How to Use India’s Digital e Rupee: A Comprehensive Step-by-Step Guide

The Digital e Rupee (e₹) marks a historic shift in India’s financial landscape. Issued by the Reserve Bank of India (RBI), it is India’s official Central Bank Digital Currency (CBDC). Unlike cryptocurrencies, the Digital e Rupee is legal tender backed by the RBI, making it as trustworthy as physical notes and coins.

For retail users, traders, and investors, understanding how to use the e₹ is crucial as India transitions toward a more cashless economy. This guide explains everything you need to know — features, benefits, challenges, and a step-by-step process to start using the Digital Rupee

What is the Digital e Rupee?

The Digital e Rupee is a digital form of the Indian Rupee, equivalent in value to physical cash.

- Issued & Regulated by RBI – Unlike Bitcoin or Ethereum, the e₹ is centralized and backed by the government.

- Denominations – Available in the same denominations as paper currency (₹10, ₹100, ₹500, etc.).

- Transactions – Works just like paying with UPI, but instead of bank balances, you are using direct digital cash.

Example: If you buy groceries worth ₹500 using the Digital Rupee, the money moves directly from your e₹ wallet to the shopkeeper’s wallet — no bank intermediary is needed

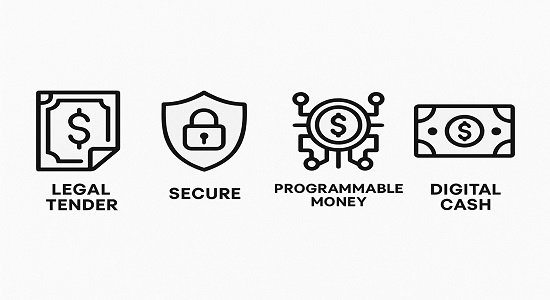

Key Features of the Digital Rupee

- Digital Equivalent of Cash – Carry money digitally without physical notes.

- Legal Tender – Accepted like cash across participating merchants.

- Secure & Efficient – Built on advanced digital infrastructure under RBI’s supervision.

- Programmable Money – Can be used for specific purposes like subsidies, vouchers, healthcare, or education payments.

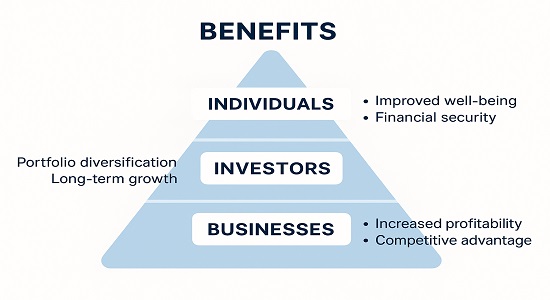

Benefits of Using Digital Rupee

- Financial Inclusion – Useful for those without bank accounts.

- Lower Transaction Costs – Eliminates costs of printing, distributing, and handling cash.

- Transparency – Easier to track payments, reducing black money and tax evasion.

- Cross-Border Potential – RBI is working on enabling fast, low-cost global transfers.

Investor Insight: Just as UPI changed the way Indians transact, the Digital Rupee could transform how money is exchanged globally

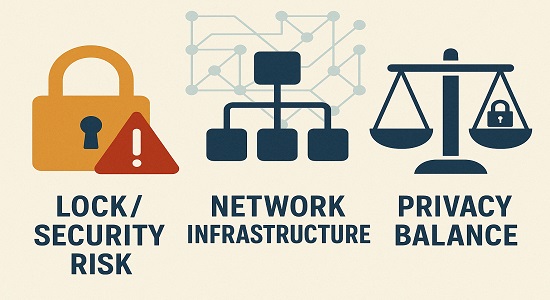

Challenges You Should Know

- Tech Infrastructure – Requires stable internet and digital literacy.

- Cybersecurity – Protecting wallets against fraud is critical.

- Privacy – Transactions may be traceable, raising concerns over data misuse.

Recent Developments in Digital Rupee (as of 2025)

- Pilot Launch – Started in December 2022 with select banks.

- Adoption – By Feb 2023, over 50,000 users and 5,000 merchants participated.

- Transaction Volume – On Dec 27, 2024, RBI reported 1 million CBDC transactions in a single day.

- Private Sector Integration – Google Pay, Amazon Pay, and PhonePe are in talks to support e₹ payments.

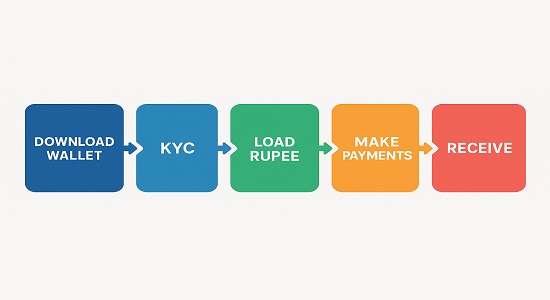

Step-by-Step Guide: How to Use the Digital Rupee

| Step | Action | Details |

| 1 | Download CBDC Wallet | Available via RBI Partnered Bank (HDFC , SBI , ICICI , Axis Bank) |

| 2 | Complete KYC | Similar to opening a bank account requires PAN/Adhaar. |

| 3 | Load Digital Rupee | Add e₹ to your wallet using your bank account. |

| 4 | Make Payments | Scan, QR codes or send |

| 5 | Receive Payments | Accept e₹ directly into wallet |

Pro Tip for Investors: Unlike UPI, the Digital Rupee doesn’t depend on bank balances. Think of it as carrying digital cash, which can be useful during market transactions or emergencies

Future Outlook

The RBI is gradually expanding the e₹ to more sectors. In the future, we may see:

- Integration with stock market settlements.

- Use for government subsidies and welfare programs.

- International adoption for cross-border trade.

FAQs on Digital Rupee

Q1 Is the Digital Rupee different from UPI?

- UPI transfers money from your bank account, while the e₹ is direct digital cash issued by RBI.

Q2 Can I invest in Digital Rupee?

- The e₹ is not an investment asset like stocks or Bitcoin, it is only a digital currency

Q3 Where can I use it today?

- Currently in pilot phase — available with select banks, merchants, and platforms. RBI is expanding it step by step

Final Thoughts

The Digital e Rupee is more than just a payment method — it is a financial revolution in India. For retail users, traders, and investors, understanding and adopting e₹ early can make transactions faster, more secure, and future-ready.

As RBI fine-tunes this initiative, the Digital Rupee could become a backbone of India’s digital economy, shaping how we transact both locally and globally.