Navigating Price Surges: Understanding Upper Circuits in the Stock Market

In the dynamic world of stock trading,Upper circuit is a common occurrence. To maintain market stability and protect investors from extreme price fluctuations, stock exchanges implement mechanisms known as circuit breakers. These include “upper circuits” which set the maximum and minimum price limits a stock can reach during a trading session. This article delves into the concept of the upper circuit, its significance, and its impact on trading activities.

What Is an Upper Circuit?

An upper circuit represents the highest price level that a stock or security can attain on a given trading day. When a stock hits its circuit, it means that its price has reached the maximum permissible limit set by the exchange for that session. At this point, trading in the stock is typically halted to prevent excessive volatility and speculative trading.

Purpose of Upper Circuits

The primary objective of implementing this is to curb excessive price movements that could destabilize the market. By setting a ceiling on how much a stock’s price can increase in a single session, exchanges aim to:

- Protect Investors: Prevent investors from making impulsive decisions based on sudden price surges.

- Maintain Market Integrity: Reduce the likelihood of market manipulation and speculative trading.

- Ensure Orderly Trading: Allow time for the dissemination of information, enabling investors to make informed decisions.

How Are Upper Circuits Determined?

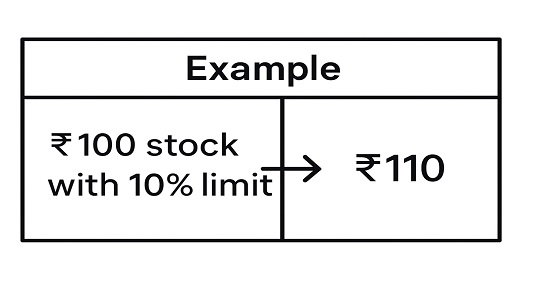

In India, the Securities and Exchange Board of India (SEBI) regulates circuit limits. These limits are typically set as a percentage of a stock’s previous closing price and can vary based on the stock’s volatility and market capitalization. Common circuit limits are 2%, 5%, 10%, and 20%. For instance, if a stock closed at ₹100 and has an above circuit limit of 10%, it can rise to a maximum of ₹110 the following day.

Implications of Hitting the Upper Circuit

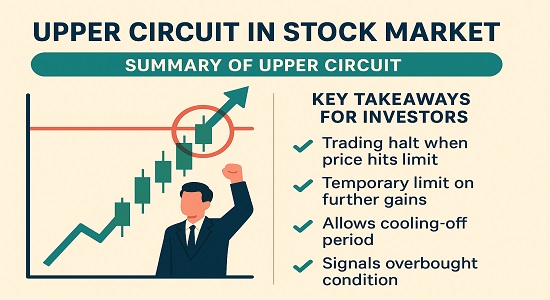

When a stock hits its above circuit, several scenarios unfold:

- Trading Suspension: Further buy orders may be placed, but no sell orders are available, leading to a halt in trading for that stock.

- Market Sentiment Indicator: Reaching the above circuit often signals strong bullish sentiment and high demand for the stock.

- Liquidity Concerns: Investors looking to enter or exit positions may face challenges due to the lack of counterparties.

Factors Leading to Upper Circuit Hits

Several factors can cause a stock to hit its above circuit:

- Positive News: Announcements such as robust earnings, new product launches, or favorable regulatory decisions can boost investor confidence.

- Market Speculation: Rumors or speculative trading can drive up demand, pushing the stock price to its upper limit.

- Low Float Stocks: Stocks with a limited number of shares available for trading are more susceptible to hitting upper circuits due to supply constraints.

Strategies for Investors

For investors, stocks hitting upper circuits can present both opportunities and challenges:

- Entry and Exit Timing: Investing in stocks that frequently hit upper circuits requires careful timing, as liquidity constraints can impede buying or selling.

- Due Diligence: It’s crucial to investigate the reasons behind a stock hitting its upper circuit to ensure that the price movement is backed by solid fundamentals rather than mere speculation.

- Risk Management: Implementing stop-loss orders and diversifying the portfolio can help mitigate risks associated with such volatile stocks.

Conclusion

Understanding the concept of circuits is essential for navigating the stock market effectively. These mechanisms play a vital role in maintaining market stability and protecting investors from extreme volatility. By comprehending how upper circuits function and the factors that lead to their activation, investors can make more informed decisions and develop strategies that align with their financial goals.keeping an eye on daily market statistics, can offer insights into stocks currently experiencing upper circuits.

An uppercircuit in stock market is a testament to overwhelming demand and investor confidence,marking a surge that redefines market momentum.