The Complete Guide to Fixed Income Mutual Funds in India (2025)

Fixed income mutual funds are a popular investment option for individuals seeking steady returns and low risk. These funds primarily invest in fixed income instruments such as government securities, corporate bonds, and money market instruments, offering predictable income and capital preservation. For investors looking to diversify their portfolios or stabilize returns during volatile market conditions, fixed income mutual funds can be an excellent choice.In this blog, we’ll explore what fixed income mutual funds are, their types, benefits, risks, and how to select the best fund for your investment goals.

What Are Fixed Income Mutual Funds?

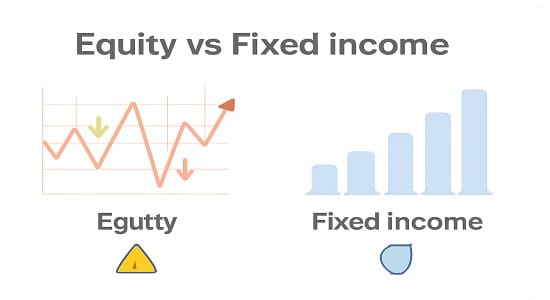

Fixed income mutual funds are funds that invest in debt and money market instruments. These include government bonds, corporate bonds, treasury bills, and certificates of deposit. The primary objective of these funds is to provide regular income, preserve capital, and minimize risk.

Unlike equity mutual funds, fixed income funds are less volatile and focus on generating stable returns over time. They are ideal for conservative investors, retirees, or those looking to balance the risk in their investment portfolios

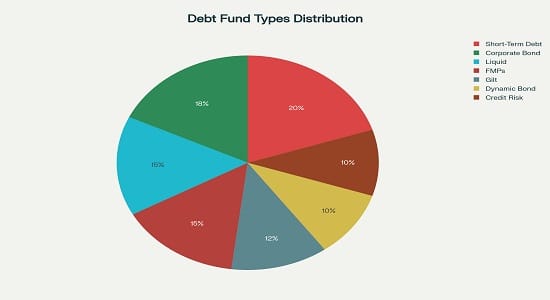

Types of Fixed Income Mutual Funds

Fixed income mutual funds come in various forms, catering to different risk appetites and investment horizons. Here are some common types:

- Liquid Funds: Invest in short-term instruments with maturities of up to 91 days.Ideal for parking surplus funds temporarily with low risk and quick liquidity.

- Short-Term Debt Funds: Focus on instruments with maturities ranging from one to three years.Suitable for investors with a short to medium-term horizon.

- Corporate Bond Funds: Primarily invest in high-rated corporate bonds.Offer higher returns compared to government securities but with slightly higher risk.

- Gilt Funds: Invest in government securities with no credit risk.Suitable for risk-averse investors seeking stable returns.

- Dynamic Bond Funds: Actively manage investments across short- and long-term bonds.Ideal for investors looking to capitalize on changing interest rate scenarios.

- Fixed Maturity Plans (FMPs): Close-ended funds that invest in fixed income instruments with a fixed maturity date.Offer predictable returns with low risk.

- Credit Risk Funds: Focus on lower-rated bonds to earn higher yields.Suitable for investors with a higher risk appetite.

Benefits of Investing in Fixed Income Mutual Funds

- Steady Income: Fixed income funds provide regular income through interest payments, making them ideal for individuals seeking stability, such as retirees.

- Low Risk: Compared to equity funds, fixed income funds are less volatile, offering predictable returns with lower risk.

- Diversification: Adding fixed income funds to a portfolio helps balance risk and reduce the impact of market fluctuations.

- Liquidity: Most fixed income funds offer high liquidity, allowing investors to redeem their investments as needed.

- Professional Management: These funds are managed by experienced professionals who select high-quality bonds and actively manage the portfolio.

- Tax Efficiency: Certain fixed income funds, like debt-oriented hybrid funds, can offer tax-efficient returns, especially for long-term investors.

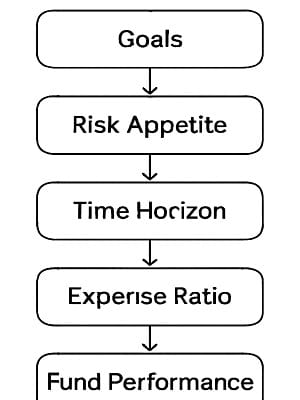

Factors to Consider When Investing in Fixed Income Mutual Funds

When selecting a fixed income mutual fund, consider the following factors:

- Investment Goals: Define your financial objectives—whether it’s generating regular income, preserving capital, or balancing risk.Match your goals with the type of fixed income fund.

- Risk Appetite: Assess your risk tolerance. For conservative investors, gilt funds or short-term debt funds are safer options, while credit risk funds are better suited for aggressive investors.

- Time Horizon: Choose funds that align with your investment horizon. Liquid funds are suitable for short-term goals, while dynamic bond funds are ideal for long-term objectives.

- Interest Rate Sensitivity: Understand how interest rate changes impact the fund’s performance. Longer-duration funds are more sensitive to rate changes compared to short-term funds.

- Fund Performance: Review historical returns to assess the fund’s consistency and reliability.Compare the fund’s performance against its benchmark and peers.

- Expense Ratio: Lower expense ratios translate to higher net returns for investors. Compare expense ratios across funds before investing.

- Credit Quality: Check the credit rating of the bonds in the fund’s portfolio. High-rated instruments indicate lower credit risk.

Risks Associated with Fixed Income Mutual Fund

While fixed income funds are generally considered safer than equity funds, they are not risk-free. Here are some potential risks:

- Interest Rate Risk: Changes in interest rates can affect the value of the bonds in the portfolio. For instance, rising interest rates typically lead to a decline in bond prices.

- Credit Risk: If the issuer of a bond defaults on payment, the fund’s returns may be impacted. This is more common in credit risk funds.

- Inflation Risk: Fixed income investments may not keep up with inflation, eroding the purchasing power of returns.

- Liquidity Risk: In some cases, the fund may face difficulties in selling its holdings, especially during adverse market conditions.

Who Should Invest in Fixed Income Mutual Funds?

Fixed income mutual funds are suitable for:

- Conservative Investors: Looking for stable and predictable returns.

- Retirees: Seeking regular income with low risk.

- Risk-Averse Individuals: Preferring safer investments over equities.

- Diversified Portfolios: Investors aiming to balance their portfolio by adding fixed income assets.

Top Performing Fixed Income Mutual Funds in India

Here are some of the top-performing fixed income mutual funds in India:

- Aditya Birla Sun Life Medium Term Plan Direct Growth

- Aditya Birla Sun Life Medium Term Plan Direct Growth

- HDFC Regular Savings Fund Direct Growth

- HDFC Regular Savings Fund Direct Growth

- ICICI Prudential Dynamic Bond Direct Plan

- ICICI Prudential Dynamic Bond Direct Plan Growth

- UTI Medium to Long Duration Fund Direct Growth

Fixed income mutual funds offer the perfect balance of stability and steady returns,making them a cornerstone for investors seeking reliable income with managable risk.

hi!,I really like your writing so much! percentage we keep in touch more approximately your article on AOL? I need a specialist on this space to unravel my problem. May be that’s you! Taking a look ahead to peer you.