Meesho IPO: Is This India’s Next Big E-Commerce Investment Opportunity?

Meesho IPO of India’s home-grown e-commerce disruptor Meesho is set to be one of the biggest and most talked-about public offerings of 2025 — and it could reshape retail investing for millions.

With its IPO slated to open on 3 December 2025, Meesho aims to raise around ₹5,421 crore, marking a watershed moment in India’s digital commerce story.

What is Meesho

Founded in 2015 by Vidit Aatrey and Sanjeev Barnwal, Meesho operates under Fashnear Technologies Private Limited as a value-focused e-commerce marketplace. The company connects consumers, sellers, logistics partners and content creators across India through its asset-light platform and zero-commission model. Meesho enables individuals and small businesses to sell products nationwide using social media marketing and low-cost digital tools, democratizing internet commerce for millions of users.

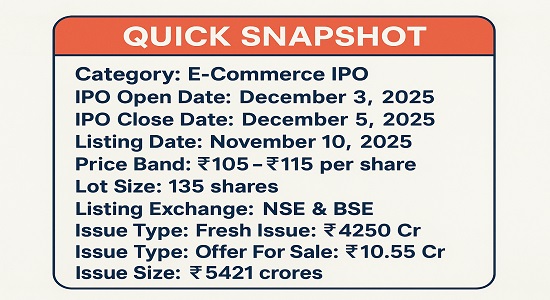

IPO Details:

- IPO Open Date: December 3, 2025

- IPO Close Date: December 5, 2025

- Listing Date: November 10, 2025

- Price Band: ₹105 – ₹115 per share

- Lot Size: 135 shares

- Listing Exchange: NSE & BSE

- Issue Type: Fresh Issue: ₹4250 Cr

- Issue Type: Offer For Sale: ₹10.55 Cr

- Issue Size: ₹5421 crores

- Meesho IPO GMP: Check Here

Why Is It Important? / Benefits To Investors

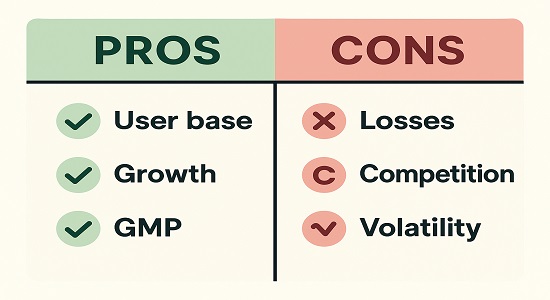

- First Major E-commerce IPO in India (2025): Meesho stands out as one of the very few large-scale Indian e-commerce platforms going public — offering retail investors a rare direct entry into India’s booming online retail sector. TechCrunch

- Massive User Base & Reach in Smaller Cities: According to its prospectus, a significant portion of Meesho’s users come from outside top-tier cities, tapping into India’s underserved value-conscious consumer base. IPO Central

- Strong Market Sentiment / Grey-Market Premium (GMP): Ahead of the IPO, Meesho has shown a healthy GMP — many brokers estimate a listing price significantly above issue price, indicating potential quick listing gains. Firstock

- Backers & Brand Recognition: Meesho is backed by big investors and has a recognizable brand, which may help in building confidence among investors seeking long-term growth. Moneycontrol.

Risks / Limitations / Challenges

- Intense competition from large domestic and global e-commerce players.

- Dependence on small, fragmented sellers may impact product quality and trust.

- High reliance on cash-on-delivery orders affecting efficiency and cash flow.

- Regulatory uncertainty around e-commerce, FDI, and data protection norms.

- Potential brand damage from counterfeit goods or negative publicity.

Financials of Meesho

| Fiscal Year | March 24 | March 25 | June 25 |

| Revenue (Cr) | 7859 | 9900 | 2629 |

| Net Income (Cr) | -327 | -3941 | -289 |

As visible, while revenues have grown significantly, Meesho remains unprofitable (net losses). This underlines that IPO is being priced more on growth potential, user base and future scalability than current earnings. EPS for FY25 was negative — showing as a loss in prospectus. Kotak Securities

Future Outlook / Expert View

- According to company statements, Meesho believes India remains one of the least penetrated e-commerce markets globally — leaving huge headroom for growth, especially outside metros. The Economic Times

- With ₹4,250 cr fresh capital, Meesho plans to invest heavily in cloud infrastructure, AI/ML teams, marketing, and possibly acquisitions — a strategy aimed at scaling operations and capturing a larger share of India’s retail-ecommerce wave. Kotak Securities

- If Meesho can convert its growing user base into profitability — by optimizing logistics, improving retention, and scaling operations — long-term investors may benefit substantially.

FAQ On Meesho IPO

Q1: When does Meesho IPO open and close?

- Opens 3 December 2025, closes 5 December 2025.

Q2: What is the price band and minimum investment?

- ₹105–₹111 per share; minimum 135 shares (≈ ₹14,985) per retail lot.

Q3: What is the total size of the IPO?

- ₹5,421.20 crore (fresh issue ₹4,250 cr + OFS by existing investors).

Q4: When is listing date?

- Expected around 10 December 2025 on BSE / NSE.

Q5: Is Meesho profitable currently?

- No — as per FY25, Meesho reported a net loss.

Q6: Check Allotment Status for Meesho IPO?

- To check your allotment status – click here

Conclusion / Key Takeaways

- Meesho IPO offers rare exposure to a high-growth Indian e-commerce platform with deep reach beyond metros.

- The listing could offer attractive upside — both via short-term listing gains (given grey market buzz) and long-term growth — depending on execution.

- But risk is real: the company is unprofitable, and success hinges on scaling, logistics, competition and converting growth to profits.

- Verdict (from investor’s lens): Invest only if you are comfortable with risk and have a medium-to-long-term horizon. For aggressive investors, participation (at least for listing gains) may be worthwhile.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.