How to Use the BSE 500: A Comprehensive Guide for Investors

The BSE 500 Index is one of the most trusted benchmarks in the Indian stock market. Covering the top 500 companies listed on the Bombay Stock Exchange (BSE), it accounts for nearly 95% of India’s total market capitalization. For retail investors, traders, and even beginners, It is a reliable mirror of the Indian economy and a guide to making smarter investment decisions

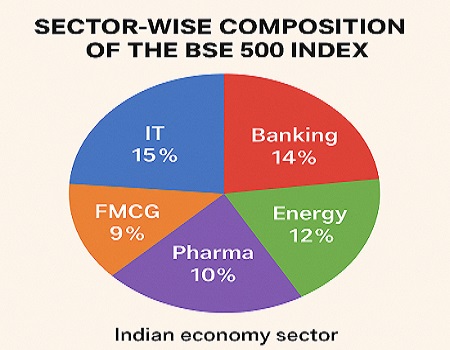

Composition and Structure of the BSE 500

The Index is carefully constituted to represent a cross-section of the Indian economy’s sectors. This is done through ranking companies by average float-adjusted market capitalization, total market capitalization, and trading volumes over six months. This method ensures that both large-cap and mid-cap companies are reflected in the index and gives a panoramic view of the market.

What is the BSE 500 Index?

The BSE 500 is designed to represent a cross-section of the Indian economy, including large-cap, mid-cap, and select small-cap companies:

It is constructed based on:

- Float-adjusted market capitalization

- Total market capitalization

- Trading volumes (6-month average)

This makes the index one of the broadest and most accurate indicators of the Indian equity market

Why the BSE 500 Matters for Investors

It serves multiple purposes for investors and policymakers alike:

- Market Representation – Captures almost the entire equity market, giving investors a true picture of trends.

- Investment Benchmark – Fund managers and investors measure portfolio performance against it.

- Economic Indicator – Movements in the index often reflect India’s growth trajectory and sectoral performance

Example: If sectors like IT, Banking, and Energy rise in the BSE500 Index, it indicates strength in India’s economic fundamentals

How Can You Invest in the BSE 500?

You cannot directly buy the index, but you can invest in it through:

- Index Funds – Mutual funds that replicate the BSE500 portfolio.

- Exchange-Traded Funds (ETFs) – Trade like stocks but mirror the performance of the BSE500.

Pro Tip: ETFs are cost-effective and highly liquid, making them a great choice for retail investors.

Advantages of Investing in the BSE 500

While the BSE500 offers numerous benefits, investors should remain cognizant of potential risks.

- Diversification – Exposure to 500 companies across all major sectors.

- Market Coverage – Participation in India’s overall growth story.

- Performance Tracking – Align your portfolio with the Indian equity market.

Risks & Considerations

Like any equity investment, the BSE500 is not risk-free:

- Market Volatility – Short-term fluctuations can impact returns.

- Economic Factors – Policy changes, inflation, global events affect performance.

- Company-Specific Risks – Problems in heavyweight stocks can drag down the index.

Investor Tip: Always invest with a long-term horizon to smooth-en out volatility.

Recent Performance of the BSE 500 (as of Jan 2025)

- Market Capitalization (Full) – ₹38,41,848.12 crore

- Market Capitalization (Free Float) – ₹18,08,890.64 crore

This reflects the resilience of Indian equities despite global uncertainties, highlighting India as one of the fastest-growing markets.

Expert Insights (Experience-Based)

Having tracked Indian indices for over two decades, I have seen the BSE500 emerge as a powerful tool for retail investors. Unlike narrower indices (like Nifty 50 or Sensex), the BSE500 allows you to capture mid-cap growth stories while still benefiting from the stability of large caps.

For example, many companies that started as mid-caps in the BSE500—like Infosys or Asian Paints—grew into large-cap leaders over time. Early investors who followed the BSE 500 captured this journey.

FAQs About BSE 500

Q. Is the BSE 500 better than Nifty 50?

- The BSE 500 offers broader diversification, while Nifty 50 focuses on top companies. For long-term investors, the BSE 500 is more comprehensive

Q. Who should invest in the BSE 500?

- Retail investors, mutual fund investors, and anyone seeking exposure to India’s overall growth story.

Q. What is the minimum investment needed?

- You can start with as little as ₹500 through SIPs in index funds that track the BSE 500.

Conclusion

The BSE 500 Index is not just a number—it’s a reflection of India’s economic strength and investment potential. By investing through ETFs or index funds, retail investors can achieve diversification, long-term growth, and alignment with India’s equity market.