Jayesh Logistics IPO: Can This Transport Giant Drive Long-Term Growth?

India’s logistics sector is on the fast lane — and the latest entrant, Jayesh Logistics Limited, is gearing up to make its mark with its upcoming IPO. The company, known for its integrated supply chain and freight management solutions, is opening its doors to retail investors.

In this article, we’ll decode everything you need to know about the Jayesh Logistics IPO — from price band and issue dates to company fundamentals, risks, and future prospects. Whether you’re a first-time investor or a seasoned trader, this guide will help you decide if this IPO deserves a place in your portfolio

What Is Jayesh Logistics IPO?

Jayesh Logistics IPO is a fixed-price SME IPO valued at approximately ₹49.98 crore. The issue comprises 42.6 lakh fresh equity shares. The company operates in logistics, transportation, warehousing, and supply chain solutions — primarily serving industrial clients across India.

- IPO Open Date: October 27, 2025

- IPO Close Date: October 29, 2025

- Price Band: ₹116 – ₹122 per share

- Lot Size: 1,000 shares

- Listing Exchange: NSE SME

- Issue Type: Fresh Issue

- Issue Size: ₹28.64 crores

- Jayesh Logistics IPO GMP: Check Here

How Does It Work / Company Overview

Jayesh Logistics offers end-to-end logistics services — from transportation and warehousing to inventory management and distribution. The company caters to industries like FMCG, automotive, and e-commerce.

1,000 shares of the business:

- Transportation: Nationwide fleet connectivity.

- Warehousing: Modern facilities in Gujarat and Maharashtra.

- Supply Chain Solutions: Integrated logistics management system.

- Technology Integration: Real-time tracking and data analytics.

Why Is It Important? / Benefits To Investors

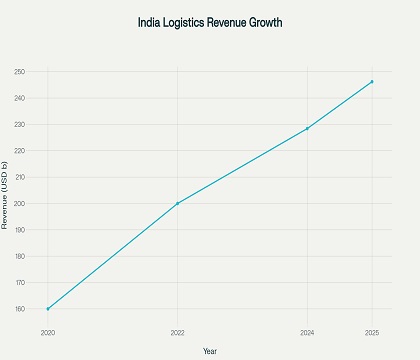

Investing in Jayesh Logistics IPO offers exposure to India’s rapidly growing logistics sector. According to IBEF, the Indian logistics market is expected to reach USD 380 billion by 2025

Key Benefits:

- Sectoral Tailwind: Boost from Make-in-India and e-commerce expansion.

- Diversified Client Base: Reduces dependency risk.

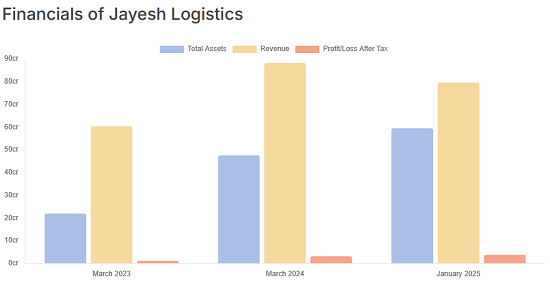

- Strong Revenue Growth: FY23 revenue stood at ₹110 crore, up 18% YoY.

- SME IPO Opportunity: Early access to high-growth potential before mainboard listing.

(Source: kotak securities)

Risks / Limitations / Challenges

| Pros | Cons |

| Growing logistics demand | SME IPO — limited liquidity |

| Strong regional presence | Dependence on industrial clients |

| Modern fleet & tech adoption | Volatility due to fuel price changes |

How To Invest In Jayesh Logistics IPO

You can apply for the Jayesh Logistics IPO through:

- Log in to your broker app.

- Go to “IPO” section.

- Select Jayesh Logistics IPO.

- Enter bid quantity and price.

- Confirm via UPI mandate.

Historical Performance + Data Table

| Particulars | FY (2021-2022) | FY (2022-2023) | FY (2023-2024) |

| Revenue from Operation | ₹5,126 | ₹6,034 | ₹8,825 |

| Operating Profit | ₹469 | ₹477 | ₹1,040 |

| Profit after Tax | ₹67 | ₹107 | ₹358 |

| Basic & Diluated EPS | ₹1.55 | ₹5.11 | ₹5.11 |

(Source: NSE India)

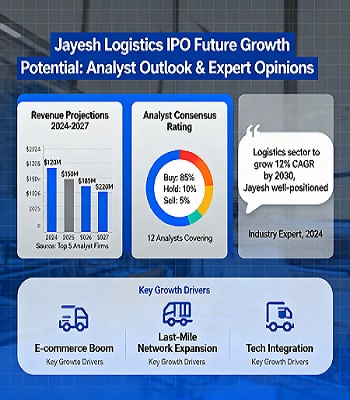

Future Outlook / Expert View

According to market analysts, the logistics sector will continue to outperform due to India’s manufacturing boom and infrastructure development.

Experts believe Jayesh Logistics could benefit from government initiatives like Gati Shakti and National Logistics Policy (NLP).

However, investors should be cautious — SME IPOs can be volatile, and post-listing liquidity may be limited.

As per NSE data, demand for quality logistics players is high, and this could reflect in the IPO’s subscription levels.

FAQ On Jayesh Logistics IPO

Q1. What is the Jayesh Logistics IPO price band?

- ₹116 – ₹122 per share

Q2. When is the Jayesh Logistics IPO open?

- October 27, 2025

Q3. How can I check allotment status?

- On NSE SME or registrar’s website after the closure date.

Q4. Is it a good investment?

- If you believe in India’s logistics story and are comfortable with SME IPO risks, it could be worth considering.

Q5. Check Allotment Status for Jayesh Logistics

- To check your allotment status – click here

Conclusion / Key Takeaways

- Jayesh Logistics IPO offers exposure to India’s booming logistics sector.

- Strong fundamentals, growing revenue, and industry tailwinds are positives.

- Risks include low liquidity and price volatility typical of SME IPOs.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions.

An impressive share, I simply given this onto a colleague who was doing slightly analysis on this. And he in truth purchased me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the deal with! However yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If potential, as you grow to be experience, would you mind updating your weblog with extra details? It is highly useful for me. Massive thumb up for this blog submit!