WeWork India IPO – A Complete Guide for Retail Investors

The long-awaited WeWork India IPO has drawn interest from retail investors, traders, and market watchers. After WeWork’s rocky global history, the Indian branch is getting ready to list, signaling a new chapter. But should retail investors get involved? Let’s break it down in simple terms.

What is WeWork India?

WeWork started operating in India in 2017 with the Embassy Group. They provide flexible co-working spaces in major cities like Bengaluru, Mumbai, Delhi, and Pune.

- Founded (India operations): 2017

- Headquarters: Bengaluru

- Business Model: Leasing large office spaces, customizing them, and renting them to startups, SMEs, and corporates.

- Current Presence: 50+ locations, over 90,000 members (as of 2024).

Why is the WeWork India IPO Important?

For retail investors, the IPO provides:

- Exposure to India’s expanding co-working space market.

- Participation in a rapidly growing real estate technology model.

- Opportunity to invest in a brand known worldwide.

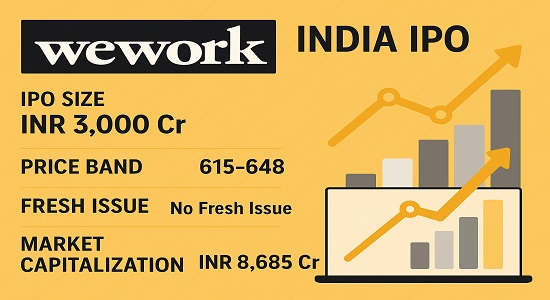

WeWork India IPO Details

| IPO Details | Figures |

| IPO Size | INR 3000 Cr |

| Grey market Premium | Check here |

| Offer for Sale | 4.63 crore shares |

| Price Band | 615-648 |

| Market Capitalization | 8,685 Cr |

| Listing Exchanges | NSE , BSE |

Business Model of WeWork India

WeWork India follows an asset-light model:

- Long-term lease agreements with developers.

- Renovation and customization of office spaces.

- Renting to companies, startups, and freelancers.

- Revenue from membership fees, additional services, and corporate contracts.

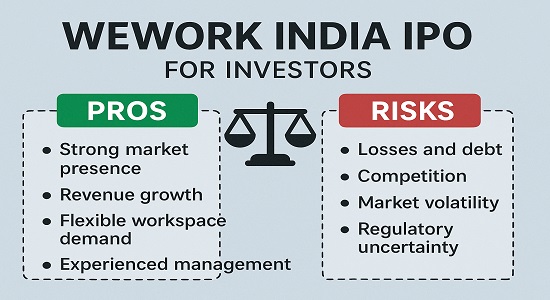

Strengths of WeWork India

- Strong Demand: After the pandemic, hybrid work culture increases demand for co-working spaces.

- High Occupancy: Occupancy rates are between 75% and 80% in major Indian hubs.

- Brand Value: Global recognition from WeWork strengthens credibility.

- Partnerships: Embassy Group provides real estate expertise.

Risks Investors Must Know

- High Competition: Indian co-working market has Awfis, Smartworks, Regus.

- Global WeWork Struggles: Parent company’s bankruptcy may raise concerns.

- Lease Obligations: Long-term rental commitments can impact cash flow.

- Economic Slowdowns: Demand for office spaces is cyclical.

WeWork India vs Competitors

| Company | Presence | Focus Area | Occupancy % | Strength |

| WeWork India | Pan-India | Premium co-working | 75-80% | Global Brand+Embassy Support |

| Awfis | India-wide | Affordable spaces | 70-75% | SME Focus |

| Smartworks | Metro cities | Corporate offices | 70% | Enterprise Client |

Should Retail Investors Subscribe?

For beginners and intermediate investors:

- Short-Term Traders: May benefit from listing gains if demand is strong.

- Long-Term Investors: Should evaluate debt, expansion strategy, and occupancy trends.

- Conservative investors may wait for post-listing clarity.

FAQs on WeWork India IPO

Q1. Is WeWork India profitable?

- WeWork India managed to trim its net loss by 51% to INR 14.1 Cr in the first quarter of the ongoing financial year (Q1 FY26) from INR 29.2 Cr in the same quarter last year.

Q2. How is it different from WeWork Global?

- WeWork India operates independently in partnership with Embassy Group, with stronger local fundamentals.

Q3. Who should invest in WeWork India IPO?

- Risk-taking investors interested in real estate + tech growth stories.

Conclusion

The WeWork India IPO represents an exciting opportunity for investors who believe in the future of co-working and flexible office spaces. With strong demand in metro cities, a reputed partner in Embassy Group, and improving financials, the IPO could attract both traders and long-term retail investors.

However, risks like competition and global brand challenges must be factored in. As always, retail investors should read the SEBI prospectus and consult financial advisors before making decisions.

For those betting on India’s real estate + flexible work growth story, WeWork India IPO may be worth watching closely.

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions

That is the right weblog for anybody who desires to search out out about this topic. You notice so much its almost hard to argue with you (not that I truly would want…HaHa). You positively put a brand new spin on a subject thats been written about for years. Nice stuff, just nice!