PhysicsWallah IPO: The ‘Affordable’ EdTech Revolution Hits Dalal Street

Bold move: India’s booming ed-tech revolution gets a public test with the upcoming PhysicsWallah IPO. According to recent filings, the company is opening its doors to public investors, offering a chance to participate in one of the fastest-growing learning platforms in the country. In this article, you’ll gain a clear understanding of the PhysicsWallah IPO — what it is, how it works, the benefits and risks for investors, and whether it fits your portfolio. By the end you’ll be equipped to evaluate whether this deal is worth your time and money.

What Is The PhysicsWallah IPO?

The PhysicsWallah IPO is the initial public offering of PhysicsWallah Ltd, an Indian ed-tech company known for its online and offline hybrid learning model. Through this IPO, the company is opening up part of its equity to public investors in order to raise fresh capital and/or allow existing shareholders to sell shares.

In simple terms: if you buy into this IPO, you become a shareholder of PhysicsWallah along with the founding team and other investors — you share in both its upside growth and downside risk.

IPO Details:

- IPO Open Date: November 11, 2025

- IPO Close Date: November 13, 2025

- Listing Date: November 18, 2025

- Price Band: ₹103 – ₹109 per share

- Lot Size: 137 shares

- Listing Exchange: NSE & BSE

- Issue Type: Fresh Issue: ₹3100

- Issue Type: Offer For Sale: ₹380

- Issue Size: ₹3480 crores

- Pine Labs IPO GMP: Check Here

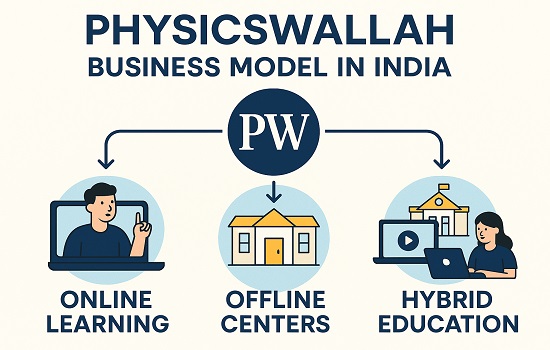

How Does The Hybrid Model Work?

PhysicsWallah operates on a unique hybrid model that combines the massive reach and affordability of its digital platform with the trust and structure of traditional, physical coaching.

This online-to-offline (O2O) strategy is what differentiates it from peers.

The core components include:

- Massive Online Reach: A vast ecosystem of over 200 YouTube channels and a proprietary Learning Management System (LMS) offer low-cost or free content.

- Vidyapeeth (Offline Centres): These are physical centres for competitive exam preparation (like JEE and NEET), offering classroom learning and doubt-solving.

- Affordable Pricing: The flagship online courses are priced around ₹4,000, catering directly to the ‘Bharat’ consumer who prioritizes value.

- Technology Integration: Use of AI-based tools like AI Guru for 24/7 doubt resolution enhances the personalized learning experience at scale.

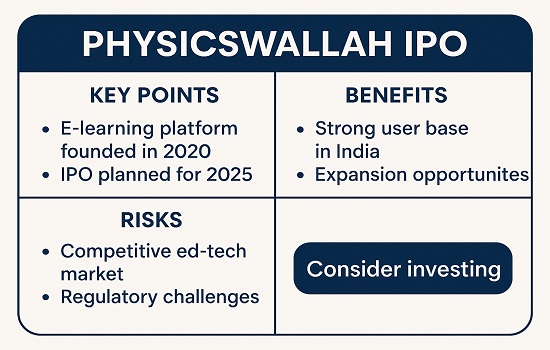

Why Is It Important? / Benefits To Investors

The PhysicsWallah IPO is seen as a key indicator for the future of new-age tech listings in India. Its potential benefits for investors are closely tied to its strong fundamentals and market position.

- Strong Brand Recall & Community: PW has built a massive, loyal student community. As of June 2025, it reported 4.46 million paid users and nearly 100 million social media subscribers.

- Scalable Hybrid Model: The O2O approach allows for high user engagement and higher Average Revenue Per User (ARPU) from the offline centres, providing a financial safety net against online volatility.

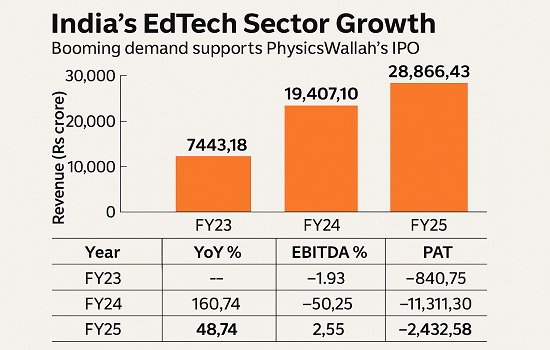

- Exceptional Revenue Growth: The company has demonstrated robust top-line performance, with revenue from operations growing at a CAGR of 96.9% between FY23 and FY25 (Source: RHP, SEBI filings).

- Improved Financial Trajectory: While historically loss-making, the company has shown signs of improving efficiency. Adjusted EBITDA margin recovered strongly to 14.96% in FY25 from a low of 3.45% in FY24.

- Founder’s Skin in the Game: Post-IPO, the founders will continue to hold a significant stake (around 72%), a good signal for long-term commitment.

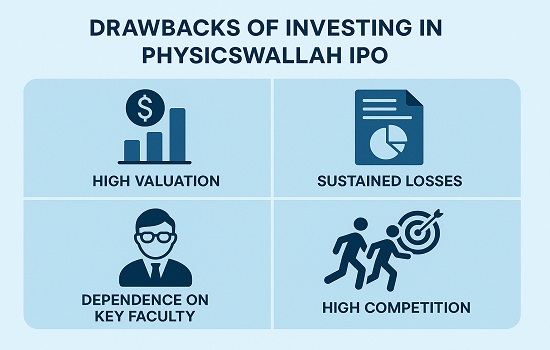

Risks, Limitations, And Challenges

Investing in a high-growth edtech company like PW involves unique risk factors that investors must consider.

- Sustained Losses: Despite rapid growth, PW reported a net loss of ₹243.26 crore in FY25.

- High Valuation: The valuation at 10x-11x Price/Sales is perceived as high compared to older education peers.

- Dependence on Key Faculty: High faculty attrition rate (36.51% in FY25) poses a challenge to core operations.

- Execution Challenge: Rapid offline expansion requires massive capital expenditure and sophisticated operational management.

Historical Performance + Data Table

| Year | Revenue | YoY % | EBITDA % | PAT |

| FY23 | 7443.18 | – | -1.93 | -840.75 |

| FY24 | 19407.10 | 160.74 | -50.25 | -11,311.30 |

| FY25 | 28866.43 | 48.74 | 2.55 | -2,432.58 |

Future Outlook / Expert View

The general sentiment toward the PhysicsWallah IPO is cautiously optimistic:

- Long-Term Potential: Experts see PW as a potential leader in the edtech 2.0 era, largely due to its strong balance sheet (minimal debt) and focus on the underserved market segment.

- Growth Drivers: Future growth will be driven by its planned expansion into 500+ physical centres, continued acquisitions (Xylem Learning and Utkarsh Classes), and investment in scalable AI infrastructure.

- Analyst View: While the valuation at 10x Revenue is deemed aggressive, analysts from InCred Equities have given a ‘Subscribe’ rating, citing the “strong moat and top-line/business expansion” (Source: ETMarkets). Conversely, other brokerages suggest a ‘Neutral’ or ‘Avoid’ due to the sustained losses and high P/S multiple.

In summary: PW is a high-growth stock that requires a high-risk appetite and a long-term horizon from investors.

FAQ On PhysicsWallah IPO

Q1. Is PhysicsWallah a profitable company?

- No, the company has reported a net loss of ₹243.26 crore in FY25. However, its revenue and adjusted EBITDA are growing strongly.

Q2. When is the PhysicsWallah IPO listing date?

- The shares are tentatively scheduled to be listed on the NSE and BSE on November 18, 2025.

Q3. Who are the main competitors of PhysicsWallah?

- Its main competitors in the test-prep space include both online peers (like Unacademy and Vedantu) and offline giants (Allen Career Institute and Aakash Institute).

Q4. Check Allotment Status for PhysicsWallah IPO

- To check your allotment status – click here

Conclusion

- Investable for Growth-Seekers: It offers exposure to a high-growth, technology-enabled education platform with a dominant presence in the mass market.

- Risk vs. Reward: The high valuation and historical losses demand caution. The investment case rests heavily on the successful execution of its aggressive offline expansion and a swift move toward profitability.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.