Mahamaya Lifesciences IPO: Everything You Need to Know Before Investing

The Mahamaya Lifesciences IPO is generating great excitement for its growth prospects in the pharmaceutical and biotech company. With the rising demand for new and innovative healthcare solutions in India, this was certainly an IPO to watch for 2025.

In this blog, we are going to simplify everything in the Mahamaya Lifesciences IPO including the grey market premium (GMP), price band, subscription status, allotment date and listing expectations. You will also get a data driven outlook which included expert opinions so you can decide whether the Mahamaya Lifesciences IPO belongs in your portfolio.

What Is Mahamaya Lifesciences IPO?

Mahamaya Lifesciences has launched an IPO to raise funds for expanding its production capabilities, research work, and working capital. The company operates in the life sciences and pharmaceutical area, and it is focused on the manufacture of superior quality chemical intermediates and active pharmaceutical ingredients (APIs).

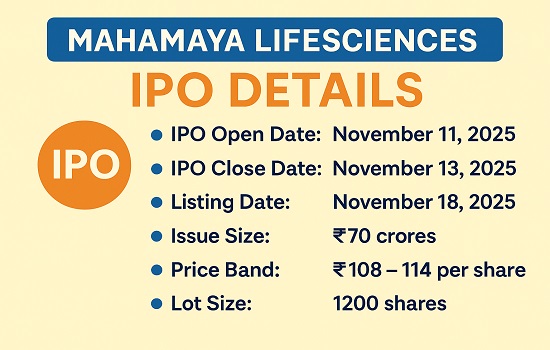

IPO Details:

- IPO Open Date: November 11, 2025

- IPO Close Date: November 13, 2025

- Listing Date: November 18, 2025

- Price Band: ₹108 – ₹114 per share

- Lot Size: 1200 shares

- Listing Exchange: NSE & BSE

- Issue Type: Fresh Issue: ₹60 Cr

- Issue Type: Offer For Sale: ₹6 Cr

- Issue Size: ₹70 crores

- Mahamaya Lifesciences IPO GMP: Check Here

Why Is It Important? / Benefits To Investors

Investing in Mahamaya Lifesciences IPO could be appealing due to several factors:

- Strong industry outlook: The pharma sector in India is projected to grow at 10–12% CAGR by 2030.

- Niche focus: The company focuses on life sciences innovation, tapping into high-margin segments.

- Export potential: Growing global demand for Indian pharmaceutical ingredients.

- SME growth advantage: Early-stage SME listings have historically outperformed traditional IPOs in the first year.

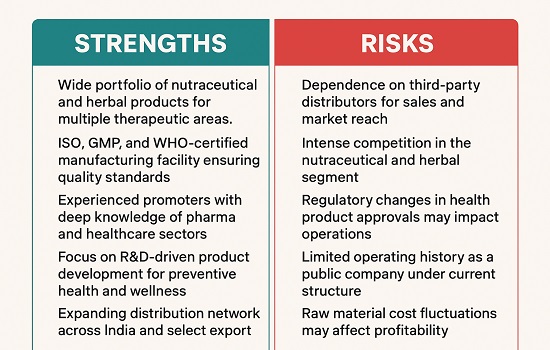

Risks / Limitations / Challenges

Every IPO comes with its set of risks. Here’s a quick pros vs cons table:

| Pros | Cons |

| High-growth pharma segment | Market volatility risk |

| SME IPOs often give strong listing gains | Limited liquidity post-listing |

| Attractive valuation for long-term investors | Regulatory and R&D dependency |

| Expanding customer base | Small issue size and price fluctuation risk |

How To Invest In Mahamaya Lifesciences IPO

You can invest in this IPO using your demat account through:

- UPI-based IPO applications on Zerodha, Groww, or Angel One.

- ASBA (Applications Supported by Blocked Amount) via your bank’s net banking platform.

Historical Performance of SME IPOs

| Recent SME IPO | Listing Gain (%) |

| Oriana Power Ltd | 85% |

| Drone Destination Ltd | 70% |

| Pentagon Rubber Ltd | 90% |

| Expected for Mahamaya Lifesciences | 60–80% Expect |

Future Outlook / Expert View

- According to market analysts and NSE data, Mahamaya Lifesciences operates in a promising niche within the pharma industry. With an expanding R&D base and growing export potential, analysts expect moderate to strong listing gains, provided overall market sentiment remains positive.

- Given the growth of the Indian pharmaceutical manufacturing ecosystem, Mahamaya Lifesciences could benefit from increasing API exports and domestic demand,” — ETMarkets Analyst Report (Nov 2025)

FAQ On Mahamaya Lifesciences IPO

Q1. What is the Mahamaya Lifesciences IPO GMP today?

- The latest GMP (Grey Market Premium) is around ₹25–30, indicating positive investor sentiment.

Q2. What is the IPO allotment date?

- Expected on November 14, 2025.

Q3. When will it list on NSE & BSE?

- Listing Date: November 18, 2025

Q4. Is Mahamaya Lifesciences IPO a good buy?

- For long-term investors, the pharma focus and SME growth story look promising — but risk-averse investors should tread carefully.

Q5. Check Allotment Status for Mahamaya Lifesciences IPO

- To check your allotment status – click here

Conclusion

- Mahamaya Lifesciences IPO belongs to a high-growth sector (pharma & life sciences).

- Attractive GMP trends suggest strong investor interest.

- Suitable for risk-tolerant investors seeking short-term listing gains or long-term SME exposure.

- Always evaluate financials and fundamentals before investing.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.