How to Invest in High-Alpha Stocks: Understanding the Nifty Alpha 50 Index (India, 2025)

In today’s fast-paced investment world, the search for high-return opportunities is as active as ever. Among India’s equity indices, the Nifty Alpha 50 has gained prominence for its unique focus on stocks that deliver high “alpha.” But what exactly does “alpha” mean, and why is it relevant for investors? In this blog, we’ll explain the Nifty Alpha Index, its composition, and why it might be a valuable addition to your investment portfolio.

What is the Nifty Alpha 50?

The Nifty Alpha 50 is a specialized index on the National Stock Exchange (NSE) that measures the performance of stocks with high “alpha.” In finance, alpha refers to a stock’s ability to outperform the broader market or its benchmark index. Put simply, high-alpha stocks generate better returns than the average, making them attractive for investors who seek above-market gains.By tracking high-alpha stocks across various sectors, the Nifty Alpha 50 serves as a benchmark for investors aiming to capture outsized returns compared to traditional indices like the Nifty 50.

How the Nifty Alpha 50 is Constructed

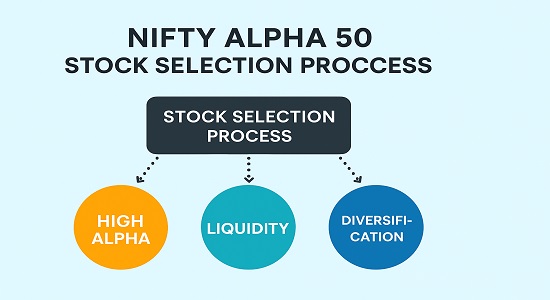

The Nifty Alpha Index includes stocks with a proven track record of delivering high alpha. The selection process involves screening stocks based on specific criteria, such as historical alpha generation, trading volume, and liquidity. The index is re calibrated periodically to ensure it continues to reflect the top-performing stocks in terms of alpha.

Key Selection Criteria

- High Historical Alpha: Stocks that have shown a consistent ability to outperform.

- Liquidity: Only stocks with a certain level of trading volume are included, ensuring they’re easy to buy and sell.

- Sector Diversification: The index maintains sectoral diversity, which provides a well-rounded representation of high-alpha stocks across different industries.

Why is Alpha Important for Investors?

Alpha is a critical metric for investors because it measures a stock’s out-performance relative to the market. Investing in high-alpha stocks is often seen as a strategy to generate better returns, particularly in bullish or upward-trending markets. Here’s why alpha matters:

- Out-performance Potential: High-alpha stocks offer the potential to exceed market returns, providing added value to an investor’s portfolio.

- Market-Beating Strategy: For investors who aim to outperform traditional indices like the Nifty 50, an alpha-focused strategy can be highly appealing.

- Risk Management: While high-alpha stocks can be volatile, they also offer risk management benefits when diversified correctly, potentially offsetting under performing assets.

Key Components of the Nifty Alpha 50

The Nifty Alpha Index features a mix of companies across multiple sectors. Here are a few notable sectors that contribute to the index’s performance:

- Financial Services: Financial stocks often display high alpha due to their strong growth potential and cyclical nature. Banks and non-banking financial companies (NBFCs) are frequently represented in the index.

- Technology: Tech stocks, particularly those in the IT and software segments, have shown robust growth potential. In India’s growing tech landscape, companies with innovative products or services often yield high returns.

- Consumer Goods: With rising consumer spending in India, FMCG (Fast Moving Consumer Goods) companies have experienced high demand, resulting in above-average returns.

- Pharmaceuticals: The pharmaceutical sector is known for its resilience and growth, particularly with increased global demand for Indian generics and specialty drugs.

Growth Drivers of the Nifty Alpha 50

Several factors are driving the growth and appeal of the Nifty Alpha 50:

- Growing Investor Interest: As investors become more sophisticated, the demand for high-alpha stocks has increased. Many now look beyond traditional indices, seeking to optimize returns with high-performance stocks.

- Economic Reforms: Recent government reforms, including tax incentives and deregulation, have helped companies within the Nifty Alpha Index flourish, especially in sectors like manufacturing and services.

- Technological Advancements: As technology transforms industries, companies adopting innovative solutions have been able to capture higher market share, leading to alpha generation.

- India’s Emerging Middle Class: With the growing spending power of India’s middle class, sectors like consumer goods and retail have shown significant growth potential, contributing to high alpha in these segments.

Why Invest in the Nifty Alpha Index?

Investing in the Nifty Alpha Index offers several benefits:

- High Return Potential: For those willing to take on slightly higher risk, the Nifty Alpha Index offers the chance to achieve returns that outperform the broader market.

- Diversified Exposure to High-Growth Sectors: The index includes a balanced mix of high-growth industries, providing a diversified portfolio within a single investment vehicle.

- Strong Historical Performance: Historical data shows that high-alpha stocks in the index have often delivered substantial gains over traditional benchmarks.

Risks of Investing in High-Alpha Stocks

While high-alpha stocks offer attractive returns, they do come with certain risks:

- Increased Volatility: High-alpha stocks are often more volatile than average, which can lead to sudden price swings, especially in turbulent markets.

- Concentration Risk: High-alpha strategies sometimes result in overexposure to specific sectors or industries, which can increase risk.

- Economic Sensitivity: High-alpha stocks may be more sensitive to economic changes, especially if they operate in cyclical industries like finance or real estate.

Strategies for Investing in the Nifty Alpha Index

If you’re considering investing in the Nifty Alpha Index, here are a few strategies to keep in mind:

- Long-Term Holding: High-alpha stocks often require a longer investment horizon to see substantial returns. A long-term strategy can help smooth out short-term volatility.

- Diversified Approach: Combining Nifty Alpha Index investments with other indices or asset classes can reduce risk while preserving growth potential.

- Periodic Re balancing: Since the Nifty Alpha Index is re calibrated periodically, consider re-evaluating your investment in line with the index’s updates to stay aligned with the best-performing stocks.

Alpha of greater than zero means an investment outperformed, after adjusting for volatility.