LG India: Why Investors Should Watch This Game-Changing IPO

The much-anticipated LG India listing is turning heads — anchor investors have already committed ₹3,475 crore, hinting at blockbuster investor demand.

In this post, you’ll get a clear, no-fluff breakdown of LG India — what the business is, why the IPO matters, how it stacks up financially, what risks lurk, and most importantly, whether it’s a smart play for long-term investors. By the end, you’ll be able to decide confidently whether to dive into LG India.

What is LG India?

Define clearly what you’re referring to when you say “LG India” — the business, entity, or planned IPO.

- LG India” refers to LG Electronics India Limited, the Indian arm of LG Electronics (South Korea), which handles manufacturing, sales, and distribution of LG’s consumer electronics and appliances in India.

- The upcoming IPO is an Offer For Sale (OFS), where existing shareholders are selling their stake — not issuing fresh shares.

- This gives Indian investors a chance to own a piece of LG’s Indian operations, which competes with Samsung, Whirlpool, etc.

How Does LG India Works / Business Components

Break into sub-segments such as:

- Product lines & operations — e.g. appliances (refrigerators, washing machines), televisions, air conditioners, etc.

- Manufacturing, supply chain & localization — plants in India, sourcing, cost advantages.

- Distribution & retail network — how LG reaches Indian customers (own stores / third-party outlets).

- Parent support & branding — benefits of being part of LG global, R&D, tech transfer.

Why LG India is Important / Benefits to Investors

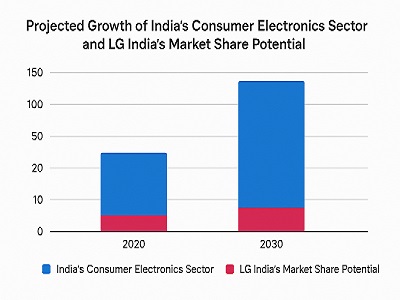

- Brand & scale advantage — LG is a trusted global brand; that gives it an edge in consumer trust.

- Growing appliance / electronics demand in India — rising incomes, electrification, smart homes.

- Opportunity to participate in growth story — IPO allows retail investors access. (Economic Times)

- Potential listing gains — early signs show grey market premium ~22% over issue price band. (Economic Times)

- Diversification — adds exposure to consumer tech / durable goods within India.

- International backing / confidence — anchor investors from Singapore, Norway content with participation. (Reuters)

Risk / Limitations / Challenges

| Pros | Cons / Risk |

| Strong brand Anchor backing | Market volatility, Hurt listing gains |

| Large market in India | Competitive from Samsung Local players |

| Parent support | Currency risk Imported components |

| Demand tailwinds | Regulatory, tariffs |

- Listing risk: The IPO is structured as pure OFS (proceeds go to sellers, not company expansion) (The Economic Times)

- Market timing risk: LG previously paused its IPO plans because of volatility (Reuters)

- Valuation risk: If growth expectations are too high, valuations may overshoot

- Operational risks: supply chain disruptions, raw material price swings, competition

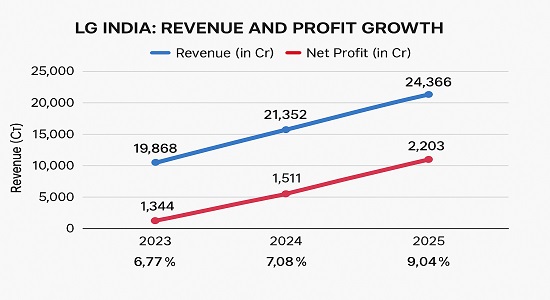

Historical Performance

Since LG India as a listed entity doesn’t yet have prior public trading history, you can:

- Show financials of LG Electronics India (private) — revenue, profit, margins over last 3–5 years from its audited reports. ( LG AU+2LG AU+2 )

- Compare to peers in Indian consumer electronics / appliances

- Possibly include parent LG Electronics global performance to show the strength of the umbrella business (from LG annual reports) (LG AU)

| Year | Revenue (in Cr) | Net Profit (in Cr) | Margin % |

| 2023 | 19,868 | 1,344 | 6.77 % |

| 2024 | 21,352 | 1,511 | 7.08 % |

| 2025 | 24,366 | 2,203 | 9.04 % |

Future Outlook / Expert View

- Cite expert opinion: “Analysts expect double-digit listing gains” The Economic Times

- According to LG’s own rationale, India is being positioned as a global manufacturing hub for electronics. Reuters

- Risks and catalysts: new product innovation, supply chain optimization, tariff changes

- Scenario analysis: what happens if India demand slows vs if China + export opportunity scales.

FAQ LG India

Q1. Is LG India a new issue or OFS?

- It is an Offer For Sale — existing shareholders are selling their holdings.(The Economic Times)

Q2. What is the price band and lot size?

- Price band: ₹1,080 to ₹1,140 per share. (The Economic Times)

Q3. Will the IPO proceeds be used for expansion?

- No — the proceeds go to selling shareholders, not to LG India’s capital needs. (The Economic Times)

Q4. Has LG delayed or paused the IPO earlier?

- Yes — due to market volatility, LG had paused the IPO process earlier. (Reuters)

Q5. What are the listing date expectations?

- Tentatively, the IPO opens Oct 7 and closes Oct 9, 2025.( The Economic Times)

- LG Grey market Premium

Conclusion

- LG India is a highly anticipated IPO offering a rare chance for retail investors to own a stake in a global brand’s Indian operations.

- Strengths: strong brand equity, consumer demand tailwinds, anchor investor confidence.

- Risks: volatility, valuation premium, OFS structure (no capital raise).

- Key insight: use the grey market premium, IPO fundamentals, expert views before deciding.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions

Fantastic web site. Plenty of useful info here. I’m sending it to a few friends ans also sharing in delicious. And naturally, thanks for your effort!