Atlanta Electricals IPO 2025: All You Need to Know Before You Subscribe

If you’re a retail investor in India considering new IPOs, Atlanta Electricals IPO is one getting attention. In this post, we dissect its business, IPO structure, financials, strengths & risks, and help you decide whether it might fit your portfolio

What is Atlanta Electricals?

Atlanta Electricals Limited is a transformer manufacturing company founded in 1988, making power, auto, inverter-duty, furnace, generator, and special-duty transformers Its manufacturing facilities are in Gujarat and Karnataka. The company supplies to private and government customers across 19 states and 3 union territories

IPO Details at a Glance

Here are the key parameters of the IPO. Useful for comparing with peers or considering your investment.

| Features | Details |

| Issue Size | ₹687.34 crore total |

| Fresh Issue | ₹400 crore |

| Offer For Sale | ₹287.34 crore by existing shareholders/promoters |

| Price Band | ₹718 – ₹754 per share |

| Lot Size | 19 shares (i.e., minimum investment ~₹14,300+ at upper band) |

| IPO Open and Close Date | Opens: September 22, 2025; Closes: September 24, 2025 |

| Use of Proceeds | Repay/prepay borrowings (~₹79.12 crore), working capital (~₹210 crore), general corporate purposes |

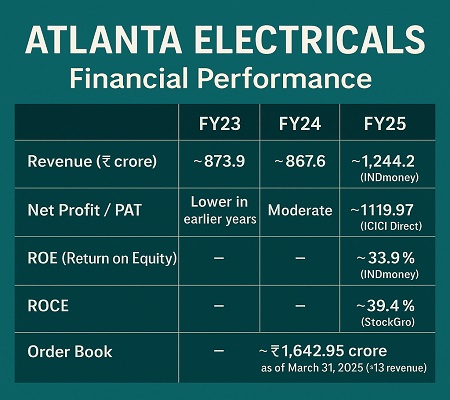

Financial Highlights & Performance

Retail investors should especially focus on growth, profit margins, return ratios. Here are some numbers and comparisons of Atlanta Electricals

| Metric | FY23 | FY24 | FY25 |

| Revenue | 873.9 | 867.6 | 1,244.2 |

| Net Profit/PAT | Lower in earlier year | Moderate | 119.97 Crores in FY25 |

| Return on Equity | NIL | NIL | 33.9% in FY25 |

| ROCE | NIL | NIL | 39.4% in FY25 |

| Order Book | NIL | NIL | 1,642.95 in Crores as of March (2025) |

Strengths & What Makes Atlanta Electricals Attractive

Here are the positives that are making many analysts and brokers give it a “Subscribe – Long Term” tag:

- Diversified product range: Transformers for various needs (power, inverter etc.)

- Growing capacity: New facility at Vadodara commissioned in July 2025, increasing ability to meet demand.

- Strong order book: Good visibility of future revenues.

- Healthy return ratios: ROE/ROCE are quite high compared to many peers.

- Low to moderate debt: Helps in interest cost control and reduces financial risk.

Risks & What You Should Be Careful About

Even promising IPOs have downsides. Here are what to watch:

- Valuation seems high: P/E at upper band is ~49× for FY25 earnings. For comparison, many peers trade lower.

- Dependence on major customers & government contracts: Revenue concentration risk.

- Raw material / input cost volatility: Copper, steel etc. cost swings can squeeze margins.

- Regional exposure: Most operations and sales in Gujarat. Local regulatory or supply disruptions could hit.

- Market sentiment & listing premium expectations: Grey Market Premium (GMP) is showing strong interest (₹125-₹142 etc.) but GMP is unofficial and can fluctuate.

Should a Beginner / Intermediate Investor Consider Subscribing?

Here are factors to help you decide.

H3: When it might make sense

- If you believe in India’s power transmission, renewable energy growth, and transformer demand rising.

- You are comfortable paying a premium now for growth and expect long-term gains rather than short-term flips.

- You have a moderate risk appetite and want exposure to infrastructure / industrial sector.

H3: When you might hold back

- If your budget is limited and you’re seeking IPOs with lower valuations.

- If you’re wary of high P/E and want immediate returns rather than waiting post-listing.

- If raw material inflation or supply chain issues worry you.

FAQs on Atlanta Electricals

Q1. What is the lot size and minimum investment for Atlanta Electricals IPO?

- Lot size is 19 shares. At the upper price band (₹754), minimum investment required is ~₹14,326.

Q2. When will it be listed and when will allotment happen of Atlanta Electricals

- IPO closes on September 24, 2025. Tentative allotment date: September 25. Listing likely on September 29.

Q3. How is the issue composed (fresh issue vs OFS)?

- Fresh issue: ~₹400 crore. OFS (offer for sale) by existing shareholders: ~₹287.34 crore.

Q4. What is GMP, and what does its value indicate for this IPO?

- GMP = Grey Market Premium. It’s an informal indicator (unofficial) of what shares might list at vs IPO price. For this IPO, GMP has ranged ~₹125-₹142, implying 16-18% over issue price possibly. But GMP can change rapidly.

Conclusion

Atlanta Electricals IPO is certainly one of the more compelling issues currently in India’s industrial / infrastructure space. With solid order books, high ROE/ROCE, increasing capacity, it has potential to be a long term investment, especially if you think India’s demand for transformer capacity and grid expansion will continue to increase.

But the valuation multiple at premium, reliance on key customers, and raw material price risk-fulness makes you consider carefully. If your horizon is short few years, this IPO may be worthy of part of your allocation (not your entire portfolio). If you are more cautious or seeking speedy listing returns, maybe observe market conduct near listing date or listing day performance before investing significantly

Disclaimer: This blog is for educational purposes only. The securities or companies mentioned are examples, not recommendations. It does not constitute investment advice. Please conduct your own research before making any investment decisions