Nifty Healthcare: A Lifeline for Indian Stock Market Growth

Healthcare forms a significant portion of India’s economy, National Stock Exchange introduced the Nifty Healthcare Index, which gave investors a focused benchmark for healthcare stocks. In this blog, we’ll explore the Nifty Healthcare Index, its components, significance, performance, and why it is an essential avenue for investment in India’s thriving healthcare industry.

What is the Nifty Healthcare Index?

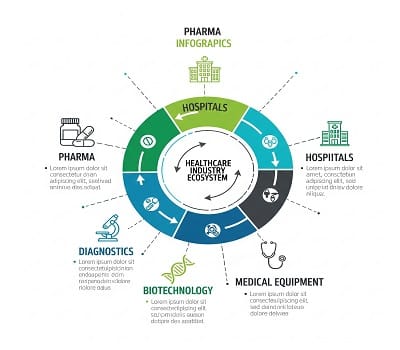

The Nifty Healthcare Index is a sectoral index, which consists of stocks of healthcare sector companies listed on the NSE. This index includes all the segments: pharmaceuticals, hospitals, diagnostics, biotechnology, and medical equipment. It can be used as a barometer for the health of the sector, so it is possible to judge the overall performance of top health care companies in India.

Key Features of the Nifty Healthcare Index

- Sector-Specific Focus: The Nifty Healthcare Index provides exposure to companies exclusively operating in the healthcare space, offering targeted investment opportunities in this essential sector.

- Market Representation: It includes top healthcare companies, ensuring a broad representation of the industry’s performance.

- Weight age: The index is calculated using the free-float market capitalization methodology. This means that the weight of each stock is determined by its free-float market cap relative to the total market cap of the index.

- Re balancing: The index is re balanced semi-annually to ensure it remains updated with the latest market dynamics.

Why Invest in the Nifty Healthcare Index?

- Growing Demand for Healthcare Services: India’s population growth, increasing life expectancy, and rising awareness about health have led to a surge in demand for healthcare services. This makes the sector resilient and a critical part of the economy.

- Global Pharmaceutical Hub: India is known as the “pharmacy of the world,” contributing significantly to global generic drug production. Investing in healthcare stocks provides exposure to this booming sector.

- Diverse Portfolio: Nifty Healthcare Index consists of companies from various sectors. This ensures a diversified portfolio that minimizes risk while maintaining growth potential.

- Epidemics and others: COVID-19 pandemic Highlighting the importance of healthcare infrastructure This has led to increased investment and growth in the sector. The long-term growth outlook remains strong.

Components of the Nifty Healthcare Index

The Nifty Healthcare Index comprises prominent players in the Indian Pharma sector, including:

- Pharmaceutical Companies: Sun Pharmaceutical, Dr. Reddy’s Laboratories, Cipla, and Aurobindo Pharma.

- Hospitals: Apollo Hospitals and Narayana Hrudayalaya.

- Diagnostics: Dr. Lal PathLabs and Metropolis Healthcare.

- Biotechnology: Biocon and Laurus Labs.

Analyzing the Key Drivers of Healthcare Market Growth

- Government affairs: Programs such as Ayushman Bharat and National Health Mission aim to improve healthcare access and affordability. and increase the growth of this sector.

- Increase investment in research and development: Healthcare companies invest heavily in research and development. which leads to the discovery of new drugs and advanced treatment methods

- Export opportunities: India’s stronghold in producing generic drugs has opened up export opportunities. Especially to markets such as the United States, Europe, and Africa.

- Technological progress: telemedicine AI-powered diagnosis and innovative treatment options It is changing the healthcare landscape.

Unlocking Healthcare Sector Growth: Investing in the Nifty Healthcare Index

- Flexibility: The healthcare sector has been less affected by the economic downturn. making it a passive investment option

- Constant regression: This index provides consistent returns. This is driven by the sector’s critical nature and continued growth.

- Investing ethically: Investing in health care is consistent with ethical considerations and contributes to social welfare.

Healthcare Investment Risks: What Investors Need To Know

While the healthcare sector offers immense potential, investors should be aware of the following risks:

- Regulatory changes: Policies that affect drug pricing and approval can affect profitability.

- Global Competition: Indian pharmaceutical companies are facing stiff competition from global players.

- Market Volatility: External factors such as currency fluctuations and raw material costs can affect stock performance.

Conclusion

Nifty Healthcare Index provides investors with strategic opportunities to capitalize on India’s growing healthcare sector. This index represents a diversified portfolio of leading healthcare companies. It combines potential financial returns with an important and expanding industry. Investors benefit from the growth of this sector. technological progress and increased health awareness This makes it an attractive investment option for those seeking stability and growth potential.

It serves as a benchmark for the Indian healthcare sector.

Very excellent visual appeal on this internet site, I’d value it 10 10.