading to reduced profitability and limiting the ability to lend further.

Regulatory Compliance:

Indian banks are subject to stringent regulations from the RBI, which sometimes creates challenges in swiftly adapting to market conditions. Balancing compliance and innovation remains a critical challenge for banks, especially in an era of rapid technological change.

Competition from Fintech:

The rise of fintech companies offering alternative financial services has increased competition. Fintechs provide services such as digital wallets, peer-to-peer lending, and online investment platforms, often with a better user experience and lower costs than traditional banks.

The Future of Banking in India

The future of banking in India looks promising but will require continuous innovation and adaptability. As technology becomes more ingrained in the fabric of the sector, we can expect greater emphasis on digital banking, cybersecurity, and personalized financial services. Additionally, the push for financial inclusion and regulatory reforms will continue to shape the sector’s evolution.

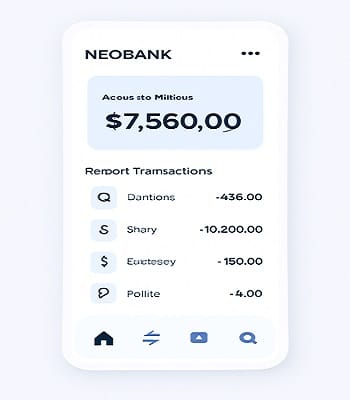

Expansion of Digital Banking:

The rise of digital-only banks or neobanks is expected to gain momentum, offering services entirely through mobile apps without physical branches.

Strengthening of Cybersecurity:

With increasing digitization, banks will need to invest heavily in cybersecurity measures to protect against data breaches and cyber threats.

Greater Financial Literacy:

Efforts to increase financial literacy will help more Indians understand and take advantage of the financial products available to them, further integrating them into the formal banking system.

Conclusion

The Banking Sector in India stands at a crucial juncture, balancing the demands of modernization with the need for financial inclusion. By embracing technological innovation, addressing challenges like NPAs, and continuing to focus on serving the Indian banks have the potential to drive significant economic growth and societal development in the years to come.

Each line feels like a stepping stone, leading the reader toward greater understanding and insight.

Chicken Road gamehttps://apkpure.com/p/app.chickenroad.game

free $100 casino chip 2021 uk, usa roulette rules and top poker sites in united states, or usa real money slots no deposit bonus

Here is my site we love gambling

rooster bet https://www.pgyer.com/apk/apk/rooster.bet.app

NeoSpin Casino app download https://www.pgyer.com/apk/apk/neospin.casino.slots

Hi!

finskul.in, It’s clear you put real effort into your site—thank you.

I recently published my ebooks and training videos on

https://www.hotelreceptionisttraining.com/

They feel like a standout resource for anyone interested in hospitality management studies. These ebooks and videos have already been welcomed and found very useful by students in Russia, the USA, France, the UK, Australia, Spain, and Vietnam—helping learners and professionals strengthen their real hotel reception skills. I believe visitors and readers here might also find them practical and inspiring.

Unlike many resources that stay only on theory, this ebook and training video set is closely connected to today’s hotel business. It comes with full step-by-step training videos that guide learners through real front desk guest service situations—showing exactly how to welcome, assist, and serve hotel guests in a professional way. That’s what makes these materials special: they combine academic knowledge with real practice.

With respect to the owners of finskul.in who keep this platform alive, I kindly ask to share this small contribution. For readers and visitors, these skills and interview tips can truly help anyone interested in becoming a hotel receptionist prepare with confidence and secure a good job at hotels and resorts worldwide. If found suitable, I’d be grateful for it to remain here so it can reach those who need it.

Why These Ebooks and Training Videos Are Special

They uniquely combine academic pathways such as a bachelor of hospitality management or a master’s degree in hospitality management with very practical guidance on the duties of a front desk agent. They also cover the hotel front desk receptionist job description, and detailed hotel front desk tasks.

The materials go further by explaining the hotel reservation process, check-in and check-out procedures, guest service handling, and practical guest service recovery—covering nearly every situation that arises in the daily business of a front office operation.

Beyond theory, my ebooks and training videos connect the academic side of hospitality management studies with the real-life practice of hotel front desk duties and responsibilities.

– For students and readers: they bridge classroom study with career preparation, showing how hotel and management course theory link directly to front desk skills.

– For professionals and community visitors: they support career growth through questions for receptionist, with step-by-step interview questions for receptionist with answers. There’s also guidance on writing a strong receptionist job description for resume.

As someone who has taught hospitality management programs for nearly 30 years, I rarely see materials that balance the academic foundation with the day-to-day job description of front desk receptionist in hotel so effectively. This training not only teaches but also simulates real hotel reception challenges—making it as close to on-the-job learning as possible, while still providing structured guidance.

I hope the owners of finskul.in, and the readers/visitors of finskul.in, will support my ebooks and training videos so more people can access the information and gain the essential skills needed to become a professional hotel receptionist in any hotel or resort worldwide.

Wishing you continued success with your site—truly.