Exploring the BSE Small Cap Index: A Gateway to Emerging Opportunities

The Bombay Stock Exchange (BSE) Small Cap Index is one of the most closely watched indices by retail investors, traders, and wealth managers in India. Small-cap stocks may look risky at first glance, but they often turn out to be multi-baggers when chosen carefully.

I’ve seen the BSE Small Cap Index act as a launchpad for many companies that eventually grew into mid-cap and even large-cap giants. But to benefit, investors must understand the risks, opportunities, and strategies that drive this index.

What is the BSE Small Cap Index?

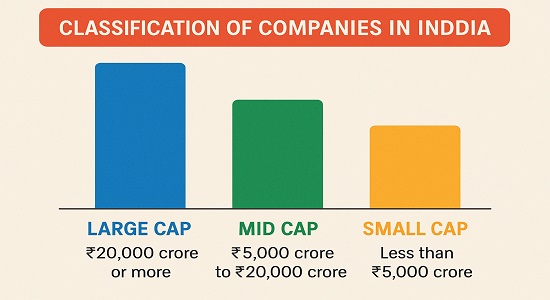

The BSE Small Cap Index consists of companies ranked below the top 250 stocks by full market capitalization listed on the Bombay Stock Exchange.

It captures companies that fall in the 95%–100% market capitalization range—essentially the “smaller players” in India’s listed universe. For retail investors, it acts as:

- A benchmark to track the performance of small-cap companies.

- A yardstick for mutual funds, ETFs, and portfolio managers focusing on this segment.

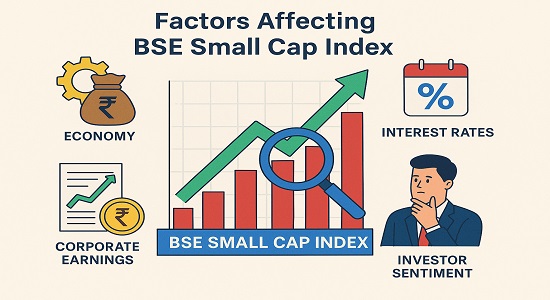

Factors Influencing the BSE Small Cap Index

- Economic Conditions – Small caps are more sensitive to inflation, interest rates, and GDP growth.

- Liquidity – With lower trading volumes, small-cap stocks can be volatile.

- Regulatory Policies – Government reforms in taxation, MSME support, or sector incentives can disproportionately impact them.

- Market Sentiment – Retail enthusiasm and FOMO often drive valuations faster than fundamentals.

Why Should You Invest in Small Caps?

- High Growth Potential – Many successful large caps today (like Bajaj Finance or Eicher Motors) started small.

- Diversification – Adding small caps helps reduce portfolio concentration.

- Innovation Edge – Small firms often lead in niche markets and emerging industries.

But be cautious of risks:

- Volatility – Prices swing sharply in both directions.

- Low Information – Limited analyst coverage makes research critical.

- Liquidity Risks – Large trades can distort stock prices.

Best Strategies for Small Cap Investing

- Thorough Research – Study financials, promoter track record, and sector positioning.

- Diversification – Don’t bet heavily on a single stock or sector.

- Long-Term View – Small caps may take years to unlock true value.

- Active Monitoring – Keep an eye on quarterly results, market news, and global cues.

Pro Tip: Avoid chasing momentum blindly. Focus on companies with strong earnings growth and manageable debt

Recent Trends in Small Cap Segment

- In August 2025, equity mutual fund inflows surged by 15% month-on-month, led by small-cap and mid-cap funds.

- Small-cap funds saw a 4.3% inflow rise, indicating stronger investor confidence in this segment despite volatility.

Performance BSE Small Cap Index (as of Jan 20, 2025)

| Period | Returns (%) |

| 1 – Year Return | 18.13% |

| 2 – Year Return | 72.47% |

| 3 – Year Return | 259.81% |

These numbers show that patient investors who stay invested during volatility can enjoy multi-fold wealth creation

FAQs

Q1: Is investing in BSE Small Cap Index suitable for beginners?

- Yes, but only through mutual funds or ETFs, as direct stock picking requires in-depth research.

Q2: What is the risk level of small-cap stocks?

- High. Expect sharp ups and downs; invest only if you have a 5–7 year horizon.

Q3: How much of my portfolio should I allocate to small caps?

- Experts recommend 10–15% of total equity exposure, depending on your risk tolerance.

Conclusion

The BSE Small Cap Index is a dynamic part of the Indian stock market that has consistently rewarded long-term investors. While the growth potential is undeniable, small-cap investing requires discipline, research, and risk management.

If you’re a retail investor or a trader looking to diversify your portfolio, small caps can be an excellent addition—provided you stay informed and patient

As someone who has tracked markets for over 25 years, my advice is simple:

- Don’t ignore small caps, but don’t over-allocate either.

- Enter with knowledge, diversify smartly, and let time work for you