Capillary Technologies IPO Explained: Unlocking Growth in the SaaS Market

The upcoming Capillary Technologies IPO is set to become one of the more watched issues in India’s software-SaaS space. With the company setting its price band at ₹549-577 and aiming to raise around ₹877.5 crore, it promises exposure to the high-growth customer-loyalty & engagement platform market. In this blog you’ll get a clear breakdown of what is the Capillary IPO, how it works, why it matters, what risks you need to know, how to invest, its performance outlook.

What Is Capillary Technologies IPO?

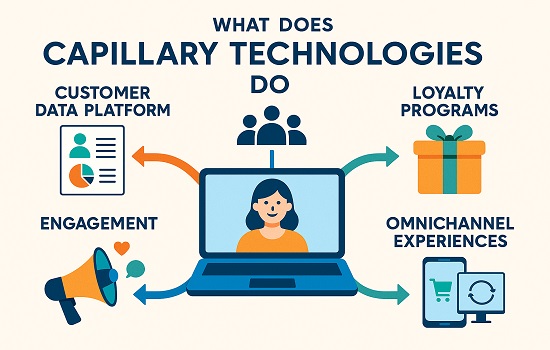

Capillary Technologies is a global software product firm offering AI-based, cloud-native SaaS solutions that help enterprises enhance customer and partner loyalty. They specialise in designing end-to-end loyalty and engagement systems that enable brands to build strong, data-driven relationships and drive long-term growth

The Capillary Technologies IPO refers to the public issue of shares by Capillary Technologies India Ltd, where existing shareholders offer an Offer for Sale (OFS) and the company offers a fresh issue of shares. The objective: tap public capital, provide listing liquidity, and raise funds for growth.

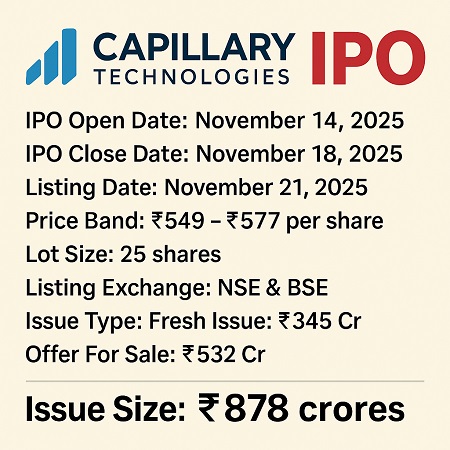

IPO Details:

- IPO Open Date: November 14, 2025

- IPO Close Date: November 18, 2025

- Listing Date: November 21, 2025

- Price Band: ₹549 – ₹577 per share

- Lot Size: 25 shares

- Listing Exchange: NSE & BSE

- Issue Type: Fresh Issue: ₹345 Cr

- Issue Type: Offer For Sale: ₹532 Cr

- Issue Size: ₹878 crores

- Capillary Technologies IPO GMP: Check Here

Why Is It Important? / Benefits To Investors

Investing in the Capillary Technologies IPO offers potential benefits:

- Exposure to India’s growth-oriented SaaS sector, especially in customer-loyalty/engagement which is gaining traction in retail, FMCG, healthcare.

- Recurring-revenue business model: Capillary claims a high proportion of subscription revenues ( 89 %) which lends visibility. Business Standard

- Global footprint: Serving over 410 brands across 47 countries. Value Research Online

- Opportunity to participate early: As a newly-listed player, IPO investors get in before extensive market trading.

Risks / Limitations / Challenges

- Heavy dependence on a few large enterprise clients for major revenue share.

- Rapidly evolving technology landscape may require continuous innovation.

- Exposure to data privacy, cybersecurity, and regulatory compliance risks.

- Intense competition from global SaaS and customer engagement platforms.

- Foreign currency and geopolitical exposure from significant overseas operations.

Historical Performance + Data Table

| Financial Metric | FY25 | FY24 |

| Revenue from operations | 598.25 crore | 525 crore |

| PAT (Profit After Tax) | 14.15 crore | Loss |

| Fresh Issue Size | 345 crore | — |

| Price Band | 549-577 per share | — |

Future Outlook / Expert View

- According to brokerage notes: some analysts recommend caution because the valuation appears aggressive (e.g., 323× FY25 P/E). Business Standard

- The company itself emphasises three growth engines: scaling SaaS operations, expanding internationally, leveraging acquisitions (as noted in recent awards coverage) The Economic Times

- A favourable tailwind: enterprises globally increasing spend on loyalty, engagement platforms, and data analytics.

- Key to watch: the company’s ability to convert high growth into sustainable profitability, manage client concentration, deliver on acquisitions and expand margins.

FAQ On Capillary Technologies

Q1. What is the minimum amount I need to invest in the Capillary IPO?

- Minimum one lot = 25 shares × ₹549–577 = approx ₹13,725–14,425.

Q2. When will the shares be listed?

- 21 November 2025 on NSE/BSE.

Q3. What is the valuation at the top of price band?

- At ₹577, post-issue P/E ~323× on FY25 profits — considered steep by analysts. Business Standard

Q4. What are the major risks I should know?

- Revenue concentration among few clients, high competition in global SaaS, high valuation, nascent profitability. Zerodha

Q5. How will the fresh issue proceeds be used?

- For cloud infrastructure (~₹143 crore), R&D (~₹71.6 crore), computer systems (~₹10.3 crore), and to fund acquisitions & general corporate. Moneycontrol

Q6. Check Allotment Status for Capillary Technologies IPO

- To check your allotment status – click here

Conclusion

- The Capillary Technologies IPO gives you an opportunity to invest in a fast-growing Indian SaaS company with global reach and recurring revenue model.

- But it comes with high valuation, and meaningful execution risk — which means both high reward and high risk.

- If you believe in the long-term structural growth of loyalty & engagement platforms, and are comfortable with volatility, this can be part of a growth-oriented portfolio.

- If you are looking for safer, value or income-oriented stocks, you may either subscribe cautiously or wait for a correction post listing.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.

The price band of ₹549-577 seems reasonable given the current market conditions; I found some interesting related analysis on https://tinyfun.io/game/one-piece-merge that provides a broader perspective on SaaS valuations.