China’s Debt Trap: The $800 Billion Crisis Reshaping Global Finance

Over the past two decades, China’s Debt has quietly transformed from the “world’s factory” into one of the world’s biggest lenders — with over $800 billion in overseas loans. What started as development finance for emerging economies has now evolved into a looming global debt crisis.

In this blog, we’ll decode what China’s debt strategy really is, how it works, and why it poses both opportunities and risks for the global economy. You’ll also gain insights into the debt’s structure, its impact on developing nations, and what it means for investors keeping an eye on emerging markets.

What Is China’s Debt?

China’s Debt refers to the massive lending China has provided to developing nations, estimated at over $800 billion across Asia, Africa, and Latin America. Unlike Western institutions such as the IMF or World Bank, China’s lending is often bilateral and opaque — meaning the loan terms, amounts, and conditions are rarely made public

For Example:

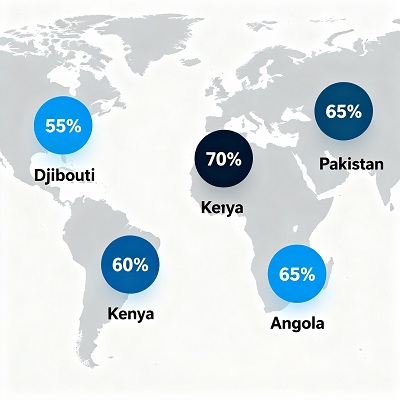

- Djibouti’s debt to China: 55% of GDP

- Angola: 65% of GDP

- Pakistan, Kenya, and Egypt are now spending up to 50% of their export earnings just servicing Chinese debt.

These loans are typically used for infrastructure — roads, railways, and ports — under China’s Belt and Road Initiative (BRI), launched in 2013

How Does It Work?

China’s global lending mechanism differs from traditional financial aid programs.

Here’s how it typically functions:

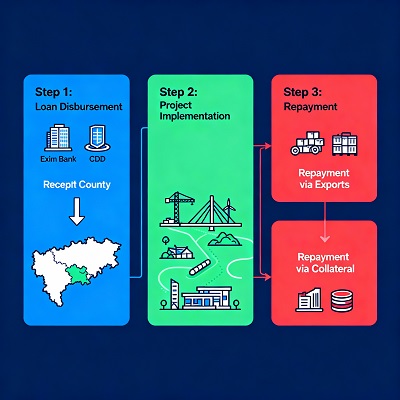

- Loan Agreements: Developing nations sign dollar-denominated loans from Chinese state banks (often at LIBOR + 2.5%).

- Collateralization: Many loans are backed by revenue-generating assets or foreign exchange earnings (like oil or minerals).

- Confidentiality Clauses: Borrowers are often forbidden from disclosing loan terms publicly.

- No Paris Club Clause: Countries cannot include Chinese debt in multilateral restructuring negotiations — forcing them to negotiate separately with Beijing.

This makes China’s Debt system opaque, strategic, and highly influential in shaping borrower nations’ financial policies

Why Is It Important?

Despite the risks, China’s debt has accelerated development in capital-starved regions.

Key Benefits and Insights:

- Infrastructure Growth: Roads, ports, and power plants in Africa and Asia got built faster than ever.

- Access to Funding: Many low-income countries, ignored by Western lenders, found new capital sources.

- Strategic Leverage for China: Ensures long-term access to raw materials like oil, copper, and lithium.

- Economic Diversification: Helped nations like Ethiopia and Kenya expand industrial sectors.

Source: IMF Global Debt Database, World Bank Data (2024)

Risks / Limitations / Challenges

| Pros | Cons / Drawbacks |

| Fast infrastructure development | High debt servicing cost (up to 13% of exports) |

| Cheaper loans than private creditors | Lack of transparency & hidden clauses |

| Political alignment with China | Dependence on Chinese contractors |

| Access to foreign currency | Collateral-based control over national assets |

Key Risk Factors:

- Debt Servicing Pressure: External debt payments in low-income countries have risen from 1.9% to 5.7% of exports (2013–2024).

- Systemic Risk: The credit quality of China’s overseas loans fell from BB to B- (near junk rating).

- Economic Vulnerability: Nations like Pakistan, Kenya, and Egypt are devoting 10–13% of export earnings to service Chinese loans.

Historical Performance + Data Table

| Year | China’s Total Lending ($bn) | Net Transfer (Loans–Repayments) |

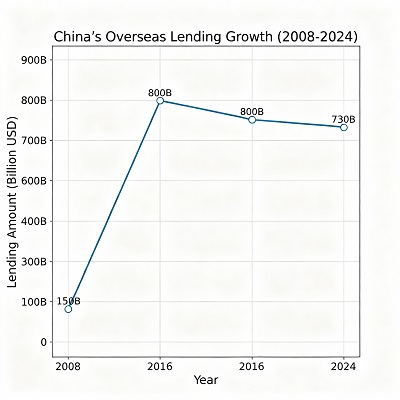

| 2008 | 150 | +40 |

| 2013 | 620 | +85 |

| 2018 | 800 | +20 |

| 2024 | 720 | -10 |

Future Outlook / Expert View

Economists Carmen Reinhart, Sebastian Horn, and Christoph Trebesch warn that the China Debt Trap could mirror the Latin American debt crisis of the 1980s, if left unresolved.

According to IMF data (2024)

With China’s domestic slowdown, an aging population, and falling real estate sector, its ability to offer debt relief is weakening. Unless major creditors (China, IMF, and Paris Club nations) coordinate debt restructuring, dozens of emerging economies could face default-like conditions by 2026

FAQ China’s Debt

Q1: What is China’s total global debt exposure?

- China’s global loan portfolio stands at over $800 billion, exceeding the combined lending of the IMF, World Bank, and Paris Club nations.

Q2: What is the “No Paris Club Clause”?

- It’s a contract term preventing countries from including Chinese debt in multilateral restructuring talks.

Q3: Why do countries still borrow from China?

- Because China offers faster, less conditional funding for infrastructure than Western lenders.

Q4: Is the China Debt Trap real or exaggerated?

- While not every borrower faces a trap, many countries experience unsustainable repayment cycles, giving China strategic leverage.

Conclusion

- China’s Debt now exceeds $800 billion, covering 100+ developing nations.

- Nearly half of these loans are collateralized, giving China control over foreign assets or revenues.

- Debt servicing costs have tripled in a decade, straining poor nations’ budgets.

- A coordinated global debt relief framework is the only path to stability.